In the second part of our interview with ABO Wind CEO Karsten Schlageter, we discuss the companies’ ambition in renewables. You can find all our interviews in our ABO Energy archive.

We have discussed the following topics:

- Intro

- Welcome to part 2 of the ABO Wind video

- From ABO Wind to ABO Energy

- Becoming a global player in renewables

- Understanding ABO Wind's markets

- Political shifts

- The most attractive markets

- How to navigate risk in regulated markets

- The challenging markets

- Learnings from new market entrants

- Patience

- Bottlenecks for ABO Wind

- Margins in the different markets

- The Role of Europe for ABO Wind

- Costs of A megawatts

- The hydrogen pipeline

- Valuing the hydrogen pipeline

- The battery pipeline

- Valuing the battery projects

- Future growth

- Closing thoughts

- Thank you & goodbye

Intro

[00:00:00] Karsten Schlageter: We are patient because we understand that sometimes it takes long or we need to wait for the right moment or regulatory change or government change. But that does not mean we sit there passively. Twenty years back, were all almost in the niche market. Now all big companies are in, we are in this big segment of renewables. So it’s mainstream. It will not simply go away as it did in the past for some years.

Welcome to part 2 of the ABO Wind video

[00:00:35] Tilman Versch: Dear viewers of Good Interesting Talks. It’s great to have you back with my second part of the interview with Karsten Schlageter of ABO Wind. Today we are looking into the growth chances of the company and I had to quickly pause when I said ABO Wind because they plan to rename to ABO Energy. Why is that so? Why are you planning to change the name of the company?

From ABO Wind to ABO Energy

[00:44:00] Tilman Versch: Today we are looking into the growth chances of the company and I had to quickly pause when I said ABO Wind because they plan to rename to ABO Energy. Why is that so? Why are you planning to change the name of the company?

[00:01:00] Karsten Schlageter: It was always or, not always, for many years in the discussion. I mean, we are 27 years now successful in this industry. We started, of course, with wind only and now we have become a much more broader company. We are now really focused on the energy transition as a whole. So we are active in wind, solar, battery systems, storage systems and hydrogen. So this brought us in the end to the decision to remember us to reflect that also in our name and ABO Energy KgaA was chosen to be best reflecting this ambition.

[00:01:54] Tilman Versch: We take a deeper look into the new additions next to the wind. Solar is already well known, but we take a look into this later.

Becoming a global player in renewables

[00:01:54] Tilman Versch: We take a deeper look into the new additions next to wind. Solar is already well known, but we take a look into this later. But you also have the wish that you want to be the global player in the renewable industry in the future. What does that mean? If you put it into practice?

[00:02:14] Karsten Schlageter: I think we already are. We have a very strong international presence. We have 16 markets. We are of course strong in Europe. That’s our stronghold. We are in Germany, especially in Finland, Spain, and France. Of course, these are the four strongest markets. And we also have a good pipeline in many other European markets to complete the picture.

UK and Ireland have a nice perspective to be a stronger market. We have medium markets like Hungary, and Greece where we are also very strong on top of that in Poland, which especially with the new government, with the more progressive outlook is very promising.

We are in the Netherlands. That is always a front runner in the renewables. Outside Europe and that’s probably what you mean by global. We have a strong presence in Canada since we spoke the last time. We have grown into several other provinces. We are in Colombia with a strong pipeline and we are building our first projects there and the solar business.

So this is also very promising. We are in Argentina. These are the Americas and in Africa, we are in North Africa and Tunisia with a strategy that is more and more focused on hydrogen. We are in Tanzania, which is a rather small market for us and very strong in South Africa. So I would say this has been already branded international or global, maybe we missed Asia. Yeah, but we also want to stay focused at least from a time zone definition point of view.

[00:04:13] Tilman Versch: Are you planning to add more markets in those time zones or…?

