In this talk, Greggory Warren of Morningstar explains 5 Reasons to Consider Buying Berkshire Hathaway. Greggory Warren is a member of the questionnaire panel at the Berkshire Hathaway Annual meeting. This talk was recorded on 05th November 2019 at the International Value Investing Conference.

Greggory Warren has discussed the following topics:

- Greggory Warren's presentation

- Greggory Warren on: Do recent sellers of Berkshire have a point?

- Diversification provides opportunities

- Greggory Warren: A decentralized structure and efficient capital allocation have been central to Berkshire’s success

- Five reasons to consider buying Berkshire Hathaway

- Berkshire is evolving into a vehicle for returning more capital to shareholders

- Berkshire’s shares remain undervalued in a market that is near valued

- A question on the shareholders’ meeting and the quality of it

- Greggory Warren, When do buybacks happen?

- The insurance business

- Deal-making at Berkshire Hathaway

- The readability of the 10K is questioned

- Greggory Warren on Li Lu

- Disclaimer

Greggory Warren’s presentation

[00:00:07] Greggory Warren: I’m Greg Warren. I’ve been with Morningstar for 14 and a half years now. I’ve been covering Berkshire for about a decade. I’ve also been covering the US-based and the Canadian asset managers.

[00:00:19] Greggory Warren: A lot of people, when they hear the Morningstar name, don’t realize that we actually cover stocks. We have been doing stock research in the mid-nineties, big beneficiaries of the Spitzer settlement during the early two thousand. We were to build out a more expansive research group at this point. Right now, we got about 65 analysts covering stocks in the US, 20 here in Europe, and another 20 in the Asia Pacific region. So, a decent amount of coverage at this point. We tend to focus on higher quality names, companies that we consider to have economic moats. It’s a term that we stole from Warren and he has not held it against us yet.

[00:00:58] Greggory Warren: But overall, we look at companies that have several competitive advantages and try to forecast what their cash flows are going to be over an extended period. It is a very down-in-the-dirt sort of research work, you know, fundamental, but I think the best part about what I do is it is independent. I can say what I want about any company within reason and that really helps.

[00:01:25] Greggory Warren: And I think as far as the Berkshire panel goes, last year was my sixth year of being on the panel and I was really excited the first year when they asked me to join. It was that year that we were trying to find another bear on Berkshire after Doug Cass offended a lot of shareholders. And, they reached out to me about five weeks before the meeting started and asked if I would be willing to do it because they could not find a bear. And I looked at it as “If I’m going to do this, I want to sort of being able to carve out a notch for independent research” because for those who are familiar or not, every year, Jonathan Brat from Sequoia comes. He is a buy-side analyst. You have the sell-side analysts who rotate through insurance analysts and then then I am on the panel as well. And so far, I feel like I have been doing a good enough job because they keep asking me back every year.

[00:02:20] Greggory Warren: When we think about Berkshire, I mean, the interesting thing about the meeting overall is, you know, in the past, when it was not live cast on Yahoo, I would walk away from the meeting and do a write-up and say, “Look, this is what happened at the meeting. This is what was said, these are the highlights.” But once the meetings started being live cast, I am like, “I can’t do that” because everybody sort of already knows. So, I started focusing more on, “What did I learn from the meeting? What insights did I gain that helped me think about the company, helped me think about research?”

[00:02:49] Greggory Warren: And, within the first two weeks after the meeting, I will come out with a piece that talks about what I pulled away from the meeting and how it improved or enhanced our evaluation or our assessment of the company. This year was a little bit different. I mean, it was not that there was not a spirited debate and there were not a lot of questions. It was just that I came away from the meeting and I was like, “Hmm, I feel like it’s sort of the same thing again and again.”

[00:03:12] Greggory Warren: And I am not really producing a unique way to look at how this meeting went this year. It took me a while and I started thinking, “What would I say to somebody really producing a unique way to look at how this meeting went this year? It took me a while and I started thinking about, “What would I say to somebody who was new to the name or somebody who hadn’t been at the name for a while and was interested in Berkshire and give them at least five good reasons to start thinking about buying the company?” And that is really sort of the nexus of the report that we ended up writing and putting out in August. But really, it is taken talking about the five sorts of key highlights of the business that investors really need to look at, especially now where we are in the cycle.

[00:03:49] Greggory Warren: But before I do that, I think it’s important…I’m not sure if you can read all of this from the back of the room, but I think it’s really important to sort of look at what some of the naysayers are doing or saying right now.

Greggory Warren on: Do recent sellers of Berkshire have a point?

[00:04:05] Greggory Warren: We’ve had some high-profile purchases within the past three, four months, Ackman being one of them, but we also had a high-profile sale: the Wedgewood Partners that owned it for an exceedingly lengthy period decided to sell out. And I started listening to these kinds of rationales that a lot of these guys were putting out for selling, and I do not necessarily disagree with some of the points that they brought up.

[00:04:29] Greggory Warren: I mean, the biggest point is always “Berkshire’s size is going to be an impetus to them growing over the long run.” Charlie, I think, has said years ago that size is a big anchor and it really makes it more difficult to grow the business. And I think what we have seen over the past 10 years is a firm that has a large market cap, and generated a lot of cash but has no real opportunities to really grow the business. So, it has been even more difficult than we have seen historically.

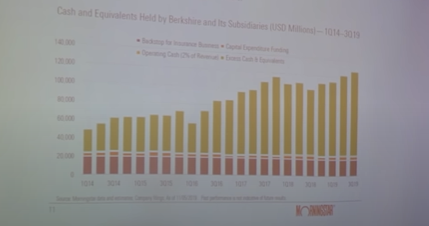

[00:04:58] Greggory Warren: The second line, is actually the title of a piece I wrote in 2013 when I walked away from the meeting. And my key conclusion was the company had too much cash and not enough good ideas. And I think back then they were sitting around $30, $40 billion in cash, and on a dry powder basis that probably worked out to about 15 to 20.

