Here you can find the transcript of the live stream we had with Fred Liu of Hayden Capital (Homepage) on 03 June 2020. This is the video of our conversation:

- Introduction

- Fred's cooking skills

- How Fred Liu grew as an investor

- How meeting intense his research at Hayden Capital

- Hayden Capital's edge

- Asia as an investing opportunity

- His recent take aways from Asia

- Shopee and Lazada

- How the South East Asian internet space looks like

- Sea's Growth potentials

- Corona's effect on the market

- How Hayden Capital stays disciplined in a challenging market

- Is the market overvalued?

- Opportunities in Sea Limited

- The S-Curve

- JD.com

- The internet in China

- Carvana

- Carvana's management

- Carmax

- Carvana and the S curve

- Flexibility in Fred's approach at Hayden Capital

- Being wrong

- Hayden Capital in 10 years

- Meet people!

- Disclaimer

Introduction

[00:00] Tilman Versch: Hi Fred – and hello to our audience. It’s nice to have Fred Liu of the Hayden capital here today. Hi, Fred. How are you doing?

[00:08] Fred Liu: I’m doing well, thanks, Tilman. I had a little blip there, but quite all right.

Fred’s cooking skills

[00:14] Tilman Versch: I am sorry for messing up to start. But before we start, we have to do some regulatory things and I have to show you our disclaimer. Let’s do that quickly. The key message is this is no investment advice. You have always to do your research and we are giving you opinions and qualified remarks, but it’s no investment advice. And please do your research.

Fred, for the beginning, maybe let’s start with a question that isn’t from the investing space. In your last letter, you said that you’re working on your cooking skills and cooking quality. So what came out of this?

[01:05] Fred Liu: Yeah, so it’s a couple of things. I’ve never baked or made fresh pasta before. So that was my first achievement. I can say by the second time it came out pretty well. The next dish made some stuffed cabbage. So, ground beef, rice, tomatoes that they experience because you cook it and cuisine. And so it was good to venture outside of that. And then the third thing is probably a Chinese dish from where I where my family’s from. So she and it’s called Mashita. So basically little chunks of those carrots, potatoes, green beans, all in a stew and very tasty dish I had all the time growing up. So and it’s hard to find in New York or the US. And so you’re kind of forced to make it yourself.

How Fred Liu grew as an investor

[01:57] Tilman Versch: That sounds very tasty. And you should send me to the receipt that I get some idea how to do it, but maybe I should find a good Chinese restaurant to cook it first.

Let’s switch to investing and maybe let’s start with the question: How did you become an investor and what were the best things that contributed to your growth as an investor?

[02:23] Fred Liu: Yeah, it starts at the beginning. I got my first shares of stock from my father when I was 11 years old. Fifteen shares of Walmart. And then, like I was saying, I distinctly remember bragging to my friends on the school bus about how I owned a chunk of Wal-Mart. I think I’ve always loved that sense of ownership. Whenever we walk into a Wal-Mart, my father would say, like: “Hey, you know, you own that door or that brick or that shelf.” And I thought that was so cool. And then I took the wrong turn. Initially, by the time I could open a minor custodian account when I believe I was 12 or 13 years old, I started day trading.

I started listening to CNBC, watching Jim Cramer, trying to get an earnings box. Needless to say, over the course of summer, I lost everything that I had. It was a couple of thousand bucks that I had saved up until that painful for 12, 13 years old. And I started going to penny stocks taught me around about level 2, quote, bid, ask spreads, all of that. So that was a good lesson. After that experience, I went to the library and said: “There must be a better way to pursue investing.” And so the first book that kind of always stares at you is Warren Buffett. Right? He’s kind of the most famous investor.

And so I picked up the book “The Warren Buffett Way”. It was one of the first books. And then I read a lot about value investing throughout that period of school in high school. And by the time I got to high school, I knew I wanted to be an investor. I had done banking internships. I took classes at Columbia University by that point, and I fell in love with the kind of discipline. My dad wanted me to be an engineer. He sent me to like summer camp to try to force me to be an engineer. I knew I didn’t want to do it. He’s a mechanical engineer himself.

Tilman Versch [04:26]: What did you build these summer camps?

[04:27] Fred Liu: Paper airplanes to see who could fly at the furthest bridge is to see if anyone can hold the most weight. Yeah. So, yeah, that experience wasn’t for me. So I decided to go to NYU specifically because I didn’t want that liberal arts background. I knew I was an investing nerd by then. I wanted to learn how to build models, FCFs, what have you. Yeah, so after NYU, I went to JP Morgan Asset and I worked on their small-cap equity team at the moment. I had already developed a similar philosophy to how I think about investing today.

When I first started in college, definitely like everyone. I kind of gravitated towards the net-nets “The detailing type of names” like I was saying. I think most investors that I know kind of start off in that space, either because it’s simpler to understand or it’s like a quantitative exercise rather than qualitative. I think as an investor, you don’t appreciate the qualitative aspects of the business until you get more sophisticated as you progress in your career. So, you know, like my first stock was during that time was SL Green Realty Corp during the financial crisis. You can still find things like that. I was evaluating like “What is the net asset value of all of the office space that they own within Manhattan” and trying to run some calculations based on that and being able to buy at like half their bulk of what I calculate as their book.

And then I have made my way to JP Morgan. They had a much more quality kind of focus within small-cap space, looking for names under two billion dollars with five analysts. And so that helped home my philosophy a lot. The problem with working at a larger asset management firm and a more institutional firm is that there is a big push towards not only force diversification, but also, for instance, we were closed at the time. JP Morgan would force us to open new products and whatnot. And I could just feel our time getting stretched, if we were evaluating a new name. I talked to other friends at other firms. So it’s not just firms like JP Morgan, but other firms as well. You only have so much time to go deep into each individual name. I felt like that wasn’t the right way to proceed to investing.

