John Zolidis is an expert on retail and restaurant stock. I had the pleasure to interview him on different opportunities in his universe of coverage.

We have discussed the following topics:

Check out Interactive Brokers

[00:00:00] Tilman Versch: This episode of Good Investing Talks is supported by Interactive Brokers. If you’re ever looking for a broker, Interactive Brokers is the place to go, I personally use their service because I think they have a great selection of stocks and markets you can access, they have super fair prices and a great tracking system to track your performance. If you want to try out the offer of Interactive Brokers and support my channel, please click on the link below. There you will be directed to Interactive Brokers and can get an idea what they offer for you. I really like their tool and it’s a high recommendation by me. And now, enjoy the video.

Who is John Zolidis?

[00:00:39] Tilman Versch: The audience of Good Investing Talk, it’s great to have you back. Today, I’m having an American who has a firm named in Latin, Quo Vadis Capital , and he lives in Paris. It’s great to have you here, John.

[00:00:51] John Zolidis: Thanks for having me.

[00:00:54] Tilman Versch: You have an interesting background in investing, and today, we are mostly focusing on your core expertise. It’s restaurants and the retail industry, which you’re covering from the value investing perspective. What has brought you to this kind of setup and why are you in Paris as American?

[00:01:12] John Zolidis: Okay, so, just a little bit of background about me. I was actually born in Germany, which you probably didn’t know, and grew up in a small town in Wisconsin, and attended some university in England. I’ve lived in the Czech Republic and then I married a French girl, so that eventually brought me to Paris. So, I’ve always been pretty internationally oriented as far as my interest from a cultural and, kind of, lifestyle standpoint. Looking back at investing and value investing, originally, I was a Philosophy Ph.D. student, which is also probably not what you normally hear. I moved to New York to pursue a Ph.D. in philosophy, but quickly found that was an untenable career choice and went directly into finance.

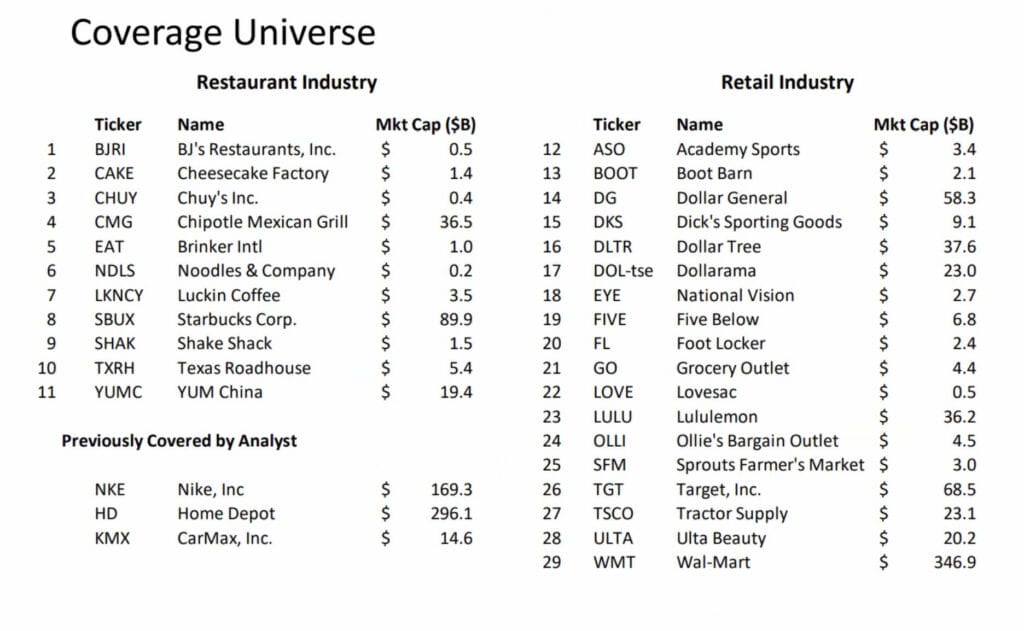

From there, I started in equity research and over time, I’ve graduated towards the value investing species with a focus on the consumer, particularly retail and restaurant. So, I’m following some US companies, some Canadian companies, some Chinese companies, and I try to get on the road quite a bit to see the businesses, meet with the management team, as well as do my modelling etc. from here and talking to clients with clients in the US, UK, Australia, different places around the world.

Focusing on retail & restaurants

[00:02:43] Tilman Versch: So, why did you decide to go for retail and restaurants as your focus of analysis?

[00:02:50] John Zolidis: Well, retail was a little bit of an accident, so when I got my first job as an analyst, which is at a firm called Sidoti and Company, they kind of just gave me a retail business to analyse. A small retailer called Piercing Pagoda which sold jewellery kiosks, now part of Zale Corp. But it turns out that that was a really good area for me because it combined, if you will, kind of left brain and right brain approach. I was a little bit more on the qualitative side in terms of my thinking and how I approach life in general versus a pure analytic sort of person, so combining those two things happened to be pretty appropriate to my way of thinking and something that I found interesting and enjoyed.

For the restaurants, that came out of a more technical approach that I developed looking at retailers, which was focused on unit-level economics. So, over probably 15 years, maybe longer, I’ve developed an approach to breaking retailers down into their component parts and analysing them at the unit level. And I have an entire approach that uses this as a basis for forecasting and what I discovered is, I’m kind of agnostic about what is sold in the box. And so, it can be any kind of retailer and realistically, restaurants have the same financial structure of a corporate headquarters, some expenses that can be leveraged, and then the economic, the value of the engine of the economic value creation is the individual box. And so, I’ve been able to take that retail discipline which I developed and apply to this other area. It also works in different things, for example, fitness gyms. Anything where there’s a lot of individual units that can be analysed for their return properties.

It combined, if you will, kind of left brain and right brain approach. I was a little bit more on the qualitative side in terms of my thinking and how I approach life in general versus a pure analytic sort of person, so combining those two things happened to be pretty appropriate to my way of thinking.

Tracking the US consumer

[00:04:55] Tilman Versch: The US consumer plays a super important role to understand the dynamics of retail and restaurants. So, how do you keep up to date on the US consumer, what are key metrics here you are tracking? What can you share with us?

[00:05:10] John Zolidis: When I look at the US consumer, the number one thing that we look at first on is employment. And so, generally, the idea is that if consumers are employed, they’re going to keep spending. And as you know, US consumer spending is two-thirds of the economy domestically in the US. Aside from that, the next things we look at are access to capital, so we look to see if borrowing costs are going up or down, if banks’ willingness to lend is changing. We look at the expense trends that the consumer might have, that’s obviously a very important topic today. We look at oil prices and gas prices in particular, which historically, have been volatile.