[00:05:19] Greggory Warren: They just reported over the weekend, $128 billion. You take out the $200 billion backstop for the insurance business and some of the mandatory sort of CapEx start-up and operating cash, you are about a hundred billion in dry powder. It has just gotten to the point where there is just too much cash in the business.

[00:05:41] Greggory Warren: Another point that one of the sellers brought up was the performance of some of the businesses they’ve bought over the past 10 years has been underwhelming. Precision Castparts, I agree, has not been as good of a deal as you’d like to…I mean, I think they bought it too early, and then they’ve had declining earnings, write-downs, impairments in parts of the business. And I think the story going in was there is this great bolt-on acquisition vehicle that historically was buying up companies and generating better and better margins over time, and that under Berkshire was just going to get better because they did not have the restraints and greater access to capital. And honestly, they have not done a whole lot from an acquisition front since Berkshire folded them in. And that same sort of thing played out with the automotive group that they bought. The thought was consolidation would come. They would start consolidating auto dealerships, and it just has not happened. And then Lubrizol had the same thing. They found some deals to do. But, I say, about half of them have not really worked out. So, for shareholders, it has been a bit of a disappointment in some regards.

[00:06:52] Greggory Warren: The other point here is “Buffet’s been really poor about returning capital to shareholders”. I mean, he has historically had the notion of “I’m not going to pay a dividend because I could probably do a better job reinvesting the retained earnings than most shareholders can do.” The problem is, the past 10 years, that has not been the case. I think somebody getting that dividend, putting an index fund would have been doing better over that 10-year timeframe than they had with Berkshire. The advantage, though, is having that much capital in their hands when deals do pop up. So, it is a double-edged sword.

[00:07:29] Greggory Warren: The other question is “Berkshire shares are likely to get pummelling once Buffet leaves the scene”. I’m not sure how much faith to put in that. I mean, I did look at the whole Steve Jobs situation with Apple when he passed on a few years ago, and I think that was a more unique situation because people knew that he was still for a good nine months to a year before, you know, the event actually happened. So, it wasn’t a surprise. But I think the thing is when we look at the cash balance, I’ve generally told people like, “Look, I don’t think Berkshire will come out and say it, but I get a sense that part of that cash balance is a break-glass-in-case-of-emergency fund, that if Buffett does pass tomorrow and the stock goes down dramatically, they could quickly put money to work shoring up the stock price and keeping it from depressing too far.

[00:08:22] Greggory Warren: I think the pressure for the company is, “What happens with the Class A shareholders and what do they do?” The less liquid of the two shares and trades about 300, 400 shares a day, you just increase that tenfold. That’s only 3,000, 4,000 shares a day, but you think in an event where, you know, Buffett were to pass, you could potentially see that. The real issue is how much downward pressure that puts on the stock overall.

[00:08:51] Greggory Warren: And then, the classic “Berkshire’s underperformed the past year, they’ve not done well”. And as I pointed out in the research piece we just did, well, they tend not to do well when the market’s up double digits. I went back and looked at all the periods, you know, the past two decades and when the market’s up more than 10%, Berkshire on average tends to trail the market by about 800 basis points. This past year, it has been about a thousand basis points, but we also sort of later in the cycle with the market, and that’s sort of what really sort of brought me to the idea of, “Could I come up with five clever ideas why investors should be really looking at this firm and thinking about it for a longer-term investment?”

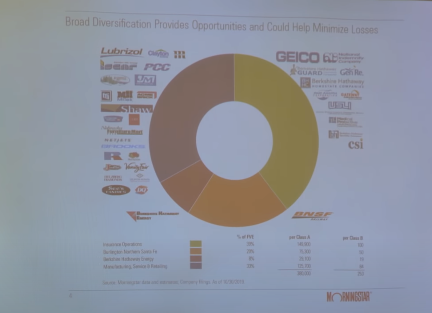

[00:09:37] Greggory Warren: The first one was the broad diversification within the portfolio and the decentralized nature of the business. It tends to provide additional opportunities for the managers running those businesses and tends to minimize losses. We have seen a sort of easing over time or a folding out of bad results on individual parts of the business when it is offset against the rest of the portfolio. And I always highlight to clients, you know, when you think about GEICO, when they went through that almost two-year phase where they were aggressively underwriting a business when everybody else had pulled back, and taking on a much higher loss ratio in the process, they could afford to do that. They are just one insurance company within a larger conglomerate of insurance businesses within a larger business overall. So, they could afford to post a lower combined ratio than they typically have and grow market share in the process. I mean, it’s not a process we like to see with PNC insurers overall, but I think Berkshire’s unique, and those managers are positioned where they can do that from time to time.

Diversification provides opportunities

[00:10:45] Greggory Warren: And the thing is, too, is when you look at what makes up the whole. I mean, the more interesting thing about the insurance business historically is, you know, the fastest growing and most profitable piece of Berkshire’s insurance empire is the primary group. It is not GEICO, it is not the reinsurance business, it is the primary group which is a hodgepodge of a lot of specialty insurers. Their combined ratio on average has been closer to 90%. GEICO’s, historically, has been about 95% and the reinsurance business strives to be breakeven and does not really succeed at that. But again, that’s reinsurance, which is a much tougher business to generate consistent operating profitability.

[00:11:28] Greggory Warren: But then on the other side of the coin, you have got the MSR which is now this big hodgepodge of a lot of different businesses doing a lot of different things. And what is more important on that side of the business is what Lubrizol, Clayton Homes, Marmon, ISCAR, and Precision Castparts are doing because they are the biggest generators of operating profitability for that business.

[00:11:48] Greggory Warren: Burlington Northern, a good stable wide moat railroad firm, and then Berkshire Energy, and whenever I talk about Berkshire Energy, I like to point out the fact that they are the most uniquely advantaged utility operating in North America because they are not public, they do not have to pay out 60 to 70% of their earnings as a dividend and because they are part of the larger profile on the tax basis with Berkshire. They can invest a significant amount of money in alternative wind power solar farms and get tax breaks from the federal government than they would as a standalone business.