[00:04:18] Karsten Schlageter: The strategy that we designed last year and also published is to focus on these markets and also we want to do that for the period that we have defined. But of course, there might be new markets coming in the future that are not excluded. But for the moment, we are still in a consolidation in a sense of internationalisation. We have still markets to grow, we have markets where we can invest in a lot, and we have especially markets where there is a huge growth perspective and no need to go to additional ones.

Understanding ABO Wind’s markets

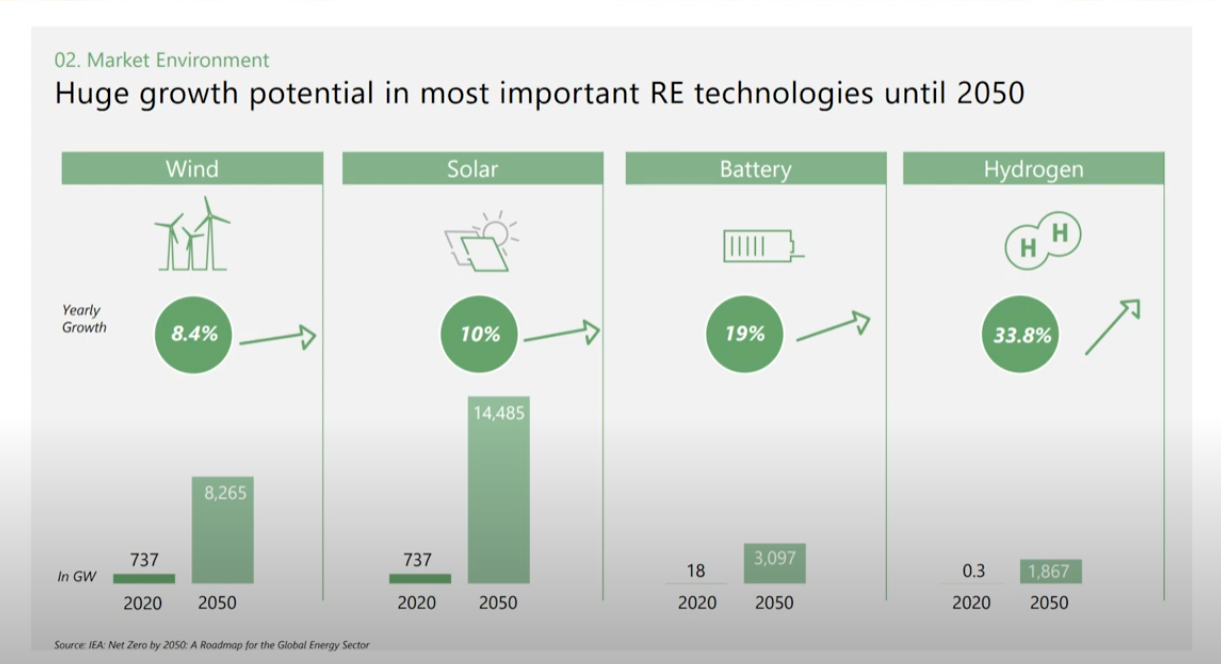

[00:04:58] Tilman Versch: So you have this interesting, the viewers will see this slide embedded into the video and you don’t have to show it. You can take a look at it. It’s the growth trajectory of the markets you’re in and there’s in between 7% per annum growth so that the digit growth in this market. So what is the general market environment you’re operating in looking like?

[00:05:27] Karsten Schlageter: I mean, that’s coming from the very big drivers from the crisis of mankind. We have climate change, so we know, but I think it has become mainstream in most governments, especially of the European Union, but also the United States came back under Joe Biden and climate change is accepted, so we need to come to a net seal environment where we really get rid of carbon emissions.

So this is the main driver. Then we have unfortunately had the Ukraine war since we spoke the last time. So we have had the need to substitute all kinds of fossil energies by implementing renewables in Europe, and especially Germany, this has driven a lot of our business outlook short, medium and long term. And we have inflationary pressure. This, of course, is related. So again, adding the cheapest sources of energy where today are solar and wind resources has become a paradigm of most of the European governments, and also of many outside European governments.