And then, we look at the housing market as that’s a big driver of consumer activity. We look at the stock market that can impact the higher income consumers spending activities. And then consumer confidence, I find that a little bit more of a lagging indicator. I actually think retail sales are a better measurement of consumer confidence than is consumer confidence as it stated. And one other thing that can affect the consumer that we pay attention to is the media. So we look, in particular, political news can be disruptive and change what consumers are doing from behaviour standpoint. But realistically, the main thing is employment followed by some expenses. And then beyond that, we’ll look at some psychographic trends and secular trends that are causing consumers to change what they’re doing or their behaviour or their values. But those are a few of the things that we start with.

Also, I spend my time… I try to talk to a lot of different companies. I’m talking to companies every week, consumer companies; and so, when I speak with them, I ask them what they’re hearing from their consumers, what kind of behaviour is going on, what concerns there are. Some of the businesses that I follow, namely Walmart specifically, conduct their own consumer confidence surveys and frequently, they are willing to share some details that they get there, and so, all of these things kind of come together to create a mosaic, if you will, for a view of how the consumer is feeling right now. And then, of course, as investors, we’re looking into the future, so we’re thinking about how the consumer might be changing 6, 9, 18 months into the future and what the implications might be for the financial results of the companies that we follow.

The main thing is employment followed by some expenses. And then beyond that, we’ll look at some psychographic trends and secular trends that are causing consumers to change what they’re doing or their behaviour or their values.

Trends in restaurants & retail spaces

[00:07:58] Tilman Versch: Why are you a bit sceptical with the consumer confidence measures?

[00:08:03] John Zolidis: I don’t think they’re that great. So there are two consumer confidence measures that people look at; there’s the University of Michigan and then there’s the Conference Board. And oftentimes, what you’ll find in the media is they will cite consumer confidence from those two sources to either by positive or negative about things that are going to happen in the future with the economy. But what happens, in my view, is that those surveys capture short-term sentiment changes in the consumer; but that doesn’t necessarily correlate with what they actually do with their money. So they may feel uncertain but continue to spend as if nothing had really changed. And so, that’s why I think retail sales is a better measurement. So when you see retail sales go down, that tells you the consumer is pulling back. And they don’t necessarily line up with the surveys.

Those surveys capture short-term sentiment changes in the consumer; they may feel uncertain but continue to spend as if nothing had really changed. That’s why I think retail sales is a better measurement.

[00:09:02] Tilman Versch: Where do you see changes happening in the consumer taste preferences in the restaurants and retail spaces? What big trends or what micro trends shape the space?

[00:09:14] John Zolidis: Well, right now, everything is still the after-effects of Covid. Those are the biggest identifiable secular shifts in behaviour. So for example, you also have some demographic shifts. So, you have consumers moving from urban areas to suburban or rural areas, we might call that rural revitalization. You have more interest in health and well-being because there was a very strong correlation between negative outcomes with Covid and personal health scenarios. So, there’s an amplified interest in remaining healthy and activities around that.

There has been some change in travel. These views kind of continue to develop, so initially, no one travelled, and now there’s an explosion of travel demand, but there are also people that are still airplanes and airports and so they’re buying RVs or traveling within domestic US in their automobiles. Those are a few of the trends and then from the secular standpoint right now, more of an economic standpoint, you have a divergence in spending based on income group. So the lower quintile income group in particular is under a lot of pressure based on inflationary changes. And so that income group is pulling back from discretionary spending. Other higher-income groups seem to kind of be continuing in the same vein as before and absorbing the higher costs. So we’re paying attention to that as well.

And you know, there’s still some question about whether you’ll get what’s called ‘reversion’ in some of these categories that have seen a significant pick up in sales. For example, the sporting goods category is still significantly higher than it was pre-Covid from a sales productivity standpoint. Is that going to revert back to the pre levels? Or is that going to stay at a higher levels of sales and consumer demand because of secular change. So, these are some of the debates that are out there and in some of them, people lean one way or another, stock prices may be reflecting one dominant view. We may or may not have that view and then we’re looking for data points to support whichever outcome to think is going to happen.

Example of stability

[00:11:40] Tilman Versch: Being a few years into this kind of research field, are there any spaces or taste preferences where you are still surprised that they are that stable? Or there’s a lot of debate about change and adaption.

[00:12:00] John Zolidis: So two examples, I mentioned sporting goods, right? Another example, a [inaudible 00:12:06] company called Tractor Supply and they sell to what’s called the hobby farmer. So this might be a little bit challenging to get your mind around. Even I grew up in a rural area and I didn’t really understand what this was, which is, they’re talking about people who have a couple of acres. They may grow some crops but they’re not professional farmers. People who maybe have a few horses and have chickens. I know it sounds kind of unusual but this group of these homesteaders have… There’s been an influx of people into this lifestyle, which is also very independent and self-sufficient. It tends to be, obviously, it’s more rural but they were less impacted by Covid and social distancing because they were already distanced before all this happened. And so the sales in these categories have gone up quite considerably.

There’s also a strong correlation with this group of individuals in pet ownership. So pet ownership went up a lot during the pandemic. A lot of people adopted dogs because, you know, they felt lonely, they needed companionship. And so these pets continue to be around. And so pet sales are still elevated relative to the pandemic. So there’s some question, you know, does that tail off over time? Is this a permanent shift? Are these changes going to last for a long time? And then you had also in the US, complicating it, the distribution of all these funds and you had a pent-up period where people didn’t spend money. And then now, over the last year or 18 months, have gone out and spent on things that they didn’t buy during the pandemic. Is that the new level of spending or is that been elevated and is somehow ethereal and it’s going to tail off?

A different example just to add one more to the mix is the beauty category. So during the pandemic, there was still some need to wear makeup, maybe a little bit less, but you still wanted to look good, I guess, on your Zoom call. And the self-care component of beauty also continued to do well as part of the health and wellness focus. But one category that did not sell so well during the pandemic was fragrances. So you don’t really need to smell that good on your Zoom call, but now that the economy has opened up again, there’s been a big resurgence of fragrance sales.

And so the beauty business is seeing more people spend on a kind of feel-good, treat yourself, you only live once sort of approach. In addition, they’re spending on fragrances which tend to be high price tag and a very high margin. And so you’re seeing for example, Ulta beauty just reported fantastic sales, perhaps the highest quarterly sales and profit in the company’s history, on the back of this surge in spending in this category. So in my mind, the question is, is this a one-time makeup, not to use a pun there, but one time recovery of past spending that didn’t happen or is this a new higher level of spending that’s going to be sustained?

The distribution of all these funds in the US when they had a pent-up period where people didn’t spend money. And then now, over the last year or 18 months, have gone out and spent on things that they didn’t buy during the pandemic. Is that the new level of spending or is that been elevated and is somehow ethereal and it’s going to tail off?

Comparing the US and European market

[00:15:35] Tilman Versch: Two interesting questions. You have this also interesting state that you’re living in Europe and you have this focus on the US. It’s quite interesting to use these two lenses because there are some concepts, for instance, Walmart, they did try to expand to Germany, they failed. So, are there any concepts that are quite unique to the US market and that won’t transfer to other geographies that easily?