I realized a lot of people sit behind their computer screens and think that they can have an edge on the market.

Fred Liu (Hayden Capital)

And so it was around that time that I started thinking about: What does a great investment firm look like from a client standpoint? How do you structure the firm so that everything is aligned in the client’s best interests? And then also how can the frustration. I also had to start realizing at that time, just talking to a lot of people in industries, I realized a lot of people sit behind their computer screens and think that they can have an edge on the market. By doing that, they feel more comfortable because there’s a lot more information on the Internet nowadays. But I think the underappreciated part is understanding the incremental unit economics behind selling these businesses. And you’re never going to find that on the Internet, right? By the time it’s in a 10K or a public filing, it’s already relatively well known.

So, I think a lot of the edge in the market today is just doing the good old fashioned channel checks, talking to as many people as possible. So I wanted to build an eventually build a firm like that after JP I went to a firm called The New Street, a boutique research shop. They do really good work around the new economic analysis that I was talking about.

And they also do really good workaround building their networks and trying to get information from people just through industry sources or through relationships that they already have. And so after New Street, I decided to launch Hayden. We’ve kind of been pursuing that strategy ever since. It’s gotten honed over the last couple of years. But the basic core principles are the same.

How meeting intense his research at Hayden Capital

[08:52] Tilman Versch: So, how many people do you meet a year if you do your research?

[08:58] Fred Liu: Sure. I think it’s increased. I remember looking a couple of months ago and actually, we did three hundred plus meetings or calls last year. For me personally, I was looking at my calendar. It’s about five meetings a week, so one a day. And then when I’m traveling, I generally try to take about three to four meetings per day during my travels. And so that gets you into that that three hundred range.

[09:29] Tilman Versch: This is quantity. How do you get the documentation on the quality of the meetings? Because it needs some time to work after them and prepare them as well. Or: How does a normal meeting looking like?

I think there’s something to learn from everyone.

Fred Liu (Hayden Capital)

[09:44] Fred Liu: Yeah, well I personally love meeting everyone. So whether it’s company executives, former employees of a firm, whether it’s like these investors who may be investing in earlier stage companies that we would look at to understand what’s going on in that segment of the market and potential threats to the companies that we own, or it’s just other investors as well. Right.

I think there’s something to learn from everyone. And even if, you know, let’s say both of you have disagreeing views on a certain stock, there’s always that those are the best conversations right. So I try to meet everyone that I can to get a holistic view of a certain topic that I’m trying to have a better grasp upon. And so meetings, I mean, yeah, the meetings take a little bit of prep time, maybe like 30 minutes. Forty-five minutes beforehand, just writing down a couple of questions. But other than that, the conversations flow pretty naturally.

Hayden Capital’s edge

[10:43] Tilman Versch: Interesting. I already see that there are some questions coming in, so we’ll walk you to those questions. Let’s start: How would you describe your edge as an investor?

[11:00] Fred Liu: Like I said, I think a lot of people sit behind their computer screens these days and they feel comfortable with that. I think as an investor your best edge is to have a deep understanding of a certain industry. You work in that industry talking to all of your colleagues, all of your clients. I think that’s the best edge because a lot of people on Wall Street are sitting in New York and they may not use these products or have ever seen anyone use these products.

I think as an investor your best edge is to have a deep understanding of a certain industry.

Fred Liu (Hayden Capital)

And if you were sitting in an emerging market and have firsthand experience with it, I think that’s a real edge against a lot of the investors, the more professional investors. And so I try to do the same thing, even though, for instance, we have some investments in Southeast Asia, I can’t use the product, but talking to as many customers as possible I think helps me get closer to that first-hand experience.

Asia as an investing opportunity

[11:59] Tilman Versch: Interesting, you have a certain focus on Asian companies. Can you maybe help me and other viewers with things that desk-based investors and other investors usually get wrong about Asia and what is seen in this space?

I think people still have a strong bias against Asian companies, Asian management teams, whatnot.

Fred Liu (Hayden Capital)

[12:21] Fred Liu: I think, number one, I think people still have a strong bias against Asian companies, Asian management teams, whatnot. I think what’s what needs to be said and I think what people need to understand is that call it 20 years ago, the people who got rich in China, especially 20 years ago, they were the ones who grew the quickest. They weren’t the ones who were necessarily the smartest, the best at allocating capital. They just basically threw money into as many products as possible. And because the company was growing so rapidly or the country was growing so rapidly, they kind of got carried away with that one.

Right. And they benefited from it. If you look at, for instance, average incomes in China in the early 2000s, up until 2010, 2012, it was growing at high teens. Imagine your personal salary growing 20 percent every year. Right. That that instills a different type of mindset, like you, can’t lose type mindset. But as China has slowed, I think and just anecdotally, I’ve noticed this as well, a lot of management teams are becoming more rational. A lot of management teams have experience with Western companies or have worked inside of Western companies. They have a much better sophistication around capital allocation, return on invested capital, what have you.

And so these companies are changing. It’s just a natural dynamic that you see when a country starts maturing and the pie doesn’t grow so rapidly that you can just toss money against the wall and it’s going to bring you back a bucks or a four for each dollar that you throw. And so you’re starting to see that in China today. And I think Asia changes so rapidly that if you have a bias from even five years ago, 10 years ago, that bias is probably outdated. So I think that that’s probably something that not a lot of people quite appreciate just yet. And I would suggest anyone just go visit Asia if you haven’t already and then start talking to people. I think I think you’ll be pretty impressed with the business environment there.