[00:12:28] Greggory Warren: So, we really like that business and whenever conversations come about if we are 10, 20 years down the road and the managers cannot grow the business to pace and it comes time to potentially break up Berkshire, what would you fold off first? And I am always like, “Well, the railroad’s easy to spin out.” You would have to think about combining some of the other businesses to spin out, but insurance stays and the energy business stays because again, big, huge advantage of operating under that umbrella.

Greggory Warren: A decentralized structure and efficient capital allocation have been central to Berkshire’s success

[00:12:58] Greggory Warren: When we talk about the business overall from a conglomerate perspective, they have really succeeded where a lot of conglomerates failed. And I think part of that success has come from the fact that they have been completely decentralized. There is not a whole lot of overlapping business, not a whole lot of synergies to be sought after. So, from that perspective, they let the managers that run the business when they buy them continue to run the business, and the reporting controls and those structures are limited overall. For most of us that look at companies, our first impression is “warning, warning” but for them, it is worked. And occasionally, you have instances where things blow up or a manager does something bad, but that’s sort of the price you pay for allowing this sort of system to exist and work.

[00:13:46] Greggory Warren: And the thing is, is when you look at these different businesses, Buffett tends to be attracted to meatier firms or at least meatier firms at the times that he acquires them, companies that have some sort of advantage that allows them…there are in excess returns over a longer period. It is not to say that he does not go discount hunting or is not…or is unwilling to sort of pull up a name that may be more of a cash generator than it is sort of a growth story. That is the thing that they went through with Duracell a few years ago, where in a tax advantage trade, they gave up their P&G stock and took the Duracell business off P&G’s hands. The battery business may be dying over time, but it is still a huge cash generator for them.

[00:14:32] Greggory Warren: Overall, the big advantage is having this thing set up in the holding company structure where so much of the cash flows freely and can move around in various parts of the business when opportunities do arise.

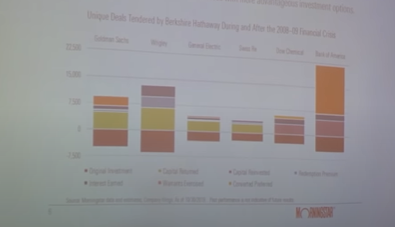

[00:14:49] Greggory Warren: And I think one of the successes we have seen over the years has been when Buffet finds a way to use his Buffet seal of approval to extract high rents out of parties. We looked at some of the deals that they did post-monetary crisis and the initial outlay from a capital perspective, and then sort of the returns they got: return of the initial capital plus interest, dividends, warrants, any other sort of kickers that were in there and surprisingly enough, everybody looks and says, “Well, yes. They made a large profit on Goldman.” Well, they had a better deal with Wrigley during that period, I think for a while there and I can talk about this because my wife works for Wrigley and she was there when all of this happened.

[00:15:39] Greggory Warren: They saddled Wrigley – Mars did a leveraged buyout of Wrigley and saddled them with 11% debt that was funded by Berkshire. So, that was the summer of 2008. And Wrigley spent the next six, seven years working aggressively to get that debt off the books, because it was killing them from a coupon perspective. But for Berkshire, they were pulling in some good returns. But the real winner was the Bank of America. That was an interesting outlay and people were surprised when he did it, but they have made a significant amount of money off the shares there, post the conversion, and that is one of the unique things that we like to point out to Berkshire and like to point out the clients, like, “Yeah, there’s a ton of cash on the books, but look what he’s able to do when we have these unique disruptions in the market.” So, sometimes some patient is rewarded.

[00:16:35] Greggory Warren: The other thing is, when we look at sort of the structure of the organization, you know, BNSF, everybody thinks it is a stodgy old railroad, but this is a company that is funnelled up about 32 and a half billion to Berkshire just in annual cash dividend payments since it was acquired. Our expectation is, over the next five years, it is about 5 billion a year. But when you look at sort of the acquisitions, they have done during the same timeframe they have owned it, just that cash payment covered about 40% of the outlay that they did for things like Precision Castparts and Nevada Energy in Lubrizol. So, that cash generation that is coming from that business is still significant and that is even with the capital-intensive nature of the business overall.

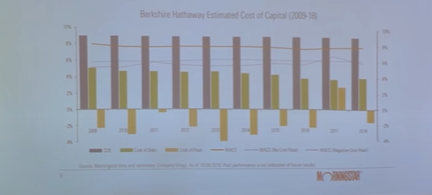

[00:17:23] Greggory Warren: The second point I put down on paper was “Berkshire’s still likely to generate turns in excess of their cost of capital.” And when we look at moats and we think about moatiness of businesses over a long-term period, that’s sort of an essential thing for us, either on an ROIC or an ROE basis, that the company’s earning more than the capital costs them.

[00:17:45] Greggory Warren: And Berkshire’s unique because on a straight cost of capital, the weighted average cost of capital basis, it is about 7.8%. You take all the debt there and look at it that way. This is where the conversation of float tends to come into. People talk about float and sort of the free capital or the negative cost float. You can tweak that cost of capital a little bit with that. I am not too positive about doing that with the negative costs because that is assuming consistent operating profitability on an underwriting basis.

[00:18:20] Greggory Warren: But yes, I still look at the fact that, somewhere closer to 7%, if you just assume the longer tail insurance business, the reinsurance business, because that stuff, they tend to hold for multi-year periods. I mean, whenever the conversation comes up about float, people are always like, “Do you value the firm on a floating basis?” I am like, “Well, no, we don’t.” Because we look at float – is it a liability? And we look at it as an essential part of the insurance business and it is intricate in our discount of the cash flow model. So, we do not try to break that out and run evaluations that way. And for your short-tail businesses, like your Geico or your primary group businesses, that turnover can be six months or a year. You are holding that money for that period and paying out 90, 95% of it. And you are earning returns on that, but you are typically in very liquid cash-like products, so you are not earning a whole lot overall. The real value of the float comes from the reinsurance business which you are holding over multi-year periods.