[00:16:03] John Zolidis: So the biggest thing when understanding the two markets from consumer standpoint, in my opinion, is dependence on the automobile. So, outside of a few select large urban markets, in the US, literally everyone is driving. And this goes up and down the income spectrum. Sometimes my clients would think that lower income consumers of rural areas didn’t have cars, but having grown up in a rural area myself, I know that you can’t get to your job if you don’t have a car. People don’t live close to wherever their employment might have been. So it’s really a necessity. You just can’t function as a family without a car and so the retail approach for consumers in the US almost always involves access via a vehicle.

And when we look at Europe, I just don’t think that is the same. I think people are much more concentrated, you have better public transportation, you have fewer stores that are built on the periphery of towns. You have longer geographies that weren’t originally designed around automobiles and so it’s just not as convenient to build all of these inexpensive cheap boxes on the exterior of population centres because people in cities wouldn’t go to them in Europe.

So with that as a backdrop, for example, one of the sector’s I follow is called the dollar stores. Now, some of them sell things only at one dollar, but many of them sell things at prices higher than that. And the idea is just that they are inexpensive sellers of consumables to consumers in a low-maintenance inexpensively constructed store, typically either in rural markets or in urban markets. So they’re situated where they don’t have to compete with Walmart or they are close to where their customer lives. And so I don’t think that that concept would translate as well to most European markets. There was a company I believe, went private in the UK called Poundland, which is a very cheeky change from dollar store. And I don’t think that there is anything of that nature that I’m aware of in France.

Another thing that’s happening right now in the US, which is worth mentioning and in the same theme, is drive-throughs for food and restaurant concepts. And so Starbucks, for example, is transforming its store base from the sit-down cafes, that originally made it so successful and popular, into a drive-through format. It’s trying to put more of its stores into drive-throughs. And that’s driven by two factors: one, technology. So you can use your app to order in advance and you can customize on the app and you get all of your loyalty programs, etc, data through the app which enables more convenience of staying in your car and getting the product correctly made for you when you arrive. Chipotle is also shifting from it’s more sit-down oriented store format to a drive-through format. There’s a small company that just went public called Dutch Bros., which sells coffee-like drinks, let’s say; all drive-through, 100% drive-through format. And you know, people don’t live in their cars in the same way in Europe. At least that’s my perception from Paris.

The biggest thing when understanding the two markets from consumer standpoint, in my opinion, is dependence on the automobile. People don’t live in their cars in the same way in Europe as they do in the US. And so I don’t think that concepts like dollar stores and drive throughs would translate as well to most European markets.

Regional differences between consumers

[00:20:17] Tilman Versch: How unique are the markets in the US compared to Europe? Like if you compare German to the French market, its apples and bananas you’re comparing. But for instance, if you compare Omaha to California or to New York, how unique are these markets or is it like easily to roll out to 400 million consumers in the US?

[00:20:41] John Zolidis: So that’s a great question and the answer is, there are regional differences and it might depend a little bit on the category. So, for example, you know, I’ve followed Foot Locker for a long time and Foot Locker has about a third of its stores here in Europe. And so they would tell me that the market in Italy is very different from the market in Germany. So what the Italian consumer wants to buy could be completely different shoes than what the German consumer is buying.

In the US, I don’t think there is as broad of a chain. You do have kind of urban versus suburban. So you have certain customer groups that live in downtown areas that may be buying specific kinds of shoes that don’t also sell in suburban markets. That’s a fashion comment. For the restaurants, there are some concepts that just work in all markets like, you know, Starbucks seems to be not only working in all markets in the US, but they have 33,000 stores worldwide. Although they do adapt, they’re not all selling the same product in every store, but the concept seems to translate quite well.

You can have differences in regional competition. You can have some influences in some Southern States. You might get a difference Hispanic population which, if you are a food retailer, you need to have specific products that cater to that customers’ interests and needs. And those can be actually different because you have sometimes different groups of immigrants from South and Central America that have different tastes. So a food retailer might have to adapt to those kind of things. But in general, I think it’s a fair bet to say that it’s relatively homogeneous and concepts that work in some places will work in other places from a consumer standpoint.

What I’ve seen happen is that the expense structure can be different. And so, in particular, if you start in California and then move to the Midwest, they may not really understand who the customer is or the density of the stores, like how close together you can put them might have to be different. And I’ve seen rent changes in rents and customer tastes happen, so it’s subtle, they can exist. You can have problems, but it’s not nearly as different as what you’re describing between going to France and Germany, for example.

In general, it’s a fair bet to say that it’s relatively homogeneous and concepts that work in some places will work in other places from a consumer standpoint.

What I’ve seen happen is that the expense structure can be different.

Thoughts on energy costs

[00:23:23] Tilman Versch: Thinking a bit about the infrastructure retailer runs in, you mentioned the cheap boxes already, which are part of this retail game or this restaurant game. These cheap boxes depend on cheap energy to run, I think, because they usually… maybe it’s a [inaudible 00:23:44] question you don’t cover, but I’m interested in this coming from this European external shock with energy prices. So, you need cheap fuels to get to the store and the store has to be cooled and to be warmed in winter. It has also like high energy costs and it’s not like the highest building quality if it’s a cheap box. Or am I wrong here?

[00:24:07] John Zolidis: So there’s a couple of things to dig into there. So first, as I’m sure you know, energy costs at the consumer level are much higher in Europe than they are in the US. Just as an example, filling up my Jeep tank here in France was costing me. 100 euros and then filling up the tank, I had rented over the summer, in a giant SUV for seven people cost me only $70 in the US. And I’m pretty sure the tank in the US was much larger than the one in Europe. I mean, I think most people are aware of that, but that was just my own personal example recently.

When I talk about the cheap box… So yes, you need the low gas prices so the customer can continue to get to the store. I think that’s important, but it’s the build out of the box that had tend to be inexpensive and then drove a very attractive financial model. For example, in the dollar stores, they would spend, I would say, less than 250,000 dollars to build the entire store. And these are probably 8,000 square foot stores so in meters that’s like 800 meters squared. And so the build-out cost is very low, like, you couldn’t build much for that kind of price, but then you have very fast turnover of consumables with low inventory. So you’re generating a lot of cash through a box with not much initial build-out.

What’s happening right now is that the cost to build all these stores is going up. So costs for steel is going up, cost for labour is going up, supply chain costs are going up. So the economics for some of these concepts is less attractive. I think building costs in general tend to be more expensive in Europe. In the UK, you can’t get five-year leases as easily, for example, as you can in the US; they tend to have 20-year leases. So you’re signing up for a much longer commitment there. I think the build-out costs and regulations here, in Europe, tend to be longer, and more onerous and more expensive. And so, there’s a little bit higher of a risk threshold to get stores into these markets. But theoretically, you would also have less competition as a result of that.

The build-out costs and regulations here, in Europe, tend to be longer, and more onerous and more expensive. And so, there’s a little bit higher of a risk threshold to get stores into these markets. But theoretically, you would also have less competition as a result of that.