Political shifts

[00:06:58] Tilman Versch: And you’re also supported by politics here. Right now, we’re at the Bundeskanzleramt here in Berlin. And you told me that you’re flying with the economic minister to Algeria quite soon.

[00:07:10] Karsten Schlageter: Exactly. So we have a lot of tailwinds and a lot of support from politicians. Also, there have been so many and I need to see very successful changes in legislation in Germany, especially to push the build-out of solar and also the acceleration of wind. Of course, we can always say we need a bit more and we find here and there, but there were many, many groundbreaking initiatives.

We are now called to be in the overarching interest of the public. This has changed a lot. This influences court rulings. This motivates many local decentral governments and civil servants. We have many specific laws that now you have priority next to auto ways auto other Bahner, famous German autobahn or next to the railway tracks, or a lot of this enabled much faster growth.

The most attractive markets

[00:08:17] Tilman Versch: You’re present in 16 markets. You already mentioned some of them. Investors are always interested in what are the most attractive markets and why. Maybe you can name the three most attractive markets.

[00:08:28] Karsten Schlageter: For the ABO Wind group, let’s say as his perspective, it’s definitely Germany, France and Spain and Finland. If you allow me I tell you four. These four were the most or are the most important ones. Then of course you can also talk about how some of them might become more competitive or more saturated, but Germany and France will definitely stay among the most interesting, lucrative, most profitable markets.

[00:09:03] Tilman Versch: Why is that so?

[00:09:04] Karsten Schalageter: Because we need huge, huge, huge local energy production. It’s not just that we want to replace fossil fuels, the carbon we want to exit from the carbon generation of electricity. We need also to satisfy the huge growth that comes from sector coupling. So we want to decarbonize our industry.

So much of that will be by switching industrial processes from burning fossils to direct electrification. We will see a huge growth in electric vehicles and we see additional growth that everyone now talks about. But sometimes we do not understand what it means. Artificial intelligence will drive data centre usage again enormously.

And all of this needs electricity. So I could probably add some more sectors that need more and more electricity. So it’s not just replacing fossils, it’s getting to a much bigger, bigger market of energy we need. In history, we underestimated the electricity market growth.

How to navigate risk in regulated markets

[00:10:17] Tilman Versch: In Germany, there was a sudden stop to renewable projects. I think in 2011, with Mr Rösler, as Economic Minister, is there a risk that something like this will happen again from your perspective?

[00:10:32] Karsten Schlageter: Our sector is very much regulated, so there’s always a certain risk that remains. There might be temporary dips, but I think it’s now mainstream that renewables are a key cornerstone of not just the energy system but the economic system. So I think this is now no longer really stoppable. It would be half suicide.

The challenging markets

[00:11:01] Tilman Versch: Coming back to the markets, which free are the more challenging markets? You can also name four if four come to mind.

[00:11:11] Karsten Schlageter: Challenging in a sense of the market environment or in the sense of?

[00:11:17] Tilman Versch: To make sustainable business there.

[00:11:21] Karsten Schlageter: Let’s start with the markets that are relatively new for us. So there it takes years to be successful in the market. You cannot jump into the market and then set up a business in some months. We need to understand that the project development takes years. And in that sense, if you go to market, you start with some projects and you build your pipeline.

So it takes years really to make a market profitable. Let’s start with maybe Colombia. We have now a pipeline of 1.5 Gigawatts. It has taken us from 2017. We now building the first two projects. Of course, then you need to learn to find the right sub-provider and suppliers in the market. You need to learn who the new investors are. So this takes a while, but I’m very positive for example in Colombia.

In South Africa, we have built a huge pipeline and we need to learn how to find the right business models. We have now sold a huge project early this year. This of course is a subject that the partner to really solve with standards, so it’s different business models in Europe but it has the prospect of really, really becoming a big additional market for us. So these other markets that are simply younger compared to Germany where we as I said 27 years. In such markets were three, four or five years only. But they turn now into very good contributors within the group.