Five reasons to consider buying Berkshire Hathaway

[00:19:27] Greggory Warren: The third point I looked at was, you know, the balance sheet has been a good positive attribute for the business. On the reinsurance side, they can write larger contracts, businesses that a lot of their competitors have not been able to touch or look at. And it is also the notion that there is so much capital flowing through the business and so much cash that is available for the current operators where they can tap into a lower cost, you know when they want to do capital investments or want to do an acquisition.

[00:20:03] Greggory Warren: When we look at the cash and equivalence at Berkshire over the last, I would say five plus years here, it continues to grow at a meaningful pace. I mean, we are setting out about 128 billion right now. And like I was saying, when you strip out the capital expenditure funding, operating cash, and then that backstop for the insurance business, you are still…you are looking at about a hundred billion in dry powder at this point.

[00:20:31] Greggory Warren: The fourth thing that sort of came to mind as I was going through this entire process was, you know, it is something we said almost five years ago. Berkshire is that sort of that precipice of evolving from a reinvestment machine or an investment vehicle overall into a returning capital to shareholders’ business. It is getting harder and harder and harder for them to find the kind of deals that Warren and Charlie were doing 20, 30 years ago. It just…there is too much capital out there chasing it, you know, too many private equity guys, valuations are too high. And it has gotten to a point where it needs to start returning more capital to shareholders. And Warren acknowledges this, but I think at the end of the day, he is hesitant to really go full board into it.

[00:21:14] Greggory Warren: He is still holding out hope that he is going to find a good deal and that next downturn. He does not want to pay dividends. What I was saying about sort of that meeting going in and putting together questions, I tend to sort of fall more on the utilities and railroad side of the questioning. Jonathan Brat and I, when we first came onto the panels, the only instructions we got from Berkshire was, “You’re not allowed to ask questions about insurance because there is a cell site insurance analyst there, so that is for them. So, you guys get to ask questions about anything else in the rest of the business.” And I have more insight from our organization into the railroad utility industry overall and so I focused a lot of questions there, but I also was looking at capital allocation questions, succession planning, a lot of different things there. And about three years ago, I started down the path of trying to gear more of my questions into cornering Warren into a position where we would all get a better sense about what capital allocation was going to look at over time.

[00:22:18] Greggory Warren: So, that first year, I really pressured them a lot about dividends and whether they set up a repeatable dividend or whether they would pay a one-time special dividend if that cash balance got too high because Warren had made, I think, the mistake of saying, “I cannot sit here a few years from now with 150 billion on the book and be able to justify it to shareholders. So, he really boxed himself in there and I was like, “Well, we need to sort of push the issue and get him into a corner.” And what I came out with in that meeting was him emphatically saying, “I will never pay a special dividend.” And he made a point of coming up to me the next day at the brunch and saying…that was the first thing out of his mouth. “So, I want to be clear, no special dividend.”

[00:23:01] Greggory Warren: So, that is off the table. A dividend itself… could still happen on his watch, but I get the sense that he wants to leave that as a tool for the next guys. Because again, if we have a lot of selling pressure out of the gate, Buffet’s gone, I think the first sort of business for the next managers is sort of placating the shareholders, calming the situation down. And, the first words I want to hear out of their mouth are, “We’re not Warren, we are not Charlie. We should not be allowed to have this much capital on the books. We are going to start returning some of it to shareholders.” And that is setting up a small, regular dividend and then increasing it over time based upon what the opportunities are for them.

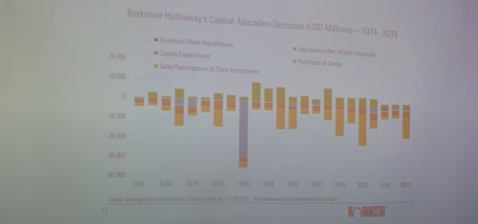

[00:23:41] Greggory Warren: And I think that’s Warren’s long-term game plan there. So, when we look at capital allocation, then, you have only really got three options: you have acquisitions, stock investments, and then share repurchases. So, the last two years, I have been more focused on, you know, “Why aren’t you doing more share repurchases? Why aren’t we seeing more from that level?” And it just makes sense.

[00:24:05] Greggory Warren: We are at this point now where there have not really been any attractive deals. And the one deal they screwed up, which was Encore, was the situation where they came in and tried to nickel and dime the sellers. It was a bankruptcy situation. They did the smart thing, went out, and got all the regulators onboard in Texas with what they were planning to do. So, they did what nobody else had bid before because there were three other bidders before they came to the table. And all of them failed because the regulators did not like the plan. So, here was, in bankruptcy, and the debt holders were controlling the situation, and Berkshire comes in, gets the regulators on board, and then comes in and offers 500 million less than the last guy and pissed off the debt holders. And they brought in a different consortium and it got taken out from underneath them.

[00:25:02] Greggory Warren: And I think for them, the problem was Buffet’s always had this mantra, “We don’t do bidding wars, we don’t do auctions.” But I think if they had walked into the table with the same price as Nexterra had, they would have walked away with Encore. And I think that would have been an incredibly attractive asset because it was a transmission asset in need of a lot of capital expenditures. So, it would do two good things for them: it would take away capital that is sitting on their books and they were likely to get more favorable rate cases from the regulators because they were willing to commit to a lot of capital investment. So, I think from that perspective, it was a missed opportunity, but overall, it has been difficult for them to find deals. I am still curious to see what they were looking at in the fourth quarter of last year.

[00:25:50] Greggory Warren: But the other thing is, in Buffet’s mind, he is looking at it from the perspective of, “This is my last deal. This next big deal that I do will be the one that I will be remembered for and I do not want to screw it up.” And I think that in some sense, it is just human nature. I think behaviourally, it prevents him from pulling the trigger on something that might, you know, 10 years ago, look more attractive to him. So, that really leaves stock investments and buying back stock.