Renting vs. owning property as a company

[00:26:54] Tilman Versch: Who owns the stores or the land? For instance, in Europe, it’s quite fascinating that Aldi and Lidl as they expanded, they always bought the land and built the stores on them. So, now they have premium land in some of the core cities in Europe.

[00:27:14] John Zolidis: Okay, so that’s going to depend on a retail-by-retail basis. In general, most public companies rent or lease their properties and they tend to be owned by all kinds of different investors. Sometimes they’ll do build to suit and they do sale-leaseback. In contrast, the big-box retailers Walmart, Target, Home Depot, and Lowe’s, for example, they all own their real estate and I believe, Costco as well. And a lot of times investors forget about that, they forget about the real estate value of that significant investment. So your return on invested capital is going to be much lower because you’re spending a much higher capital amount to acquire the box.

But on a risk-adjusted basis and on an expense structure basis, you could argue this is much more attractive because you’re not exposed to higher rents and you have an asset underlying the business. So I think when you’re analysing these kind of companies, you need to take into account the capital structure of the business’ balance sheet, but also that approach that they use from a real estate perspective.

Availability of retail space in different markets

[00:28:30] Tilman Versch: And another comparison, I often was surprised when I saw it, was the comparison of square metres available for malls and shopping concepts in Europe and the US. It’s still that US has so many square metres and malls available.

[00:28:47] John Zolidis: So I haven’t looked at that recently, but if what you’re alluding to is the report that there’s some enormous, larger square metres per capita in the US versus the rest of the world, yeah, I’m aware of that. Like Canada which is maybe more similar from just a psychographic demographic perspective to the US, they have much less retail square footage per capita. So in general, in Canada, you’ll see higher sales productivity and higher rents because there’s less space available. The US, it’s widely believed has been significantly overbuilt, specially the malls standpoint.

Now, the last time I really looked at this was maybe 10 years ago and at that point, everyone was focused on the fact that Amazon was a much more convenient and better solution, and that all of these malls didn’t really have a reason to exist. And since then, the weakest malls have disappeared or been converted into other space. And there is a lot of what, I guess, called zombie malls, where they still exist but they’re not really well visited by population. There’s generally what’s considered to be, what’s called the A mall, and there are around 300 of these in the US. You can be an A mall by being surrounded by a very high-income demographic or you can be an A mall by being surrounded by a very dense population. So the sales productivity in the malls tends to be really, really good. And these malls continue to do quite well despite the general shift or the share shift to online shopping.

The A malls, being surrounded by a very high-income demographic or surrounded by a very dense population, continue to do quite well despite the general shift or the share shift to online shopping.

Dealing with the supply chain volatility

[00:30:47] Tilman Versch: Another thing when you think about the infrastructure in the stores is the inventory they have. And through the last years, we had these problems with inventories and this volatility, that companies had to order a lot and they now have too big inventories. Do you think there’s something structurally changing in the future, especially as a lot of the production happens in China for the US?

[00:31:24] John Zolidis: It’s a good question. The companies are trying to address this supply chain volatility. Many of them have been caught with too much goods. And part of that is not understanding the extent to which business was distorted by transfer payments, stimulus checks in a post pandemic recovery where consumers also had pent-up spending ability from, you know, being stuck inside. So, this augmented or inflated demand at the time, retailers didn’t have enough goods. So, then it was taking too much longer because of ripple effects of Covid impacting production in the Far East and also the ability to get product off of the ports. And there weren’t even enough truckers and there was an issue at every moment in the supply chain, getting the product into stores.

So as result, retailers ordered more, and they ordered earlier. And so, then when demand slowed down because of inflation eating into discretionary spending ability, and fewer stimulus checks, they were left with too many goods. So that’s what you saw particularly at Target and Walmart. Other retailers have also faced that but it has been concentrated in retailers that service the lower income consumer. And I believe that these retailers will work through the inventory; the history of inventory bubbles within retailers suggest that they if they take the strong actions to clear those goods out, that margins will return to some normal level at some point in the future. Usually, you want to buy retailer when they have real problems around inventory because it’s a fixable issue.

But the second part of your question, just to continue, is if things are going to change in the future. And I think that’s an interesting question, because there’s also a heightened political tension. We put it in those terms between the US and some of its trading partners, and there’s a kind of a movement to use this as an excuse to try to bring the supply chain closer to home. One element of getting products from the Far East is that this has been a deflationary influence over 20, 25 years. And so it’s helped the government to keep interest rates low over this very long time period. So if we’re at the end of that multi-decade cycle of offshoring production to lower cost countries and we’re now bringing that product of that production back, that’s going to make it more difficult to bring down inflation in my opinion.

Now, this might be a little bit above my level of qualification to talk about, but I think that’s within some of the considerations that companies are using when they think about if they want to change their supply chains on a permanent basis to be closer to home. And for now, I think most retailers are going to stick with their Far East suppliers but that could change.

Usually, you want to buy retailer when they have real problems around inventory because it’s a fixable issue.

If we’re at the end of that multi-decade cycle of offshoring production to lower cost countries and we’re now bringing that product of that production back, that’s going to make it more difficult to bring down inflation in my opinion.

The workforce

[00:35:00] Tilman Versch: There’s a general topic also of the question if there’s enough labour, cheap labour to keep the costs so low because in Europe, I think in Germany, the next five years or 10 years, 13 million people will retire. So there’s a question to find enough laborers. And also in China, if you think about their 1 billion inhabitants or 1.2, 1.4, depends on who you quote, and there are only 10 million children every year born. So it’s an interesting question to also think about this consequence.

[00:35:35] John Zolidis: It’s definitely not positive to have a shrinking population or an aging population. The US has historically benefitted from immigration, so even though perhaps… I don’t have the numbers on this, but perhaps the higher-income more educated population has fewer children but the overall population of the US has been augmented through emigration and many European countries don’t have that same kind of component boosting up their demographics and the younger worker base that they need to be paying in taxes and producing things so that, you know, other people can retire and the economy can continue to grow. So those demographic influences are important. I think that’s important from an investment standpoint also to know that there is enough demand to create GDP growth in the market.

What could go wrong in retail & restaurants?

[00:36:35] Tilman Versch: But now let’s circle back to the restaurant and the retail sector. If you think about the sector and companies you’ve studied, what could go wrong in this sector? Like how and why do companies fail or be a really bad investment?

[00:36:55] John Zolidis: Okay. There’s a lot there to approach. You know, the most obvious one is change in competition, right? And failure to invest and stay up-to-date with what’s happening with the consumer. So, the biggest killer of retail businesses over the last 15 years has been Amazon. So you had businesses that were late to understand that the consumer was shifting to shop online. They didn’t invest in having their own solution from an omni-channel standpoint and they may have been selling product produced by others. So, they didn’t own the product from a vertical supply chain standpoint. And so they just got priced out and they had nothing really they were bringing to the table.