And I think Asia changes so rapidly that if you have a bias from even five years ago, 10 years ago, that bias is probably outdated

Fred Liu (Hayden Capital)

His recent take aways from Asia

[14:33] Tilman Versch: What are your recent takeaways from your trips to Asia?

[14:37] Fred Liu: I know we talked about this before, one of our position to see the biggest takeaway in Southeast Asia is that it’s starting to hit what’s widely called as the Golden Zone: That two to four thousand dollar US$ GDP per capita. You’ve reached a level where families can kind of feed themselves. They can take care of basic necessities. And so the play is off as each family gets an incremental dollar of discretionary income. Your discretionary spending literally gets multiplied by three or four X as compared to before. I think that’s the biggest opportunity here.

You’re starting to see a lot more startups come up as well. There aren’t quite that many listed companies. See is a great example, but they’re listed in New York in terms of local companies. The quality isn’t quite there yet. But if you look at the earlier stages, the series A, B, C. There’s quite a few like mature tech firms in the region. I think over the next five years you’re going to see these firms succeed and they’re going to start being listed. And I think part of the opportunity is just understanding the market, getting ahead of it so that in five years when these companies start being listed, you have its advantage there.

Shopee and Lazada

[16:04] Tilman Versch: Interesting, we already have some questions, I think the questions on Carvana, I will put to the later part of the interview. But we have a question here from Frank. How do you think Shopee is competing with Lazada today? Where are they each in terms of positioning today?

[16:22] Fred Liu: Yeah, so I think they’re Lazada has recognized the error of its ways, so to speak. Basically they started off as a predominantly one-stop retailer focused on high-value categories like electronics. And the problem with these types of categories, it’s a desire to low-frequency purchase rate. You don’t buy a new computer every month. You don’t buy a new cell phone every month. And logistics is very expensive versus where shoppers started out with that. It was predominately fashion and beauty-focused. If you think about a dress, it’s very easy to ship.

If you look at surveys in the region, a lot of people are willing to wait in terms of the delivery time for a piece of apparel versus maybe a brand new cell phone, a cell phone you may want tomorrow because you have some urgent need for it. And so that’s where they started off and they started off in the CDC marketplace focusing on kind of long-tail inventory. Lazada has basically started moving in the direction of Shopee as well. And Shopee likewise has started selling electronics, home goods, how normal household appliances, and whatnot.

So I think you’re starting to see them converge with it. But the difference is really in the culture of shopping, either really good fast followers, if they see a new innovation or product feature from Lazada, they’re very quick to implement the same thing. And they’re doing it about three times better. So I think at this point in time because the market has matured somewhat, that people have formed their habits, their shopping habits. For Shopee, your average number of orders per month is somewhere like four or five times a month right. If you’re ordering that frequently, that brand stays in your head. So next time you do want to order something, your first go to Shopee and you probably already have the app downloaded on your phone and your phone is probably a little smartphone, doesn’t have that much space, so you don’t want to download too many apps. So these apps become almost like real estate on your mobile phone.

And if you the average number of times a person visiting the stores multiple times a day, right, and so it’s similar to going inside of a mall call it five times a day, you may not buy something the first four times, but the fifth time you walk past something and it seems attractive. So you make that purchase. It’s the same thing that Shopee is trying to invoke right now, get people using the app, get people spending as much time as possible on the app, and eventually, they’re going to find something that they like. So they just do a much better job of that than Lazada. And they in Indonesia, they’re the number one player.

Lazada, I believe it’s like number four last time I saw. In other countries, they’re a little bit more sticky and seem to be growing quicker. So, I think by this point, two years ago, the market controversy was: “How is Shopee going to be able to compete against the capital cannon of Alibaba and Softbank”? I think that question’s been kind of proven out already, which is why you see where shares are today. But I think it’s only just the beginning. Shopee is just starting to prove that they are the winner in the market. And typically, you see e-commerce as a winner take the most type of market.

But I think it’s only just the beginning. Shopee is just starting to prove that they are the winner in the market. And typically, you see e-commerce as a winner take the most type of market.

Fred Liu (Hayden Capital)

And where you see the profitability come through is when the marketplace is two or three times larger than the next largest marketplace. So you can look at Shopee in Taiwan, for instance right. They have the dominant portion of market share, like 70, 80 percent rate, and that’s where they’re most profitable. So, if you watch how market share trends versus relative to other players, that is a good proxy for their eventual profitability as well.

How the South East Asian internet space looks like

[20:30] Tilman Versch: Maybe let’s ensure the basics for our German viewers because I have to admit that I’m not the best expert in the Southeast Asian shopping market. Can you maybe describe some of the basics of the names you just mentioned and also the background with Alibaba? There was also one question coming up.

[20:52] Fred Liu: Yeah, so Sea Limited operates two core businesses. They have the third emerging business. One of them is gaming. The gaming started off as a republisher of a lot of Tencent games. And so that’s a beautiful business and requires very little capital. If they already know what games are successful in China, they have the right to cherry-pick the best games, localize it, change the language, integrate it with the local payment methods, what have you. So that’s a beautiful business. And then they have taken the cash flow from there. They’re going to generate about 1.4 USD EBITA this year. And they’ve taken all of that cash flow to reinvest into Shopee in addition to some debt as well.

And Shopee as an e-commerce marketplace and how it differs from something like Amazon or like I was saying, Lazada, is that they started more on the concept of the social networks. A lot of sellers at the time were selling on platforms like Facebook, Instagram, what have you. And so they created a system that was very easy to take the seller shops off of Instagram and important and onto the Shopee platform. On Instagram, basically people with a lot of items, there you would send a direct message. them and negotiate the pricing, payment, where to send the payment, where to send the item. And it was a very clunky experience. And they noticed that a lot of people were doing that through the Pop Cap. And so they launched Sharpey, which is a more formalized, lower friction type of marketplace, predominantly C2C, so consumers to consumers where they started off. And so that business has grown from 2015 to today, we think they’re going to do about over 30 billion in GMV on an overall level.