[00:26:21] Greggory Warren: And on the stock investment front, we have seen a lot more activity. In fact, I was just rolling through the three Q numbers last night and it looks on a net basis. They spent another 10 billion on stock purchases during the third quarter. Apple and Amazon, for those that are wondering. But we will have to see when that 13 F comes out, but I think overall, they will be opportunistic. And I think that they have been very disciplined about that. They have been particularly good about stepping in when the market sells off to pick up some investment ideas for the portfolio. The problem is they have not done the same for their own stock, and I think for a long, long time, share repurchases were not even in the conversation. And then in, was it 2010? They rolled out the first…no, it was 2012. They rolled out the first notion that they would buy back shares at less than 1.1 times the book. And then within two years, they had to change that to 1.2 because they had a large seller of class A shares that was unwilling to take the one, one and wanted the one, two.

[00:27:30] Greggory Warren: But what happened because of that, because they drew the line in the sand, is for the next five, six years, it was a floor, and the stock rarely traded below that floor. In fact, I used to tell clients, “If it gets below one, or three, you should be buying.” Because it would barely get to 1.2 five times the book. But at the same time, it really prevented them from buying shares. And I think last year, they realized that because of a lot of the questioning we were putting on the table and a lot of pressure for them to do something with the capital, they realized they had to sort of change that up.

[00:28:05] Greggory Warren: And so, it is more opportunistic now. When we feel that it is trading at a deep enough discount to our sense of intrinsic value, we will go out and buy back stock. And the funny thing is that the first two months after they announced that he was out buying shares at 1.4 times book value, and I am scratching my head and going, “Is my valuation wrong? Have I missed something here? Is the stock worth significantly more than I think it is?” Because 1.4 to 1.5 has been the normal range of the markets attached to this thing over the last 10, 15 years. So, it is not like he is buying at a significant discount to where the markets had it. But the last three quarters, it has been closer to 1.3 times book value, which was my initial impression that if he is going to be buying, he would be buying closer to 1.3.

[00:28:52] Greggory Warren: The problem has been underwhelming. I think they have bought 2 billion this year, over three quarters, and by our maths, they could easily do one and a half to two and a half billion a quarter and not break a sweat. And just remember, we have got the railroad funneling up 5 billion in cash. So, something must give on this front at some point and I think that as that cash balance gets closer and closer to 150 billion, he is going to have to do something more dramatic. And he set the stage for that this year with the annual report, you know, trying to sort of tone down the focus on book value per share. Because what happens when you do a large share repurchase, screws everything up from looking at the firm from that perspective. So, that tells me that he is prepping the potential for them to do a large buyback somewhere over the next two, or three years if they need to.

Berkshire is evolving into a vehicle for returning more capital to shareholders

[00:30:00] Greggory Warren: Like I was saying, there have been repurchases of late. Our run rate, on an annualized basis for our forecast, is about 10 to 15 billion. And that’s because midway through the cycle, we are including a 25 billion share repurchase because we did the maths. 20 billion in free cash flow annually, rotated up, they are at 150 billion in 2021, so, they would have to do something. But for us, that is more…just honesty. It takes cash off the balance sheet and only has a marginal sort of improvement on the valuation. I mean, you know, the returns on capital and the returns on book value per share from that point on look a little bit better because you have decreased the book value per share overall.

[00:30:51] Greggory Warren: But, you know, from a capital allocation perspective, this is what we have really seen. And what really stood out to me last night as I was updating the third quarter numbers is there has been a lot more stock purchase activity in the past two years than we have seen in other periods. So, it is really kind of fascinating to sort of look at where the cash outlays are going. But again, I still think longer term, we are going to see more acquisitions overall, on our acquisition share repurchases.

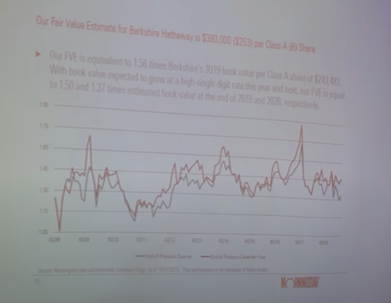

[00:31:20] Greggory Warren: And then the fifth point, and I got lucky timing-wise, was the stocks are cheap. And when I rolled out the report, it was trading at about a 25% discount to our fair value. Right now, it is about 15. So, we have had a nice little run over the last month and a half or so, but it is still reasonable.

[00:31:42] Greggory Warren: And the thing is with Berkshire it tends to be more of a defensive stock, anyways. It tends to behave more like a defensive name than it does a growth name. So, when the market does go down, it tends to outperform the market on a time basis overall. And when I looked out going forward, I mean, I cover the US-based asset managers, and I have been looking for a correction for five years now, but we know it is eventually coming. We are getting closer and closer and closer to where it is going to come. In fact, I thought the fourth quarter last year was the start of a sustained favorable market or bear market for a period, but it just did not pan out. But I think for the US, economic growth is slowing, business spending is down. It is sort of really setting up the stage for a slowdown in the US economy, if not a recession. And usually what comes with that is a selloff in the market. So, we are getting closer to that scenario.

[00:32:42] Greggory Warren: And that is really sort of the time to really sort of be looking at and buying Berkshires ahead of that, because it is going to do better than a lot of its peers and a lot of its financial services names because Berkshire is not a bank, so it is not interest rate sensitive. I mean, most of our bank coverage right now is taking it on the nose because the fed keeps cutting rates, so, that hurts them from a net interest income. But it is still relatively attractive right now at about a 15% discount.