You can have, from an investment standpoint, businesses that… Yeah, so investing in the business, I think, is one of the most important things to look at. So, another good example that maybe isn’t discussed as much anymore is Sears Kmart. So if we compare Sears Kmart to Walmart and Target, Sears Kmart has gone bankrupt and is disappearing, and there’s only a few of them left. But it used to be one of the biggest retailers in the United States before Eddie Lampert acquired it and combined the two, and then basically used it to sell off assets and benefit from that while he ran the company into the ground. So that’s an example of their just deferred maintenance. They didn’t keep the stores up to date, they didn’t invest any true e-commerce solution, and they were just run over by the competition between Walmart, Target, and Amazon amongst others.

In the fashion space, you can always get the fashion wrong. And so that’s a big risk on any of these either team-based retailers or even if you want to look at Lululemon or Nike or Adidas, you know, if they were to be on the wrong side of fashion for too long, you would lose sales and market share, and you would definitely not do well owning the stock during that period. That’s pretty hard, there’s not that many companies that can consistently deliver attractive assortments that their customer wants and anticipate where their customer is going on a season-in season-out basis over many years and in different markets. Lululemon has been incredibly good at it. And, you know, Nike is also, I think, one of the most exceptional companies in the world.

Other things that screw-up retailers are expanding too fast, bad execution. There’s a host of ways you can get killed owning retail stocks.

Threats to restaurants

[00:39:57] Tilman Versch: What could go wrong with restaurants?

[00:40:01] John Zolidis: So restaurants are a little bit more volatile because first of all, they’re more economic, they’re more cyclical, right? So, you know, historically, you save money by eating at home. So in times that things get more difficult for the consumer, restaurant stocks just underperform and we’ve seen that so far this year. They’re are also exposed to commodity price pressures more. So beef costs, wheat costs, chicken, corn – all these commodity costs are up dramatically, partially because of what’s happening in the US, but also what’s happening in Ukraine, and that is impacting the margins that these businesses report. So that hasn’t been great for them.

There is also a consumer trends within restaurants and food. There are certain things that people want to eat, they move away from You can have temporary situations like, you may recall the Chipotle E. coli outbreak, which crushed the sales and business for some time. Turned out to be a wonderful buying opportunity because they were able to bounce back and then bring in really excellent management since then. But if you’re not anticipating that, you can certainly get hurt.

And then there’s changes in, as I mentioned, consumer behaviour. So you mentioned Cheesecake Factory earlier, I think that that concept tends to appeal to an older customer and it needs to be reinvented to appeal to the millennials and the Gen Zs. And if they can’t find a way to translate that concept to that younger customer, I think it’s going to be challenging for them to remain relevant over the long term. So there’s all these different things that are happening. Brinker International which operates Chili’s has a lower income consumer, they seem to be under pressure because their business was typically driven by promotions. And now due to the commodity price pressures and labour price pressures, they feel they can’t really offer the same level of promotions and obtain reasonable margin. So they’re trying to pull back on promotional activity within their stores. Don’t know if that’s going to work.

And then lastly, I’ll mention this before I turn it back over to you. Right now in the US, there is a coordinated increase of prices at restaurants in a way that I have never seen before. So for example, Cheesecake Factory, which I spoke to last week is raising its prices about seven and a half percent compared to last year. Chipotle’s average price in the second half of the year will be 13 percent higher than last year, which in turn was 10% higher than the year before. Both companies say that prices at grocery stores have gone up even more and so therefore, on a relative basis, they’re still providing value to the consumer and it’s going to be fine and okay, and the customer’s not going to push back.

But my feeling is that if you raise your prices too much, and the consumer starts to no longer believe that your product offering presents a value, it’ll be very, very difficult to get that perception back. And so, I think these businesses or the industry in general, is running this risk right now and I don’t think that this is going to… My personal sense is that this is not going to turn out well.

My feeling is that if you raise your prices too much, and the consumer starts to no longer believe that your product offering presents a value, it’ll be very, very difficult to get that perception back.

Franchising

[00:43:45] Tilman Versch: It’s definitely a challenge with this kind of high price races, but we will see how it plays out in the future. If you think about restaurants there’s this, I would call it a bit Holy Grail for investors, the idea of franchises, because you just license out your brand or your concept and you earn royalties from it. But with this, it also goes hand in hand with the question, how you can keep up quality with your concept and give this kind of good or superior restaurant experience. What is your experience around this franchise concepts and also the general questions, how restaurants, if they scale, how they could execute on a higher level and still offer a lot of value for the customers?

[00:44:33] John Zolidis: Okay, so I recently just did a lot of work around franchising and looking at different concepts and I looked at it from a financial standpoint more than an operational standpoint. So let me talk a little bit about the financial perspective first and then I’ll address the meat of your question which is more around the operational execution side of it.

First off, yes. you’re absolutely right that being a franchisor is a very attractive business model, right? So you get your franchisee to put their capital into the business and you take a royalty off of the revenues. And in a inflationary environment, I think this is a very interesting sector to be looking at because as the franchisor, you benefit from inflation, that is, the price is going up because you’re taking a royalty off the top line but you don’t own the labour. Like your franchisee partner has the labour cost that they have to deal with or the commodity costs. So the franchisor theoretically can benefit from this, you know, within reason without being exposed to the downside. Now, my personal experience to owning some of the franchise stocks I own, they’ve done okay. I wouldn’t say they’ve been doing amazingly in 2022. But that’s point number one.

Point number two, the return on invested capital, when you look at it, does count for the franchisee. So you want to see that your franchisee partner is able to generate attractive cash flows at their box and because that’s your engine of growth there. You need your franchisee to be generating good returns and cash so they can open up more stores and that’s what creates incremental value for you as the parent company.

And then to get to your question around operations, that’s a little bit trickier. I don’t know if I have a good answer for you. I think the reality is that if you’re going to be a franchisor, you need to have a team, you need quality inspectors, you need to have guys out there in the field, you need to bring in your franchisees on a fairly regular basis, so that everybody is on the same page in terms of how the stores need to look, the standards, the products. And actually, there is a serious execution risk if you try to move too fast, you sign up the wrong people as franchisees. So, most of the big public companies I’ve dealt with, I’ve never really seen a problem from that perspective, but I imagine that there are problems for sure. And it’s a good question how they manage it, but I think the answer is with lots of people and inspections and meetings.

Being a franchisor is a very attractive business model. You get your franchisee to put their capital into the business and you take a royalty off of the revenues.

You need your franchisee to be generating good returns and cash so they can open up more stores and that’s what creates incremental value for you as the parent company.

[00:47:41] Tilman Versch: Do you know this movie about the founders of McDonald’s and…

[00:47:45] John Zolidis: I saw one movie about it recently…

[00:47:48] Tilman Versch: I don’t remember the name. But the whole topic was about, like, two founders who developed the concept, but had problems in scaling it and one guy who just saw the concept and copied it, and then was successful with McDonald’s rolling it out and constructing McDonald’s enemies. Quite interesting to understand these dynamics. And also a question that came up for me from this is if you have a successful restaurant concept or a successful store concept, how helpful is it to have an owner operator in this space? Especially if you think about scaling it and running from 10 stores to like 50, 100 stores.