They’re still not profitable, but you have to look at it on a country basis. Like I said, Taiwan is already profitable, Indonesia is close to break even, and then the other countries. We’re sure that they’re going to break even within the next two years or so now. So that’s their second business. And that’s kind of what’s driven the stock over the last year or so.

And then their third business is called Sea Money. It’s their E-wallet platform in addition to the offer seller loans. And so this is synergistic with the Shopee business because a big issue in the region is for Mom and Pops sellers: They store their extra inventory in their second bedroom. And so they have a bunch of these holiday sales. You have like ten, ten, eleven, eleven, nine, nine, twelve, and twelve. And you get these huge spikes in these holiday sales. As a seller, the biggest problem is that you often run out of inventory during peak sales and so the sellers need working capital in order to kind of meet those spikes in demand. And It will help with retention. And then also as an E-wallet platform, they’re starting to go offline as well. And so we can see kind of what Alipay has done in China to get a good idea of what the road map looks like Shopee. Yeah, those are the three core businesses of Sea at the moment.

Sea’s Growth potentials

[24:22] Tilman Versch: Do you have any idea where you see this company in five or 10 years?

[24:25] Fred Liu: I know Forbes thinks that this is going to be a one hundred billion-dollar business. It’s in the I think it hit 40 billion today. It still has a ways to go. The thing with these types of companies, we invest in relatively earlier stage companies when you have a market penetration of a couple of percents. It’s really hard to gauge where the market is going to mature in 10 years and 20 years, right.

[24:56] Tilman Versch: How much is the Internet penetration in this country’s commerce?

[25:01] Fred Liu: I mean, it’s like three percent.

[25:04] Tilman Versch: There’s some way to go.

[25:06] Fred Liu: Right? You have a long ways to go. You see, China is probably the most penetrated in the high teens, close to 20 percent. But they’re still growing very quickly. You have Amazon in the US still putting up 20 percent CAGRs despite being e-commerce penetration four to five times higher than the region. And the thing is that generally, e-commerce penetration tends to follow like density in a city or density in geography. If you’re in the US, like right now, I’m currently in Cincinnati in the suburbs; you can drive to a Wal-Mart or the mall or whatever pretty easily right.

But if you’re in a city of 20 million people in China, going to the store is a really big pain. And so you tend to use these e-commerce services a little bit more. It’s why you see like food delivery taking off in China as well. So I would think that Southeast Asia because it is more dense than places like the US, will be able to exceed where the US kind of peters out in terms of mature penetration in the market. But it’s too early to tell, these businesses change over time. Consumer habits change over time. There may be, I don’t know, instant teleportation of goods that you order and maybe someone will come out with that in 20 years or something. So it’s really hard to gauge where the top of that s curve is. So I would just say, look, maybe three to five years ahead, you can probably get more confidence there. But as to where these firms hit that top of that S curve, you should keep a close eye on it. But it’s anyone’s guess.

[26:47] Tilman Versch: It’s about the future and the future is uncertain. But you can make some predictions based on the developments in other regions. Let’s go back to the near past: The year 2020, what a year. How have you found value in this crisis and how have you positioned yourself from the beginning of the year? You mentioned some “insight information” in your letter.

[27:21] Fred Liu: I don’t know if it’s inside info. I mean, if you are paying attention to the news and reading Asian news, you could kind of tell what was happening with coronavirus and the impact that it’s having on businesses. Yeah.

Corona’s effect on the market

[27:33] Tilman Versch: And how did you so well during the last months? How have you found value in this last month?

It was effectively a free customer acquisition, right.

Fred Liu (Hayden Capital)

[27:42] Fred Liu: Yeah, so our portfolio was relatively insulated. We had some hedges on and they added a couple of percent to our portfolio, but it wasn’t significant. Our portfolio was relatively protected because we we’re invested in a lot of these Internet retailers. And so when all of your brick and mortar shops are closed, especially in emerging markets, your customers that may not have used a service like that before, they have no other choice but to use e-commerce for their daily needs. And so it attracted a lot of customers to these platforms. It was effectively a free customer acquisition, right. And so a lot of these companies benefited from this, Shopee reported, I believe, one 140% year over year GMV growth back in April. I think the opportunity was that when corona virus was starting to hit the West. A lot of people thought that people would just cut back on spending in general. So you saw some of these names take a hit in the early part of March.

And then people quickly realized that these are beneficiaries of this trend and that a lot of these customers who may not have used these platforms before. If you have a great mousetrap, they’re going to stick inside of that mousetrap and they’re going to refer more of their friends. Right, even after corona virus ends. And so I think that’s why you’ve seen such a rapid rebound in this space. And I think that one thing that’s interesting is that a lot of people – and I talked about this in my last letter as well, – that a lot of people are trying to look at the traditional brick and mortar space and gauge when is the US going to open up? When are certain countries going to open back up? When is traffic going to normalize?

If you have a great mousetrap, they’re going to stick inside of that mousetrap and they’re going to refer more of their friends.

Fred Liu (Hayden Capital)

I think that’s a really hard game to play, at least from my standpoint. I think a lot of people won’t make a lot of money doing that. But in my view, I think that I just don’t have an edge there. And so I think the best opportunity is actually to think about who is a beneficiary during periods like this. If you think about a lot of these tech companies, these Internet companies, you’ve seen the news about work from home and whatnot. These are a very resilient type of businesses. Right? If you can have your entire workforce working from home and not be in a physical office, not have to have a physical presence, that’s a resilient type of business.