And then we have some markets where of course you have political challenges. Argentina is one of them, of course. That’s no sequel tour known investors, so we have the challenges there that you cannot repatriate your dividends and so all this needs to be sorted out before serious foreign direct investment can happen in Argentina.

But even in Argentina, you have local companies that are still in such a crisis build out renewables because again, also the Argentina renewables are the cheapest of energy. We have of course countries where also you need to overcome much more, let’s say yeah regulatory topics or bankability issues. In Tunisia, we had quite a while that we needed to get to bankability for projects because of the ratings of the country itself and the absence of state guarantees.

It’s practically impossible to finance projects, so these things we sometimes need to wait. We, of course, actively try to lobby that the right framework gets in place.

Learnings from new market entrants

[00:14:25] Tilman Versch: You don’t want to do this, but theoretically, if you would enter a new market or a market you entered reasonably, are you better in getting more profitable sooner or profitable sooner or more profitable?

[00:14:40] Karsten Schlageter: You mean because we learn how to internationalise? That’s a good point. And I think absolutely we refine this process a lot. We did our first internationalisation steps 20 years ago and this was more by you know someone, somewhere and then you simply start and we became more and more systematic in analysing countries.

And today I would say we also understand much better what the real long-term drivers are. And long-term drivers, for example, are that although ABO Wind is a mid-size company. We should still operate in rather bigger markets where you have the chance with a relatively small market share to make a constant and profitable business. Niche markets are more difficult to run. You have a project every few years and that’s of course more complicated to get to profitability.

[00:15:38] Tilman Versch: So the playbook has become better.

[00:15:41] Karsten Schlageter: Definitely, we have. And you asked me in our first session about our colleagues and employees and of course, we have such a much broader and deeper management team that has many of these experiences made for first hand or brought them from other companies or every process and also the internationalisation process I think gets better in the space, so not much broader and deeper experience.

Patience

[00:16:10] Tilman Versch: How long are you patient with a country to become profitable or how do you manage this that if you have a team there build out build relationships with the people, if it really does not work?

[00:16:24] Karsten Schlageter: We are patient because we understand that sometimes it takes long or you need to wait for the right moment or regulatory change or government change. But that does not mean we sit there passively. As you said, some of the things when we see that management teams do not work, we need to make changes definitely.

Sometimes also we have to reduce or be in a positive way increase our activities. The best example is Spain. We exited half of the business by around 2012, or 2013. We needed to close one of two officers, but we stayed. We stayed patient, we invested more selectively, but very in the best places, and this turned out to be the source of today. Today is a very profitable business in Spain and and and you see, I mean even this was 10 years we are in Spain since 2003.

So it goes sometimes in cycles. It now goes less and less in cycles because we are now, as with renewables in the heart of the energy sector. Go turning us back were almost in the niche market now all big companies are renewables. We are in this big segment of renewable source mainstream. It will not simply go away as it did in the past for some years.

Bottlenecks for ABO Wind

[00:18:02] Tilman Versch: What kind of bottlenecks are you facing right now?

[00:18:08] Karsten Schlageter: We discussed some over our last meeting. It was very intense and very interesting. So one is employees, as we said, I think that’s a strong source where we are strong, we have great colleagues more than other companies as you identified this is a bottleneck in the market, skilled labour. We have sector sector-specific bottleneck which is grid connections.

Grids get saturated, especially in areas where there’s great wind or great solar. Then this gets constrained. This is definitely a topic where we also talk with institutions, so we need to build out new capacity in the grid.

We have lower delivery times with some components like wind turbines so we need to order earlier, you need more working capital also because you pay earlier, you get the money back later, so there are certain bottlenecks. I would say these are among the most important ones in some markets. Of course still takes too long to get permits. This has been quite improved.