[00:48:31] John Zolidis: Yeah, I mean, it’s a really effective business model and you can franchise so many different kinds of things. So, I think you initially might think of stores or restaurants as a concept, you know, like a Subway sandwich shop is something that you can get into as a franchisee with a relatively low initial outlay of cash. And a lot of times, the parent will actually finance, help finance that initial outlay of cash to get you in there and open up the store because they believe that the concept will be successful.

But you know, I’ve seen battery and light bulb stores franchised, I’ve seen real estate flipping businesses franchised, eyeglass businesses, really any kind of thing that can be run on a local basis can be franchised and it’s a very effective way to expand or scale, as you put it quite quickly if you have enough infrastructure and you can monitor your franchisees. Yeah, I think it’s really attractive both as a public investor and in the private space as well.

The role of “detail” in retail

[00:49:54] Tilman Versch: I often heard when I talk to people in e-commerce and retail, “Retail is detail” is a quote they give me often. So how much love to detail is needed to run a restaurant or retail business successfully?

[00:50:09] John Zolidis: It depends on the concept. I think with restaurants, you know, cleanliness is very important. So you need to have a clean store, the kitchen needs to be clean, you’ve got health inspections, you have a much higher standard and the consumer isn’t going to come back if they feel that the place that they’re eating is not safe or clean etc. That’s not the true at all in some retail concepts. And actually, a funny thing that people may not be aware of is that in the discount store space, having a cluttered messy store actually conveys value. Which is to say, if you clean your store up too much, the consumer will actually perceive your prices are higher.

So in a way, there’s an ironic benefit of being messy and disorganized if you’re trying to present to the value. Now, on the other hand, if you’re Nordstrom or you’re selling to a luxury customer, you obviously can’t get away with that. So that’s my answer is it depends on the concept. But you know, it’s important to know who your customer is and maintain store standards that are appropriate for that person.

Consumer feedback as part of the analysis

[00:51:31] Tilman Versch: Coming back to this, in your way of analysing companies, how do you look at consumer feedback, for instance, Google reviews or Yelp reviews? Are they helpful to you or are just like often biased at the moment because I’ve heard about some like Italian restaurant chains where everyone pays everyone else to review the other store badly that their store looks good and stuff like this.

[00:51:55] John Zolidis: Well, that’s very unethical. So it’s a good question. I have spent too much time looking at reviews, but what I find is that it’s not that helpful. So, if I use Lululemon as an example again, you may recall several years ago, there was a debacle where they had some manufacturing issues for some of their pants, which caused the pants to, well, be see-through. And the founder went on and made the comment that certain customers should not be wearing the pants because they were not, you know, appropriately sized and that’s why the pants were see-through because they were being stretched over to great of an area. So as you can imagine, that was a terrible thing, and I’m putting it very politely here. And the sales went down, the customers were irate, etc. So at the time, I spent a lot of time reading through the Google reviews, and everyone was talking about this.

But what I’ve come to believe is that the online reviews are a forum for people who like to complain. So you have a bias to be complaining on those forms, like you go on there to complain. So if you as an analyst, try to look at the Google reviews and try to understand them, I think it will be misleading. It’s not a good measurement. You can’t get a quantitative view of the business based on that. It might still be worth looking at now and then to just make sure that a company is executing properly, but the noise level is very high.

The online reviews are a forum for people who like to complain. So if you as an analyst, try to look at the Google reviews and try to understand them, I think it will be misleading.

The close look & the bigger picture when analyzing

[00:53:53] Tilman Versch: Coming back to the idea of “retail is detail.” Like how much detail do you need for your retail analysis? And how much do you say, “It’s more looking at the bigger picture”?

[00:54:10] John Zolidis: You definitely need to understand, you know, how I find the concept fits within the context of the competitive set? And so I’m doing a little less of it now that I’m mostly based over here in Europe. But when I was in New York, I spent a minimum of one day every month driving to stores. And so I would drive all around to stores in New Jersey, Connecticut, Long Island, Upstate New York and visit stores. In addition, every business trip I went on, I would allocate a half day or more to visit stores and local markets. So, I visited stores in the Nashville, in Seattle, in San Francisco, in Denver, in Wisconsin, in Chicago, in Georgia, Florida., all over the whole country.

And the purpose of that was to review the store standards, see how the execution is at the store, take a look at inventory levels and promotional activity and then also to view the stores relative to the competition. And so I think when you’re trying to understand why is a concept working or not working, you do need to have a grasp of that qualitative component like, why is that business different? How is it positioned relative to the competition?

Giving you example, there’s a retailer that I really like that’s reporting earnings tonight actually, it’s called Five Below; the ticker is five. There’s also a Russian food retailer with the name Five, not to be confused with this company. And what Five sells are, originally was five dollars and less, but it sells discretionary items aimed at a kind of teenage to audience in a kind of a happy but cheaply constructed store. And where does this business fit within the context of its competitive set? So if you are a college student and you want to buy some kind of decorations for your dorm room, your options might be Walmart and Target where you know you’re going to get cheapest… you know. a good price but no teenager wants to shop in that environment. Or you could have a business like an Urban Outfitters or a Hot Topic, where they have really cool things but you’re paying a significant premium to get those items.

Five Below is selling fun exciting product aimed for you at a value. And so what I found is that this concept, the value plus the psychographic target of its customer, didn’t really have competition for their model, what they were doing. And so they were providing solution and the stores have been very, very successful. They also are very good as merchants and building assortments and taking on top of trends And the stock has been a been a fantastic performer. So I think that’s maybe the best example I can give you of why it is important or how I would take into account, kind of these qualitative or observational type details when I’m analysing these businesses.

The purpose of that was to review the store standards, see how the execution is at the store, take a look at inventory levels and promotional activity and then also to view the stores relative to the competition.

Staying objective

[00:57:47] Tilman Versch: What importance do you pay to your own gut feeling or your own taste when analysing restaurants and retail shops? Or are you trying to be more like a sociologist in this way, how are you balancing between both views?

[00:58:04] John Zolidis: Another good question. I think that you need to make sure you don’t confuse your taste with the customer’s taste. So, whatever I might want to do or eat could be completely irrelevant to what many other people want to do or eat or buy. So, you have to be able to separate your own personal aesthetic or taste from your analysis. I think that’s important. You know, there are certain clothing that I would never wear but there are millions of people who would wear that clothing, and so whether I like it or not is irrelevant.

John’s unit-level approach

[00:58:49] Tilman Versch: Good point. You mentioned this unit level approach of figuring out the unit economics. Can you maybe walk as a bit through this approach?