So, I think the opportunity is even in the emerging market space where things like Shopee have a three percent market share. There are other companies out there. We were looking to buy “Buy now, pay later” type of companies. These are a small portion of the market businesses that have a superior mousetrap. Once people learn about this business model that they will use it, that they think it’s a superior way to buy something. And so these types of businesses, because they’re so nascent and the biggest friction point is educating consumers. They benefit the most during something like this where consumers are naturally looking for a way to buy things online. So I think a lot of investors kind of focus their time there, in my opinion.

These are a small portion of the market businesses that have a superior mousetrap. Once people learn about this business model that they will use it, that they think it’s a superior way to buy something.

Fred Liu (Hayden Capital)

How Hayden Capital stays disciplined in a challenging market

[31:18] Tilman Versch: Here is one question on how you remain patient in this paradox market. How do you remain disciplined in this surprising rally?

[31:36] Fred Liu: Well, I personally still think our names are cheap, and I think that helps with the patients. Right. Things like, Sea, one of our largest position, even at 40 billion dollars, I still think it’s probably one of the easiest buys in my portfolio today, just given the level of risk. They’ve proven their dominance in the market and have kind of massive macro tailwind behind them, whether it’s an industry tailwind or an even GDP tailwind in these countries. So, yeah, even though names like that have been very successful for us this year, I would recommend to new clients to continue buying them as well.

Is the market overvalued?

[32:26] Tilman Versch: And maybe adding on onto this observation: Where do you see parts of the markets that are overvalued?

I focus on my core competency. It is in a very small sliver of the market

Fred Liu (Hayden Capital)

[32:36] Fred Liu: Yeah, well, I focus on my core competency. It is in a very small sliver of the market, right, as you can probably tell. And so in my space, I think the place to look for shorts is probably, where a lot of these names have been driven by this whole trend towards work from home. People are talking about you should buy all of these tech stocks, these Internet stocks, what have you. The question is that if you don’t have a great mousetrap, but people are forced to enter that mousetrap because they have no other options. They’re going to leave as soon as the country opens up and people are allowed to go into stores again.

People are talking about you should buy all of these tech stocks, these Internet stocks, what have you. The question is that if you don’t have a great mousetrap, but people are forced to enter that mousetrap because they have no other options.

Fred Liu (Hayden Capital)

And so the question is, which companies do have a superior mousetrap as a business model and as a product? Which serve their customers the best as opposed to their customers just being forced to use the product during this period of time, and they’re going to leave as soon as they have a chance. Those are probably the most overvalued segments of the market right now because I think we’re in a period of high valuations – at least within the last month or two. Everything is just kind of trading together everyone thinks that these Internet companies will all benefit, and that’s not true. Some of these will go back to kind of the levels that they were at in terms of consumer demand and whatnot.

Everyone thinks that these Internet companies will all benefit, and that’s not true.

Fred Liu (Hayden Capital)

[34:01] Tilman Versch: How do you get confidence about the chance that people will not leave the mousetrap soon?

[34:10] Fred Liu: That’s qualitative, right? So it’s either you can talk to as many consumers as possible, you can do surveys, you can use, for instance, case studies, you can use all data to kind of track it on a weekly basis. It depends on the individual name. But I think you need to make a judgment. Right. Do you think that this company’s value proposition to its customers is superior to the brick and mortar alternatives? Yeah, it’s going to depend.

Opportunities in Sea Limited

[34:42] Tilman Versch: I hope I get it right that Sea is still cheap in your eyes. Yes, what must I what could happen that might be reevaluated and getting some valuation or valuation that make it not that cheap anymore? When is especially interesting to invest in such online retailers and when you can profit from the revaluation?

[35:17] Fred Liu: Right. So I think there’s this idea of you have to think about how quickly the intrinsic value of a company is growing, which you can use as a proxy like their current earnings power. If earnings are growing at a 50 percent annual basis, that’s pretty impressive. If you’re able to buy a company like that at a multiple or valuation, that doesn’t imply any future growth. That’s the type of situation that we look at when we bought Sea, it was about a 4,5 billon $ company. We thought the gaming business alone would make up a significant majority of that. Plus, they had a good chunk of cash on their balance sheet. And so the market wasn’t valuing the Shopee business at all.

And so those are the situations where you have Shopee that grew over one hundred percent for a couple of years and their earnings power was kind of growing in line with that. And on top of that – as they kind of prove to the market that this business is stable – this business is capable of generating cash flow and that they will be the winner in the market, you get a valuation rerating, right? You started at basically a multiple of zero. And now I’m sure the market is valuing at close to 10x or whatever. And so I think with these earlier stage companies where you are, it’s a new business model. Maybe it only started existing a couple of years ago.

You need to have confidence that even if they aren’t profitable yet, they do have a pathway to profitability. And that, again, it all derives from what is their relative market share versus competitors and what is the customer value proposition? Right. The problem is that a lot of public investors aren’t comfortable making those types of judgment calls. A lot of public investors may not do the necessary channel checks that understand what’s going on behind the scenes and what makes one marketplace stick versus another?

What makes the average customer of one marketplace use the product for an hour a day, and the other one maybe five minutes a day? And they may be valid, similarly. So I think for these companies, you need to be able to have those kinds of data points to understand what are the early signs of a marketplace that’s going to grow quicker than its competitors and then be willing to take that bet. I think that for certain names, they do get overvalued, so you want to think like if your earnings are catering at 50 percent, but it’s pricing in, say, the next four years of growth already. And so actually, let me see if I can draw something for you real quick.