Berkshire’s shares remain undervalued in a market that is near valued

[00:33:11] Greggory Warren: And we look at where sort of the stocks traded historically. Our current fair value estimate is equal to about 1.5, six times last quarter’s book value per share on our estimate basis. But we are expecting to still grow at about a high single-digit rate this year and, and next, so that puts it about 1.5 times the end of year book value, and then 1.3, seven times next year. So yes, kind of average that out and it gets back to sort of that market price. I mean, it is not intentional, that is really sort of the way it ends up working out, because the way in which we value Berkshire’s, we tear the entire business apart.

[00:33:48] Greggory Warren: So, we are valuing the railroad, you know, with our railroad analysts, we are valuing the energy business with our energy guys. I am working with the consumer cyclical analysts when I am looking at the MSR business and some of the industrial guys. And then the insurance business, we run through the regular model along with the investment portfolio.

[00:34:06] Greggory Warren: So, it is really a true sum of the parts, kind of DCF, but we also spend time triangulating our estimates and our results against the rest of our coverage to make sure that Berkshire deserves a premium. Like with the energy business, our valuation is coming to a premium relative to the rest of the group on our forecast there and where it deserves a little bit of a discount. And I put the railroad there because it is not as profitable as it is as closest peer Union Pacific. You know, it makes sense there, but overall, when we roll that all up, and get the fair value, it ends up coming close. And I look at all the work I have done and be like, “Did I really need to do all that work?” Because, you know, I could just plug that number in there. But it is intellectually honest to really sort of do it and deep down, you know, dig into it.

[00:34:56] Greggory Warren: That ended up being the five reasons, and really put the piece out that way. I mean, Berkshire is not a growth story. Berkshire is not a glamorous name, but Berkshire is uniquely positioned and has a ton of capital on its hands. And that is something investors really want to be focused on as we go through the next sort of phase of the market. And that is it. So, I guess we could take questions if we have time.

A question on the shareholders’ meeting and the quality of it

[00:35:32] Hendrik Leber: Provocative question. I have been to the Berkshire Hathaway meeting for 25 years now, and the last three years did not overwhelm me. What do you think about this intellectual capacity? Is it…I mean, it is still brilliant, better than most of us, but is he losing it?

[00:35:46] Greggory Warren: There is an enormous difference between what you see on stage in real life. I think the biggest challenge for me as an analyst asking questions is, I know Warren will evade my question if he can, and that is why I always tell…because I will get queries from clients, we will get questions phoned in during the year, like, “Hey, I thought maybe you should really look at this or really look at that.” And that does help us in some regard because if I see the same question coming up repeatedly, it sort of helps me sort of line up questions. But it is the hardest thing I do as an analyst every year because I must sit down and write questions and cut off avenues of escape for Warren because I want to direct him to where I think the answer should go.

[00:36:38] I may not get the answer I want, but it’s still, “I want you to answer the question this way.” And there was trial and error. I learned it over time with him because there was one question…I asked questions about American Express and he told me a story about traveler’s cheques and the salad oil crisis and, you know, a lot of those things. And I think for him, that’s easier to sort of spout off on. And I think when we ask him a difficult enough question about the operating businesses, he will deflect and have Matt Rose or Greg or Ajit step up and actually answer that question on that level.

[00:37:11] I do not think it is a lack of intellectual capacity. He understands the impact or the value that his words have sometimes, and now, it is even more so because they are live casting the meeting. It is why I tell clients when they say, “Well, why don’t you ask about Visa?” And I am like, “Because I asked a straight question about a stock, I will not get an answer.” Or if I ask him directly about Wells Fargo, he is not going to talk the company up. He is not going to talk the company up, he is not going to talk the company down because he does not want to be in a position where he is affecting the trading of a particular security.

[00:37:50] So, to your point. I think it has been tougher since they started to live casting the meetings for him to be as straightforward and transparent as he might have been in the past. Off-book, is a different story. I have had good conversations with him at brunch. I have had really, in-depth conversations with Ajit and Greg Abel and a lot of the other guys running the business. So, it is slightly different. But again, as I said, we were brought on board to do a job, and I looked at it the first year, I am like, “God, I am just the entertainment. I am part of the show here and they want me to ask questions so they can talk about the business.” And, you know, I walked away from that, like, “No, I’m an analyst.”

[00:38:37] So, I came in the next year and if I can get at least one or two questions where I am learning something, that is helping me understand or get a better sense of the business, I feel better. And this year too. I mean, it was not so much on a business. It was getting Warren to admit that shift to a returning capital shareholder business, that quicker shift, might happen on his watch. So, he is really sort of cognizant of where he is. And there has been a couple of years, too. I mean, it was always up in the air. For the longest time, we did not have a straight dialogue with them where they would call us up and say, “Will you be on the panel next year?” It was always “wait for the annual report to come out, is your name in it?” And you are on the panel. And that was fine.

[00:39:27] And Jonathan and I both were…he’s done it seven years now and I’ve done it six. And this past year, the annual report came out, and before I start working on their earnings, I always type in my name. And I did that, and it wasn’t there. And I typed in Jonathan’s name, and it wasn’t there. And I typed in Becky Quick because I knew that would probably be there, and it was. And what Berkshire had done is in the area where they talked about, “We’ll have three journalists asking questions and they give the names and we’ll have a panel of analysts.” And I was like, “Well, what does that mean?” So, I actually pinged Debbie Bosanek and I said, “I don’t want to assume anything, but are we on the panel this year?” You know, just because our names weren’t in there. And she’s like, “Oh, no, no, no, no. You know, we screwed up. You guys should have been in there. In fact, Warren wants you and Jonathan back every year because you ask good, tough questions.” And I was like, “Phew! I didn’t screw up, I didn’t piss these guys off and wow, I’m back on the panel every year now.”

[00:40:33] So, it’s kind of nice from that perspective. But again, I think you’re right. I think we look over the past three years, it’s been a little bit different, and I don’t think we’ve had the same level of transparency as we may have had in the past when it was more of a closed event.

Greggory Warren, When do buybacks happen?