[00:59:02] John Zolidis: Sure. It’s a little bit technical, but let me see if I can talk about it in a way without referencing specific spreadsheets, but maybe I can give you some slides that you can put on the talk to kind of overlay when I’m discussing it. I do have some presentations that go over.

Anyway, so the idea is that you can isolate the sales profit and capital captured in cohorts of stores or restaurants or individual stores and restaurants, depending on how many there are. And when you’re looking at income statement for a restaurant or retail company, the first component is to separate out the expenses that aren’t directly attributable to the stores. So I try to estimate… Sometimes they break this out for you. But if not, I estimate how much are the corporate overhead costs? What’s the GNA? And in the case of retailers, I tend to remove distribution and transportation expenses. And then you get to what is the store level margin. And you can calculate what you think the cash flow per unit is, and then based on talking to company, looking through the filings, presentations, you estimate the capital that’s involved in each store and you calculate return on invested capital that way.

That’s the first level, then you take that and you can do a peer group analysis, where you compare what you think the box level return is to many other concepts. And then that tells you, is this a good concept or not. Because sometimes what happens is companies go public with tons of unit growth and Wall Street wants to assign a large multiple to the stock because, “Hey look, they can keep opening up these stores forever.” But then, when you do the actual analysis, you find out that the return metrics on the business are actually not attractive at all. They’re just… So tons of stores with mediocre returns is not something you want to invest in. Certainly don’t want to pay a high multiple for it.

And then the second piece is to do a trend analysis. So we look, on a linear basis, are the return metrics of the box getting better or getting worse? And we try to understand what are the factors behind that sales productivity is increasing, expenses are rising faster than sales, are rents for the stores changing over time. And we generally want to own companies that have a rising return on invested capital, we want to avoid those that have deteriorating return on invested capital. We also look at cohorts of boxes. So we might say the company’s average stores are excellent, but the stores they open over the last 12 months, if we isolate these, we can see that their returns are much worse and we try to find out the reason for that. What I would call that is return on incremental invested capital.

So the best scenario from an investment standpoint is something where incremental invested capital is higher than the base capital. You just repeat that. So every incremental dollar or euro or pound that a company is putting into its business is generating a higher return than the existing business. When that happens, it means operating margins will be going up, overall return on invested capital for the company will increase, growth rate will normally accelerate – it correlates with all these things, and you get a higher multiple for the stock because you get upward revisions to earnings relative to analysts’ estimates.

And of course, the opposite is true if you have a deteriorating return on incremental invested capital. Let me give you two examples. When Chipotle went public, it wasn’t that well known, but they had some stores in New York City, where I was living at the time. And I noticed that people were willing to wait in line out the door to get to Chipotle. Well, there must be a hundred places to get lunch on every block in New York City. So I surmised that people must really believe there is a superior product there or they wouldn’t wait in line like that. It’s hot, they’re wearing suits; back in the day, people had to wear suits. And when the company went public and started opening up stores, knowledge of the brand was actually growing faster than the brand was growing itself. So over a five year period, each set of stores that opened, opened at incrementally higher revenue levels. And so this was a very virtuous scenario for the stock because the company was consistently beating analyst estimates. Margins were rising, growth was accelerating and that just makes the stock do extremely well.

The opposite of the case is Shake Shack. Shake Shack went public with a small number of stores only located in the highest volume markets in America. Times Square, Madison Square, New York City, Los Angeles, Downtown Chicago, and they’ve been growing from those locations into suburban locations, smaller towns, etc. And so each incremental store year that they’ve opened has been a weaker set of store metrics with lower revenues on a per box basis, lower margins and a reduced return on invested capital. So that is a scenario that you want to avoid. So, to tie this together from an analysis and approach standpoint, that’s really the essence of the unit level approach, is to find these trends and then understand the implications for this value of the company’s stock based on following an understanding what’s going on beneath the surface. And that’s what I do. That’s what I spend most of my day doing.

The first component is to separate out the expenses that aren’t directly attributable to the stores. And then the second piece is to do a trend analysis. The best scenario from an investment standpoint is something where incremental invested capital is higher than the base capital.

Digitization in retail & restaurants

[01:05:50] Tilman Versch: If you do this, how important is also the integration of digital services and online services for the existing retailers and restaurants? What are good examples, the companies really made it to integrate digital into their services?

[01:06:11] John Zolidis: The answer is it’s super important, but it also depends. In the case of the dollar stores, not so important because that’s a 12-dollar average ticket. The customer is buying, by average ticket I mean that’s the average size of the number of items that they’re buying in the store. It’s not something you’re going to have shipped to. It’s a convenience driven purchase at the last minute. And so, what their job is to do is to get this product to the consumer at the lowest possible price, so they can save money and buy close to need. But excluding that, in some other cases, the answer is it’s super important. And I generally attribute the revenues produced on the Internet or e-commerce to the store, which may have been what you were kind of getting to.

And so I’ll give you an example. During the pandemic, two company’s Target and Dick’s Sporting Goods had been investing in same day fulfillment for years. And because of the pandemic, people wanted to get product without interacting with others. Which is to say, either have it shipped to them, but another option is buying it and getting it actually delivered to you in the parking lot. Walmart’s also been developing something like this, they have what’s called drive-thru grocery. And you can find this in Europe too. But Walmart actually knocked out a wall onto its stores. They created a staging area with refrigerators and then integrated their grocery inventory into the app. So the consumer could go on their app, order what they wanted and then drive up and never get out of the car and Walmart would come out and put the product directly into the trunk and they don’t have to transact. They just continue driving to get home.

The challenge for Walmart is it’s extremely difficult to make money on this transaction. Because previously, if you think about it, the customer was doing the fulfillment, right? They walked through the store and picked all the merchandise and now you have extra labour because you need someone to walk through the store, pick up all those goods, stage it in the fridge, time it correctly and get it out of the store. But if we switch to companies that have higher margin products like Dick’s Sporting Goods or Target, the economics are different and they were able to finally provide a real response that Amazon couldn’t match. Because even though Amazon’s getting a lot of things shipped to you same day, there’s some inconveniences associated with getting products shipped to your home. You have the extra cart you got to get rid of, what if it’s the wrong size, you have to send it back. That’s not always so easy.

When you buy something online and you pick it up in the parking lot on the same day, you can immediately verify that it is what you ordered. You can try it on right there in the parking lot if it’s apparel and then exchange it right at that moment without having to drive to the post office. And then the customer would typically come in and get add-ons potentially when they got less concerned about Covid. And all of these capabilities were enabled by these multiple years of investment in technology and knowing where their inventory was and integrating their apps into what’s in the store, and then having the store employees be able to fulfill those orders.