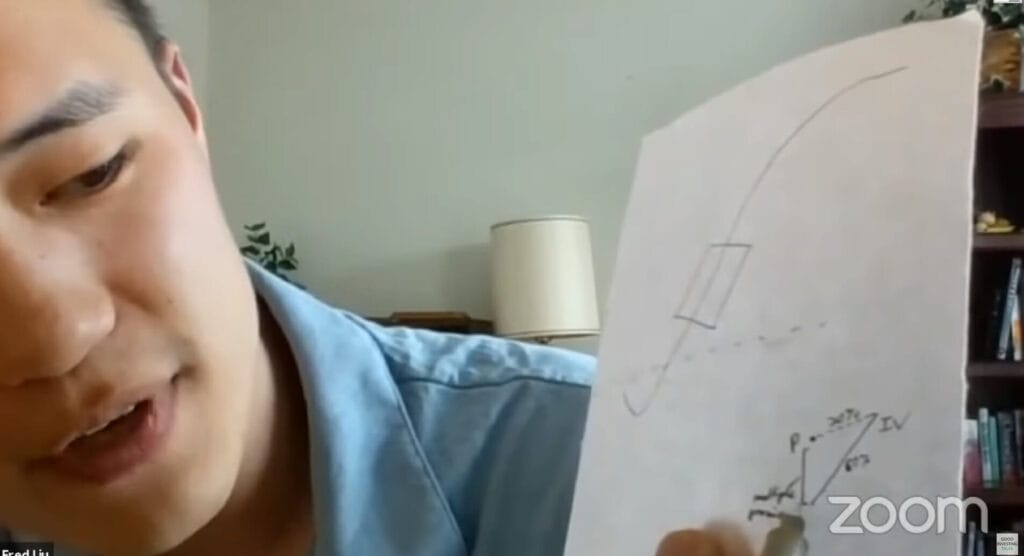

The S-Curve

[38:17] Tilman Versch: It would be good. Then I take the chance for in the short break to ask one more question I’m happy to receive more questions from the audience. We still have around twenty-five minutes to go. But let’s continue with your drawing. I’m happy to see it.

[38:39] Fred Liu: So it’s done. So basically, if you think about an S curve right, this is the first of this break. Even if you’re operating in this area right. Next, your intrinsic value, maybe catering at 60 percent, but let’s say the price is here. So as an investor, the returns that you’re going to realize may be like 20 percent. It’s that slope of this curve say this is five years out or three years out or what have you. If you’re able to buy it at a valuation up here, you’re going to realize the same Kager as that earnings power. But if it is higher than multiple, that’s justified with where the business is today, you’re probably paying a higher price.

And so you need to evaluate what is the slope of this curve. If this slope calls, it falls below. Know, we use a rough estimate of like 10 percent over the next three years, even though it might be a great company. I think it would be in times like that where you should consider starting to trim the position. But everything that we hold today, I think we’ll be able to meet that bar pretty, pretty easily.

JD.com

[39:46] Tilman Versch: The first point where I came into touch with you, was JD. We had a very lively discussion in Germany about JD as an investment just two years ago or something like that. Is JD is an example of this kind of re-evaluation and you sold it to reduce risks or because there was another reason?

[40:14] Fred Liu: So, yeah, so I think in the case of anyone who’s interested can read our letter during that period, I talked about it last.

[40:20] Tilman Versch: I will link them below so you can find the letters.

[40:24] Fred Liu: But yeah, I think by the time we bought it, JD was pretty well known in the market. Anyways, it wasn’t a case of Shopee when was started. I mean at the time it was even started 15 years before we bought it. Right. And so in that case, the issue with the name was that the product itself had a similar issue to what Lazada has today. It’s very electronics-focused, very male-focused. And honestly, male consumers don’t leave the lead very detailed reviews. They don’t refer products to their friends. They don’t refer companies to their friends.

So that segment of the market is an issue as well. And the real problem is just the low order frequency of that platform. And so we found better opportunities in cases like Shopee where, as I said, customers order multiple times a month. The basket size is very sticky. It’s a fun product to use. JD is more of like an Amazon-type model where it’s about efficiency. You saw them benefit during this coronaviruses period because they have their internal logistic systems. They’re able to get your items to you basically on the same day. The problem is that your average customer may only use the platform two or three times a year. And so you constantly have to reacquire that customer as well. And so I think that just added a lot of friction. I’m sure JD will continue to do just fine. We just saw better opportunities.

The internet in China

[41:56] Tilman Versch: How do you see the movement in the internet space in China?

I would say the internet in China is getting very competitive.

Fred Liu (Hayden Capital)

[42:10] Fred Liu: I would say China is getting very competitive. And so I don’t think you’re going to see the same opportunities in China as obviously 10 years ago, 15 years ago, when a lot of these behemoth companies were founded. You do have new companies such as Bite Dance that do have a much more international approach from the get-go. So that keeps it interesting. But the cost to acquire customers everywhere is going up. And so that’s why you see a big pivot in China, in my opinion. I talked about this in a prior letter as well. The whole trend of super apps being able to offer multiple services, multiple products on the same app, because once you acquire a customer once, you can then kind of diversify that cost across all these different product lines. And some products may be run at a cost in order to just retain the customer.

And then other products may be low frequency, but high margin type of lines such as hotel bookings or whatnot. And that’s what really kind of provides profitability to the business. But in general, I’ll say that China is just becoming much more competitive nowadays. I think a lot of Chinese companies are executing Western internet companies out. You’re seeing a lot of one of our themes is the cross-pollination of these business models. Right, because you have a lot of Silicon Valley-type of companies that are keeping a close eye on what the Chinese companies are doing. Like if you launch a new feature, like, let’s say live streaming right in, it increases your average retention of your users.