Margins in the different markets

[00:19:30] Tilman Versch: And what kind of IRS can you make in a different market?

[00:19:37] Karsten Schlageter: We do not think so much about the IRS. We talk about margin per project and this is a question many investors ask, and it’s a very of course difficult question to answer. But we have, let’s say markets where you have small projects, limited numbers of projects and usually high margins like Germany and France very fragmented.

These are very interesting for us because we can work with these countries and these environments where you need much more decentral teams. You need much closer cooperation on a local level and then we have markets like.

[00:20:27] Tilman Versch: In Germany, you have 8 offices. This is also the effect of these decentralised structures?

[00:20:32] Karsten Schlageter: Exactly. Absolutely. It’s very important to be close to landowners, close to the municipality, and to the local authorities. And then we have markets where you have huge land areas, huge projects, but specific margins being very small. And this is, for example, the case in South Africa in principle in Argentina and it’s also to some extent the case in Canada. So it’s you need to understand that and apply different business models.

The Role of Europe for ABO Wind

[00:21:08] Tilman Versch: Coming back to this presence in Europe, how much of your business revenue-wise is done in Europe?

[00:21:16] Karsten Schlageter: It’s most. Most still in Europe. This is where we have an operating umbrella the EU which helps. And structures are in some market similar. We have high margins. So most of the profit comes definitely from Europe and within that. To be transparent and most of it even comes now from Germany, again, because here we have the highest growth, we have the strongest political commitment to get the energy transition done, which is very positive to us. And we have seen an acceleration in wind and in solar. So again more than half of our profits and turnover comes from Germany.

[00:22:00] Tilman Versch: So how is the margin you’re thinking about a lot in European wind and solar projects and how is it lately developed?

[00:22:11] Karsten Schlageter: Well, we do not use to talk about individual margins. So, I can confirm the general outlook that we announced. We want to deliver again within the forecast of 21 to 26 million this year and for 2023 years, so we will deliver that and stick to our prognosis forecast for 2024 which is between 25 million net profit to 31. So we can confirm that I mean the margins sustain that business even and maybe you want to go there next with higher interest rates with a lot of headwinds we have also seen.

[00:22:58] Tilman Versch: The volatility I would have asked for, yeah. So the margin stays in a similar fashion in volatile environments like interest rates and energy prices, jumping up and down.

[00:23:10] Karsten Schlageter: Exactly. We also need to admit that per megawatt margins in Germany have gone down and this would be a surprise if there was absolutely no effect. I‘m also saying will be sheltered. So if interest rates go up and often also prices go up PAA level so that it’s a moving ceiling and floors we have embedded in our business model.

So there are compensatory effects always, but compared to the very high prices in the last years in the electricity markets, now of course this this going back to more normal levels and this lowers the value of our projects. Also, interest rates lower the project of our values, but at the same time, we have increased our volume a lot. So we overcompensate and we have growth driven especially by volume.

Costs of A megawatts

[00:24:14] Tilman Versch: How much CapEx does a megawatt cost at the moment for you?

[00:24:21] Karsten Schlageter: In to build? It just depends also on the project, per project, because sometimes you have big grid connections or access roads that are difficult to construct. Sometimes all of this is easy. So it varies a lot. I cannot give you numbers now, but I can give you examples. I mean, I could give you exact numbers, but let’s say, I would rather give general numbers that are known in the market.

So we have seen prices of solar modules that have been around 30. $0.30 per watt during the coronavirus crisis when we had supply chain issues, this has now come to 15, 14 even lower cents per watt. So you see that a lot of cost pressure has gone out of the solar market again. On the wind side, though, turbine prices have continued to increase quite a bit.

So we are much higher now than before the coronavirus level. If you want to accept numbers and when we are in now per megawatts way above a million even in a low-cost market like in Spain but in solar, yeah, it varies really it depends on what kind of structure you use if you use fixed to track our systems.