Just as a last addendum, Target, which also operates franchised Starbucks in nearly all of its stores, is trying to integrate its online ordering so that when you arrive at the store, you can also have your custom-made Starbucks coffee beverage brought out to you at exactly the same moment. Now think about the logistical challenge of doing that, right? So picking a bunch of diapers, and laundry detergent, and apparel, or whatever and putting that in the bag, that’s one thing. But to get the coffee beverage just the way you want it so it’s still hot at the moment that you arrive is another level of precision and that’s amazing. It’s definitely something that Amazon can’t do for you and it eliminates the need to do a second shopping trip or second trip if you’re that customer. So technology and omni-channel, these things are super important. They’re definitely table stakes and companies that can execute well are definitely winning.

Community Exclusive: Luckin Coffee

[01:11:15] Tilman Versch: Digitization is definitely a super interesting topic, but for the end of our great interview, I want to discuss two names in more details. It’s Luckin Coffee and Lululemon. Let’s start with Luckin Coffee. You’ve recommended it as an investment, but it was a fraud, like what happened there?

Hey, Tilman here. I’m sure you’re curious about the answer to this question, but this answer is exclusive to the members of my community, Good Investing Plus. Good Investing Plus is a place where we help each other to get better as investors day by day. If you are an ambitious, long-term oriented investor that likes to share, please apply for Good Investing Plus. Just go to good-investing.net/plus. You can also find this link in the show notes. I’m waitingyou’re your application. And without further ado, let’s go back to the conversation.

Without further ado, let’s go back to the conversation.

Lululemon

[01:12:15] Tilman Versch: So if anyone wants to discuss more details on Luckin Coffee, the person can reach out to you. Your details are below. I will link your website below. And now, let’s take a look at Lululemon. I think it’s a bit more known name, but it’s not… I honestly have not personally had no touch points with them. So, maybe you can tell a bit about the background, especially for the European listeners who hasn’t had that many touch points with them. What do they do besides recommending that some of their yoga pants shouldn’t be worn by everyone or worn by everyone?

[01:12:55] John Zolidis: That was asked. I believe they do have some stores in Germany. I’m not sure how many, I’m not sure if there’s one in Stuttgart.

[01:13:04] Tilman Versch: I have to go to it today. I’ve already planned it.

[01:13:08] John Zolidis: Okay, excellent. Well, good, visit the store which is important. So, essentially, they understood that women were looking for very high-quality athletic apparel to wear in their activities. And the alternative which was the Nike product or Adidas or some of these other athletic brands, I think, at the time was more produced with a mass customer in mind. So it’s a premium product but not ultra-premium. So Lululemon came in with very high-quality, well-designed fashionable product and really captured the consumer’s interest. They also at the stores tried to integrate themselves into the local community, and they aligned their brand with a lot of things that women in particular felt very strongly about. And so they took share by having great product with very strong service and small stores in a branded environment with values that the consumer cared about.

Now over the last 10 years, they’ve tried to expand more into men’s which I think is maybe a quarter of the business now. So it’s less female-only than it once was and men seem to have adopted the brand even though I was a bit sceptical that that would happen initially, given what I’ve already mentioned about the kind of female focus. But they’ve been really great at building assortments and continuing to excite the customer with new cuts and new fabrications and new colour schemes and get the customer to continue to buy more. Simultaneously, there have been secular trends in the company’s favour around casualisation. That is not wearing as much formal clothing, comfort, they’re closing to be very comfortable and being healthy. So you need to have athletic apparel and footwear to wear during your activities.

One anecdote, which I’ll share, you may remember of Under Armour which is not a company that I follow that carefully today but I used to follow when I was… I’m a fairly active person and I like to run and I used to run after graduating college at that time. You just wore whatever dirty old t-shirt you had lying around when you ran, and then you threw that in the wash and never thought anything about it. But then, when Under Armour came along, they took a material, which granted, was very old called polyester and started talking about its moisture wicking and cooling properties relative to cotton and then that became something that people needed to wear to do their exercise. And I started to feel, even though I personally didn’t care, that if I weren’t wearing some kind of fancy fabric that I was just not a serious runner at all. Now, why would you feel this way? Because fashion influences you whether you like it or not, or whether you’re trying to have it influence you or not.

And so Lululemon and Under Armour and Nike, they just upgraded the entire athletic spectrum, in terms of what people were willing to pay for and what their expectations were, for the performance of the product and apparel that they are wearing. And so Lululemon is now trying to replicate this success in other markets outside the US while still growing in the US. So, they open stores in the UK, in other European countries, and in Asia. And I think they have not been able to replicate that in, for example, France, somewhat in UK, but where they have done well is in China, Singapore, some of these Asian markets where they’ve seen strong demand for their product which is interesting in my mind. But it’s super powerful from a financial standpoint. The margins are really high. It’s all vertical. They only sell their own brand. They don’t wholesale it, except in very small amounts and so you’ve got a very profitable business that’s quite large and growing quite fast in a global basis. So, the market is assigning a very high multiple to the stock for these characteristics.

They’ve been really great at building assortments and continuing to excite the customer with new cuts and new fabrications and new colour schemes and get the customer to continue to buy more. Simultaneously, there have been secular trends in the company’s favour around casualisation.

[01:18:21] Tilman Versch: Do you think they can still grow in the future so that the multiple is justified?

[01:18:28] John Zolidis: Certainly you’re taking more risk, right? Whenever you pay a big multiple and I think they may be trading at four times revenues, but it’s probably a 25% EBIT margin business. You know, which is just to say that every dollar of revenue they produce, that 25 cents is profit. And they’re spinning off quite a lot of excess cash as well.

So the answer is they have been growing. I do think they can keep growing. You know, they crushed the guidance or their objectives over the last three years. So they had to update it and put even more ambitious targets out there. If they do not achieve, those as an investor, you’re going to get really hurt in the stock because earnings could still grow, but the multiple in the stock will contract quite substantially. So, this is a growth stock, this is not a value stock.

This is a name that has considerable risks from an execution and multiple standpoint, but they’ve been able to do it and so far, it’s been a smart bet to bet on them.

Closing thoughts

[01:19:38] Tilman Versch: Thank you very much for the insights into Lululemon as well and in Luckin Coffee. For the end of our conversation, is there anything you want to add people should consider when thinking about retail and restaurant investments?

[01:19:55] John Zolidis: I mean, the thing we look for are new concepts, new brands that you can buy when they’re still small hopefully at a reasonable multiple. So I think if you’re an investor, you’re an individual investor and you’re looking at the space, you should use your own experience. You should say, “Hey, where do I like to shop? Why is this concept good?” And then you can use that as an edge, as a legitimate edge to think about the business from an investment standpoint. Then do the rest of the real work that you need to do but that is a legitimate way in my view to start from a stock selection standpoint.

Bye

[01:20:40] Tilman Versch: Thank you very much for our great conversation.

[01:20:43] John Zolidis: Thanks for having me. It’s been great.

[01:20:44] Tilman Versch: And thank for the audience staying till here, bye-bye.

Disclaimer

[01:20:50] Tilman Versch: As in every video, also, here is the disclaimer. You can find a link to the disclaimer below in the show notes. The disclaimer says always do your own work. What we’re doing here is no recommendation and no advise. So please, always do your own work. Thank you very much.