Like Amazon, I’m going to take a close look at that and see if it’s applicable to the US consumer as well, because you kind of has a roadmap already, right. That’s already been trialed in China. And you may have slight differences on the margins, but consumers are generally the same globally. So, yeah, I think that a lot of these companies are becoming more mature, more sophisticated, and it’s becoming a little bit tougher to find good values there.

Carvana

[44:19] Tilman Versch: Interesting to hear that. I will now go to the questions on Carvana and we’ll start with the first from William. His questions are: What do you think about Carvana’s partner inventory program from the unit economics perspective compared to the normal retail sales?

[44:39] Fred Liu: Yeah, I think it’s a little too early to know for sure. I mean, they’ve never talked about it publicly. They just started trialing the program. I think it’s too early to know for sure what the economics are going to look like. But if you think about the benefits of the program, right. You think about the benefits that Carvana provides, it’s really around you. You’re going to Honda Accord that Carvana offers is going to be that much different than CarMax , Honda Accord, or your local brick and mortar dealers. The benefit that they provide is the convenience, the trusted brand, the logistics network, the reconditioning centers. And so they’re following the Amazon playbook. Prove to the market, educate the market. And once the market is primed with your product, then start opening it up to third-party partners and then charge them for the most valuable parts of your business, which is shipping, shipping the car, or the book or the product to the end customer and then leveraging your brand. They’ve spent a ton of money on marketing. They have great brand awareness in the market. Imagine you’re a local brick-and-mortar player. There’s no chance that you can have that same level of brand awareness even within your local market. So you can kind of charge for that. And then eventually, most likely, they’re going to move into a kind of like a sponsored placement type of model, perhaps. But I think SaaS in terms of specific numbers, I think it’s too early to know for sure.

Carvana’s management

[46:21] Tilman Versch: To learn more about Carvana, I will also link the interview here with Cliff Sosin with heavily invested in Carvana up here so you can have a look at this. Also, there’s another question on Carvana come up: You said in your letter, that Carvana is a bet on the management team, the ability to execute a business. What’s your current thought about management?

[46:51] Fred Liu: I think they’ve done everything right as I said, I wasn’t expecting them to kind of launch a marketplace model this quickly or even trial it, and the fact that they’re doing it, I think is something. So when you’re evaluating management. I always wanted to think that as an investor, you should put yourself in the shoes of management. Say, what if I was running this business? What would the roadmap for it look like? And I think if I were running a marketplace and the whole fulfill by Amazon playbook is something that I would definitely try. And you can tell management is thinking in a similar way. So that I think it gives credit towards the quality of Ernie and the entire team at Carvana.

So, yeah, my opinions haven’t changed at all. And you see during periods like the last couple of months, they raised money, even though they honestly didn’t need the money. They’re using it to get more aggressive during this period to take share at an above-trend level than they were going to do before. And so I think when your competitors are hurting. Yeah. And you aren’t as much, that’s when you should be getting aggressive. And they have access to capital that your local brick-and-mortar guy isn’t going to have. And so why not use that to your advantage? So I still think highly of them.

[48:14] Tilman Versch: Is there also some reflection in the numbers of the way they’re getting more aggressive.

[48:19] Fred Liu: I think they’ll probably release some details, but a lot of it is going to be around building out their inventory. I call it like their marketing channels, building out their vending machines, reconditioning centers, whatnot. I mean, you know, like I said, I’m sitting here in the suburbs of Cincinnati at the moment. And 15 minutes away, Carvana just announced that they’re going to build a 40 thousand square foot reconditioning center, hiring four hundred or five hundred people. They just announced that site, which I don’t even know if they’ve announced it, but it’s in the local news. So you can see them doing things like that.

Carmax

[48:56] Tilman Versch: There’s one question from Frank “Couldn’t Carmax go straight to customers? I believe they’re doing that already.”

[49:04] Fred Liu: Yea they are. I think what’s interesting is that with these industries, these nascent kinds of business models of selling used cars online, when you’re at – you know, this entire industry is one, two percent penetration of the market, depending on how you want to cut it. At that level, the biggest friction point is around consumer education, right. CarMax absolutely can do this. I don’t think that it’s going to be a winner take all type of market. But when you’re at one to two percent penetration, the biggest problem is just getting people to know, hey, you can buy a car online, sight unseen, and yes, you can trust it. And the more players that you see kind of piggybacking on each other’s marketing spend, the more beneficial it is for everyone.

And the more players that you see kind of piggybacking on each other’s marketing spend, the more beneficial it is for everyone.

Fred Liu (Hayden Capital)

And especially in a case like a used car. You’re going to spend at least 10 hours evaluating what model you want, what dealer you want to buy it from. And during those 10 hours, if you came because of a CarMax commercial, you’re probably going to make your way towards Carvana because you’re going to price shop. And then if Carvana offers a better experience, if they offer a cheaper price, you’ll probably use that, even though it was CarMax that paid for that marketing.

You see this across other industries as well. For instance, Shopee Pay or Sea Money. In the case of Sea, they let competitors burn billions of dollars on this E-wallet initiative in Indonesia to educate the market. And then nowadays, as of a couple of months ago, they started getting aggressive because the market is now educated and so they can come in with the biggest use case, which is e-commerce. And automatically they reported 40 percent of their orders in Indonesia were the through their e-wallet this past quarter. I think when markets when the total industry market share as a percent of the addressable market is at single digits; you don’t need to worry about competition as much.