Discover the Plus Investing community 👋🏻

Hey there!

Discover my Plus community! The community is great for passionate, professional investors.

Here, you can meet investors, share ideas, and join in-person events. We also support you in starting and scaling your fund.

[00:26:02] Tilman Versch: At which point would you think about enhancing your business model to also invest as an IPP compared to a pure developer? Is this something you might consider?

[00:26:14] Karsten Schlageter: We discussed this in all our strategic reviews. As long as there is almost exponential growth in the market, we think we are very well positioned to be a pure plate. Might also be interesting for investors.

You can, in our company, invest really in the first phase which is more risky but also more returning, of course, risk and reward go together. Of course, there is no embedded option to at any time switch. Should the market become flatter?

We might do that, but this might be the medium-long one. It might definitely it’s not part of next year’s strategies for 2027, it’s definitely not part of it and we think it’s for quite a while will be much more interesting and fascinating to invest in project development and drive the energy transition.

The hydrogen pipeline

[00:27:15] Tilman Versch: Then let’s jump into the projects that are in the energy part. That’s not well known. The hydrogen pipeline and the battery pipeline. You have a 20-megawatt pipeline for green hydrogen. What kind of projects are these and where are they?

[00:27:34] Karsten Schlageter: Yeah, this is a very different model for us. It’s a really large volume, it’s much more long term and it’s risky and that’s why we also show it in a separate category to investors. We have our traditional pipeline of grid-connected projects with 22 gigawatts and in hydrogen, we have built a pipeline of 20 gigawatts.

So where are they there in the most promising areas of the world where you have extremely high resource endowment? Where you have land, vast availability of land, and very low density of population.

You need access to any kind of infrastructure for exporting these energies or either ports or pipelines, and we want to use these resource-rich areas of the world to build renewables, huge volumes of renewables in the gigawatts, transform it via electrolysis into hydrogen, and then depending on what the final carrier is, either transforming it in ammonia, for example, green ammonia to export it, then to Europe.

So where are these? The strongest place where we are is in Canada, we are in New Finland and New Brunswick. There was caution with hydrogen projects and these are relatively short distances across the Atlantic to Rotterdam or Hamburg or other German ports where we could then offload the green ammonia products and consume them here in Europe.

We also have such projects in Argentina, they are more long-term term of course because of the political environment, although the wind resources are even stronger and we have also mid long-term projects in South Africa. Exactly close to and then maybe in a border where we think we can combine excellently solar resources and wind resources and then export again via any hydrogen carrier.

And then we have the North and South Corridor. So we developed hydrogen projects in Finland that could and will be connected via pipeline to Germany and from North Africa, from Tunisia and in general North Africa, we hope to export hydrogen via pipelines that will be refurbished or added as new pipelines and bring those to the South of Germany to Bavaria, to the industrial centres of Bavaria and Barton Wittenberg.

[00:30:20] Tilman Versch: What is your estimate for the development in the hydrogen space within the next five years?

[00:30:28] Karsten Schlageter: We try to be, let’s say, more realistic than many that we think are too over-optimistic. So I think personally for a really large scale export we need some years now still to develop these projects very soundly. We will see maybe one or the other, even in one of our projects that might come up with the pilot. Pilot capacity to start the export, but I think realistically we will see first strong imports from abroad by 2030 and then beyond scaling up fast.

[00:31:12] Tilman Versch: You seem to need joint venture partners to develop these projects. How have their negotiations for this project developed?

[00:31:21] Karsten Schlageter: Yeah, we need that. Of course, our wind cannot build gigawatt-scale projects, we are a mid-size company. We’re very bold and ambitious. We can do a lot, but that goes well beyond our financial and also other capacities, so we need partners for that, but also even under development you need to invest several thousands or even hundreds of millions of dollars to develop such large-scale gigawatt projects you need often harbour infrastructure.