[00:40:51] Question: Yeah. And you said he would buy back shares if it’s discounted enough. What is discounted enough for him?

[00:41:05] Greggory Warren: I think it’s apparently around 1.3 times book value. I mean, if you look at the track record of last year, that seems to be where he’s more comfortable buying back. I think if it’s less, we’d probably see more, but I think at the end of the day, Warren hates to part with money.

[00:41:23] I think he hates the idea of taking capital that he could use to buy businesses or to buy stocks and give it away because I think at the end of the day, he still looks at it from that perspective. I mean, for the business, it’s actually a good decision. From his estate perspective, it’s actually a good decision because one of the things we cornered him on was, you know, when he looks to buy back stock, he’s looking primarily at class A shares, and that’s good knowledge. That’s important for us to have. And for him, it’s about eliminating as much of the super voting rights as possible because he’s already doing that every year when he gifts his shares to the five charities he gives to.

[00:42:05] He converts all those over to class B and works it off. So, when you look at sort of the trend line of the voting control of Berkshire’s surviving shares with the trust, there is still probably about a 10, 12-year timeframe after he passes where the trust will still have significant weight on the business matters. But, you know, share repurchases buying back a bunch of class A shares that would help improve that situation. So, we will have to see, and that’s sort of a question I am trying to think about formulating for this year. It is trying to get into his mindset and how he thinks about these things.

The insurance business

[00:42:43] Question: Is there a good [00:42:44 inaudible]?

[00:42:50] Greggory Warren: He didn’t look too good this year.

[00:42:52] Speaker 3: I’ve heard from multiple people.

[00:42:54] Gregory Warren: Yes, yes. And I would not be surprised. The woman who…I cannot remember her name, but the one who was his lieutenant at Berkshire Reinsurance, who he brought over to take over control at Gen Re. Yeah, that was one of the most interesting conversations I have had with Ajit. It was that year that he took over control of Gen Re. He spent an hour with Jonathan and I talking about all the positives, but also all the negatives of Gen Re and the things he wanted to do to improve it, work on it, and fix it. And he highly praised this woman he was bringing over. And she has done an excellent job. I mean, when I look at sort of the record of accomplishment since she has come on board, you are seeing more stable earn premium growth, you are seeing better profitability overall. So, she knows the business well.

[00:43:45] Where Ajit comes in, it’s the same sort of thing with Buffet. The value of Buffet is sort of that Buffet seal of approval. It’s the ability to extract 9% preferred stock rent or 11% debt from people that need capital or need that Buffet seal approval. Ajit’s strength is finding unique, large risks that they can underwrite and potentially make a decent amount of money on. The problem is, there’s a lack of transparency within Berkshire’s insurance reporting that would allow us to see how somebody’s deals have panned out over time. The only way we’d look at this is from the perspective of ‘if I’m underwriting reinsurance and I breakeven, and I have that money for a longer period of time and I’m investing a lot more of it in stocks, then I’m probably doing okay’.

[00:44:37] So, from that perspective, it has not been bad but I am curious to look at the return profile for the AIG business because AIG scares me and their underwriting has been really, poor historically. And, Berkshire said, “Well, we’ll take on that risk and take the 10 billion upfront.” And I do not know if that’s really going to be a high return vehicle for the long term. So, you know, they, like anybody, are human. They strive to find deals sometimes. You know you step into something that may not be as lucrative as they thought it was going to be.

[00:45:13] Greggory Warren: But again, I do take comfort knowing that there is a good second in command there. In fact, it is interesting to see the changing of the guard and the embracing of different things. I mean, I think Geico’s going to run better now that Tony Nicely’s not running it. Tony Nicely is a great guy. He did an excellent job growing the business, but there was hesitance on his part to do certain things, like adopt telematics. I remember having a conversation with him about it like five years ago, you know, “Why haven’t you adopted telematics? Progressive’s doing it, and a lot of the other players are doing it. It makes sense. You get a better sense of what a driver’s record of accomplishment is, and you can do better underwriting as a result.” And Geico is just blunt force, you know. We are just going to go out and underwrite a lot of business, and drive our expense ratios down so we can carry a larger loss ratio.

[00:46:04] And it has worked. They very rarely look like they were going to underperform from an underwriting perspective. But, when I talked to Tony about it, I was like, “Why aren’t you doing it?” His answer was, “Well, automatic braking is mandatory in new vehicles in 2020, so, it’s not a problem.” And I was bewildered and was like, “Well, so seven to 10 years from then, and it will have rolled through the entire fleet. So, it is not a problem for you for 15 years?” I am like, “That just seems an awful lot of time to give your competitors the ability to basically take some of the best drivers.”

[00:48:46]Now, the word we have been hearing lately has been, “Geico’s actually testing an app to put on smartphones.” So, in some ways, this hesitance may have worked out for them from a cost perspective because Progressive was first in the pioneer, but it cost them a lot more on the expense side to roll up, run that business, and get them where they are. So, if Geico can step in now and just put an app on people’s smartphones, it is a less costly way to get it. So, that may have panned out that way. But I think that might have been the better answer than, you know, standard breaking is going to be mandatory.

Deal-making at Berkshire Hathaway

[00:47:27] Question: You just touched [00:47:27 inaudible]?

[00:47:36] Greggory Warren: Yes. They are still going to be able to do some decent deals without Buffet. But this was a question two years ago that came up in the meeting and I did not like the way they answered the first time. So, when I got my first question, I was like, “I want to follow up on that because I don’t believe you,” because Buffet basically said, “Oh, the guys behind me, they’re going to have the same opportunities, they’re going to be able to earn the same kind of returns, Berkshire will be seen as sort of a beacon of cash and influence that will be able to sort of step in.” And I was like, “I do not buy that. You have something that…they have capital, but they do not have your sort of cachet, so, they are going to earn a percentage or two points below.”