You just need to focus on executing yourself. It’s when you start getting to that high single-digit, 9- 10 percent penetration, that’s when you start putting heads against your competitors and that’s when you start the pay stops growing as rapidly. Right. Because now you need to take a piece from someone else in order to continue growing. That’s when you start seeing the problems around competition. But at a very, very early stage, I think the more marketing dollars that go into, the more it benefits everyone.

Carvana and the S curve

[51:44] Tilman Versch: Maybe you can we could go back to your drawing and what do you see Carvana the S curve currently?

[51:54] Fred Liu: Well, they haven’t broken even just yet, so they’re probably below this line, like right there.

[52:03] Tilman Versch: And where do you see it in five or ten years and five years to take the long-term view?

[52:08] Fred Liu: Sure. Ten years – we don’t know where it’s going to be. We have to be part of our process is re-evaluating these businesses every two years, every three years. What have you? So I don’t know where it’s going to be. That’s too far to call. We have to reevaluate as we go. But within a couple of years, I think they’re going to break even. I think we’re in our model. We have them doing like 15 billion in sales within about four years or so. And at those types of levels, at a normalized margin, they’re going to be doing like a billion-plus. So, the question is, what do you think that a business like that should be valued?

Flexibility in Fred’s approach at Hayden Capital

[52:50] Tilman Versch: I don’t know at the moment because I’m not a specialist. How flexible are you and your thesis if you say you’re evaluating your thesis every two years?

[53:05] Fred Liu: I think you have to constantly re-evaluate. I mean, I also talked about this in a letter about like in a concentrated portfolio like this and especially investing in companies that are a bit earlier on the curve, it almost follows that paradox principle, that 80%-20% rule. And it’s almost similar to venture funds. There’s going to be a handful of winners that drive the majority of your returns. And so you have to be confident that a lot of your names may break even they may not work out. And your thesis is probably going to be wrong. A lot of the time. So to answer your question, you have to be very flexible, because that’s just part of this model, this strategy.

You have to be very flexible, because that’s just part of this model, this strategy.

Fred Liu (Hayden Capital)

Being wrong

[53:50] Tilman Versch: So how much time does it take for you to change your thesis and also to admit that you’re wrong?

[53:58] Fred Liu: Probably longer than it should take, but generally it depends on how wrong I am, like the degree to which I’m wrong, right? If it’s a fixable problem or not. And then in certain cases, I may if I think that management has a plan to kind of fix that problem, I may give them some time to see if they’re able to. But I think it depends on it on a case by case basis.

Hayden Capital in 10 years

[54:33] Tilman Versch: You know, I like those questions where I ask you where would be something in five or 10 years. And Dennis Hong. Hi, Dennis. Nice to have you here. As well as the question of “Where do you see Hayden Capital in five or 10 years?”

[54:47] Fred Liu: I would hope that we are still in business. Number one, I’m very confident that we do it. I think there’s a certain chance for number two; I think our core process is there. I think that you know, like everything that we do, we have the tools in place as we grow larger. I hope to add depth to that process. So in terms of whether adding more analysts, I always talk about like thinking about analysts like hunters, that’s whom I’m looking for. I’m looking for autonomous idea generators rather than I can build a model myself. That’s no problem.

I always talk about like thinking about analysts like hunters, that’s whom I’m looking for.

Fred Liu (Hayden Capital)

So I hope to be able to add to that. I hope to be able to add people perhaps on the data side in order to kind of prove out these features, these PC’s are quantitative. But other than that, I think Hayden will always be concentrated. I think we will always be investing in these types of companies. Hopefully, my circle of competence will have expanded by that point to encompass adjacent industries as well. But at its core, I don’t think Hayden changed that much. You’ll still recognize the firm’s strategy, what we’re doing.

[56:04] Tilman Versch: You’re already looking for applications?

[56:06] Fred Liu: Sorry?

[56:09] Tilman Versch: Do you already look for applications for Hayden, for potentials.

[56:15] Fred Liu: For the right people? I’ll keep them in mind.

[56:17] Tilman Versch: Ok, they can contact you on Twitter. I hope your direct messages are open or else you will have to open them after the interview. And we are coming to the end of the interview. And for the end, I want to give you the room. If you want to add something we haven’t discussed or shed light on that aspect you want to go deeper into. So the floor is yours.

Meet people!

[56:42] Fred Liu: Yeah, I think the biggest takeaway for me and again, it goes back to what I was saying at the beginning of the interview, I think investors are too welded to their desks nowadays. They rely on secondhand research too much. I think we need to go back to where the industry was maybe 50, 60 years ago, actually picking up the phone and talking to people, actually grabbing coffee and going to meet people. One of my former bosses used to say, there’s someone in this world who has the information that you want and it’s your job as an analyst to go find that person. And I think that’s something that I’ve taken to heart. And I think a lot of investors will benefit from that because there’s so much information that’s just in people’s heads and you’re not going to be able to get that unless you build a relationship with them and meet them face to face. So that’s my last piece of advice there.

I think we need to go back to where the industry was maybe 50, 60 years ago, actually picking up the phone and talking to people, actually grabbing coffee and going to meet people.

Fred Liu (Hayden Capital)

[57:43] Tilman Versch: And for me, it’s also the message that you need also social distance as well as in these times. The virus is over and I hope we don’t have a second wave.

[57:51] Fred Liu: Yeah wear a mask.

[57:53] Tilman Versch: Yeah and mask outside is of work. Social distancing and masks are important, so thank you very much for the interview, and thank you very much also for our audience that you asked the good questions and helped me in asking Fred good questions. Thank you very much for joining us and please subscribe to the channel. Thank you very much.

[58:26] Fred Liu: Thank you.

Disclaimer

Finally, here is the disclaimer. Please check it out as this content is no advice and no recommendation!