You need detailed engineering of chemical plants and a balance of plant infrastructure. You need to develop, of course, all the windpipes you need to develop off the grid, so this consumes quite a bit of engineering and know-how and costs.

We need to also take some of these consulting services from outside companies, in short, we need our partners during development. And yeah, we try to find ideally placed companies that either bring local expertise and funds that want to operate it or that want to be off-takers. Infrastructure funds sometimes would like to invest in such assets, utilities or there are different types of investors. But I mean, the common thing is they need to bring quite a capital strength alongside our own capabilities.

Valuing the hydrogen pipeline

[00:33:32] Tilman Versch: How should we as shareholders think about the realistic valuation of the hydrogen pipeline? What could this be worth a few years?

[00:33:43] Karsten Schlageter: This is a key question, and it’s of course that’s why we separated it. It needs to be evaluated and valued differently. I think that’s where we are all in agreement and then I hope that investors see the additional potential. I would put it that way.

And then how you evaluate that, depends on how you see the future hydrogen market. If you really believe that we need to decarbonize fully and come to really net zero, then hydrogen will have a huge role and then it must have sooner or later huge value to develop these projects in strategic areas of the world. Design the new oil wells then. But this depends on each of the investors. I would say how fast they expect this market to mature to really become very profitable, and self-sustaining. And we of course think that it has huge potential relative to our current valuation. I would put it that way.

I cannot give it an absolute number. But currently, we are valued between 400 and 500 million. I mean, even if you have a low multiple with 20 gigawatts and you believe in the hydrogen market, it is a huge additional value compared to our current company value.

[00:35:11] Tilman Versch: How do you decide between like this kind of moon shot and where the market is in establishing itself and like the known solar and wind projects, how to put capital into batteries or hydrogen?

[00:35:27] Karsten Schlageter: We ask ABO Wind or ABO Energy, soon we think that we need to be careful, so we invest only a small portion in hydrogen. That’s also why we announced the strategy that we want to incorporate partners early on even in the development phase. That’s the focus and the cash flows in the next years definitely will come from our traditional business.

The battery pipeline

[00:35:59] Tilman Versch: Let’s move to the battery business. What kind of projects do you realise in this business, can you maybe give a few examples and how they add value to the existing?

[00:36:10] Karsten Schlageter: Yeah, we have built the first project in Ireland with 50 megawatts. That was really an amazing project and we have several of the innovation tenders in Germany that were actually market leaders. So these were several dozen of megawatts. We won there in several projects and for these projects of course we have a strong learning curve but are already profitable. Not all of them.

That’s also true, but most of them are profitable and some are because of our learning curve. We do some money but at the same time, we learn a lot valuable know-how. Again, it’s about the people we have in the company who learn it. And can we apply it in many other markets? So we will see many more of these projects in Germany.

We focus the battery business in some key markets. In Spain, we have built a series of projects there. On the UK islands and Germany, these are among the key markets. And then, yeah, we have in many additional markets smaller pipelines. Like also Hungary, in Greece, we have even taken part in the battery tendon

Columbia, but they also learned it’s not really the markets that will be the front runners for batteries. So there you have isolated tenders, but then it’s not let’s say constant business you could do that’s why we focus more on the markets, maybe including also Canada where we expect a more constant flow of projects to come.

[00:38:00] Tilman Versch: Like what kind of value does the battery system add to the energy market? It’s a bit out of your competence, but like that, people can understand why better cheap projects might be a growing path in the renewable energy system.

[00:38:17] Karsten Schlageter: Batteries have a fundamental role in the future. We will have very long term need to store energy. Probably we use the hydrogen pump storage. These things will serve to close the long-term gaps when there’s no wind and there’s no solar system and then we have the entire day changes.

Yeah, we of course, we have solar during the day and we have been blowing in some hours. But you need to shift this energy from these hours to the hours where there is limited or less wind and solar. So I think that’s easy to understand. The volatility of the renewables in the short term, if it’s during several days or especially several hours, will be done by batteries. But then there’s another thing that’s not so commonly known because of the fluctuation.