[00:48:19] So, instead of getting a 9% preferred, it’s probably seven. Instead of getting 10 or 11% debt, it’s probably eight or nine. So, they’ll still get attractive returns. It’s just not as lucrative as it was during the Buffet years. And Buffet disagreed with me, and then he asked Charlie what he thought and Charlie said, “Well, I agree with him.” So, I just turned to Jonathan at that point in the meeting and said, “Well, that’s my first question. I’m done for the day because I can’t beat that.”

[00:48:46] Greggory Warren: So, I think from that perspective overall, it is a realization that the next guys are going to struggle. And again, it is the nature of the beast too, right now. And the next guys, I think, are going to be more focused on ‘how do we assess how much capital we should have on the books and ‘how much can we return to shareholders in an expeditious way and on a consistent basis. So, that is really going to be the challenge for the next guys, but I still think they can do deals and I still think they will be looked to as a source of funding, like this deal with Anadarko recently. But overall, I just do not think it is going to be as lucrative unless Greg and Todd, and Ted have a huge record of accomplishment of doing remarkable things with the money, then they could charge a premium to what they would normally get.

[00:49:46] Speaker 4: Okay. Well, thank you.

The readability of the 10K is questioned

[00:49:48] Speaker 5: Just a small question.

[00:49:48] Greggory Warren: Okay.

[00:49:49] Question: I have great trouble taking the 10K apart cause the numbers don’t add up [00:49:53 inaudible].

[00:49:56] Greggory Warren: I have as much trouble as you do. I mean, I think the biggest problem I have is the numbers on the energy business don’t line up with the under numbers and Berkshire’s 10K, and there are a lot of adjustments I have to make. And it’s not just the…they’re only getting 90.9% of the business because that’s how much they own of it. It’s just some goofy stuff that goes on within there. Yeah, so, my biggest challenge every year is, especially when I roll the model, is trying to line all that stuff up. And that’s like, you know, because of what we do, because we strip everything apart and value the things separately. I’m always talking to other analysts and saying, “We need to err on the side of caution with everything.” If we think, it’d be 3% volume declines in I think the biggest problem I have is that the coal business, maybe it’s four. If we’re looking at the insurance business, let’s put in a super cat loss midway through the cycle, let’s make sure that we’re being conservative because when we piece this all back together again, just the potential for error has increased meaningfully. So, let’s just make sure that we are doing all the right things.

[00:51:00] But I agree with you. That is a hassle, you know, and I usually work primarily off the segment reporting numbers. But then, I am also trying to sort of line things up and our insurance, our energy analyst is always like, “You are silly. Do not even do that.” You are like, “Let’s just run it through the model this way.” He is like, “Don’t even think about revenues in this business. Think about EBITDA. That is really sort of the driver, the cash flows that come out, overall, is far more important.” So, yes. No, I mean, you are not alone and I have been doing this for 10 plus years and it is the biggest challenge with that thing, which is why it is harder. It takes me longer to roll that model every year than it does any other model because I must make sure all that stuff lines up.

[00:51:52] Speaker 5: Okay. Yes, yes, yes.

Greggory Warren on Li Lu

[00:51:53] Question: One final question before we go to dine. Munger’s always been very fond of Li Lu in his investments in his Chinese firm. There’s been a lot of talk in past years that Li Lu might be brought on board when Charlie and/or Warren will step out of this company as one of the portfolio managers, which would also increase Buffet’s international footprint, no doubt. So, to what extent is that a reasonable expectation or is that just maybe wishful thinking by people who seek the additive return?

[00:52:33] Greggory Warren: I am not sure how reasonable the expectation is. I think it would be additive, but I am not sure…attaching yourself to this ship, where it is, where it will be, is going to be a little bit different. I mean, he will bring a different profile, obviously, on an international basis and I think Ted and Todd will benefit from the interaction as well. But when I look at Berkshire overall, I mean my sense is still with Greg Abels, the guy that is going to take over as CEO. I mean, Ajit, aside from the health issues, has historically said he does not want to be CEO. He does not want to be in the spotlight. He does not want to take Warren’s place. And it is really sort of a tricky situation for the next CEO.

[00:53:19] But the situation is they are going to have to have a team of managers running this business because there are a lot of different things they must do. And shareholders have been complacent for many, many years and allowed Warren and Charlie to do what they have done, but we are going to get to a different phase in the business and I think that anything they can do to sort of help anything to improve the investment profile of the business, I think will work overall. When we look at it, too, I think Warren had thought he found a partner in 3G, but that relationship is really soured at this point. But again, that’s Warren’s own…it is just Buffet’s own fault. He thought he could be the bank, get a nice return, and let 3G run the business, and then that was one of those areas were not really being a traditional manager and decentralizing your organization, you were not focused as much on what 3G was doing at Kraft or Kraft Heinz.

[00:54:19] When I look back because I covered consumer staples for decades when Heinz was looking to buy Kraft Heinz, I was like, “I really do not understand this. You must be seeing something I do not, and there must be some synergies about having those sorts of businesses because I covered this business.” And the first big mistake they made was when they sold the pizza business to Nestle, they sold a high-growth business. And then after the Cadbury deal, they took all the good pieces and put it on Mondelez and then pushed it out the door. And it left a lot of commodity businesses that were branded, but it is brands that I was harassing Kraft for years on, you know, where I just could not understand why they were spending so much money on marketing and R&D.

[00:55:03] Greggory Warren: Now 3G’s fault was cutting all that to the bone and it broke the packaged food business, and it is going to take a while for that to be fixed. And I think for Warren, I would gesture to say that over the next five to 10 years, he is going to be a net seller of that stock as he is supposed to buy more, because his comment was, “In years past, we loved Kraft Heinz and if 3G is selling, we’re buying.” What 3G was selling this year, Buffet was not buying anything. So, you know, I look at that relationship not continuing on the same basis as we move forward. Thank you.

[00:55:45] Speaker 7: Thank you very much.

Disclaimer

Finally, here is the disclaimer. Please check it out as this content is no advice and no recommendation!