And fast fluctuation sometimes of renewables, you need very short-term net services so to to stabilise the grid and their batteries get additional revenues because they can within milliseconds provide some energy or frequency to stabilise the grid and this is paid for by grid operators. So these two sources of energy, two sources of income and energy services can come from batteries.

Valuing the battery projects

[00:39:55] Tilman Versch: Again, the same question was asked on hydrogen. What could this be worth in your opinion? Like what is the realistic valuation of the battery business?

[00:40:04] Karsten Schlageter: For ABO Wind? I think it’s it’s much more near-term. It’s again about margin and we look at into percentage or margin we can do per project and it’s similar to the solar business. So we can we can have to give you an idea. I don’t know 10% of the margin on such a project which is lucrative and sustainable.

Future growth

[00:40:33] Tilman Versch: And as a last question. You will finally also have the chance to add something we haven’t discussed. But my last question is you have this target of doubling net profit until 2027. Can you maybe walk us a bit through how you want to get there?

Follow us

[00:40:48] Karsten Schlageter: Yes, absolutely. We have grown since we met the last time. We have doubled more or less our pipeline in Germany. So we have now a lot more wind.

This will continue to grow. We will realise these wind projects in Germany alone and this will this will be a huge contributor of value. We have a big, big pipeline in solar also in Germany, but elsewhere as well these margins will not increase or even decrease in some markets, but because of this huge volume growth, we can increase our absolute net profit a lot.

And then we and then you have seen and discussed with me the batteries. I think batteries is just starting. It will have much higher compounded growth much higher than the others you have shown on the slide. It’s even more because we come from a low basis.

So we will have in the next years a much higher growth year compounded average growth rate year shorter to 2050. But this is not, let’s say, a linear growth path. It’s really we will now see acceleration and then it will flatten out towards getting closer to 2050. And in hydrogen, hydrogen is not factored in even in this 50 million. Maybe we can, we can make a profit on one or the other project, but I would not even foresee it in the next years to 2027. So we are conservative there. So investors should be assured that these targets are without the fantasy. The additional optionality and perspective of hydrogen.

[00:42:52] Tilman Versch: So hydrogen on the opposite, even costs you money to develop these projects and keep them keep, keep them going?

[00:42:59] Karsten Schlageter: It’s investment, yes. But then we will see hopefully much higher returns also beyond 2027 on these projects. But indeed, yeah, it’s a little part of our investments going to this business line, but it has huge leverage. I mean you have seen our pipelines and on a project in Canada five gigawatts, of course, is such a huge volume you need to see that in Germany. We added a little more than that last year of wind all over Germany, so you can also see what the possible magnitude of one of such projects being successful would be.

Closing thoughts

[00:43:45] Tilman Versch: For the end of our two-part interview, I usually give the guests the chance to add anything we haven’t discussed. So do you want to add anything?

[00:43:54] Karsten Schlageter: Well, I think we have again asked a lot of very interesting questions, very comprehensively.Thanks for these great talks. I would rather say ABO Wind is ideally positioned in the energy transition where in the wind, solar, batteries, and hydrogen. We have all these energies in our portfolio that will drive the energy transition.

We have still a lot to do to get to net zero used growth paths, so I hope that those investors see the value and the unique position as a pure player of maybe your winter. And hopefully when you do the next in the years again two or three years then it’s again another ABO Wind.

[00:44:42] Tilman Versch: ABO Energy.

[00:44:44] Karsten Schlageter: ABO Energy. Well, thank you very much.

Thank you & goodbye

[00:44:46] Tilman Versch: Thank you. Thank you and bye-bye to the audience. I really hope you enjoyed this conversation. If you did, please leave a like and a comment and be sure to subscribe to my channel.

Good Investing’s disclaimer

Please be always aware that this content is no advice and no recommendation and make sure to read our disclaimer: