Axel Krohne is a quite unusual investor. Because he invests where others may not even go on holiday: For his fund, the Alexander von Humboldt UI Fund, he searches for companies in emerging markets. Among other things, he invests in Cambodian casinos, Egyptian duty-free shops and Nigerian and Ugandan banks in order to offer his investors attractive returns.

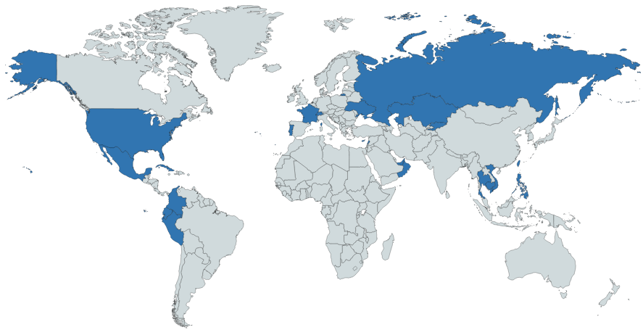

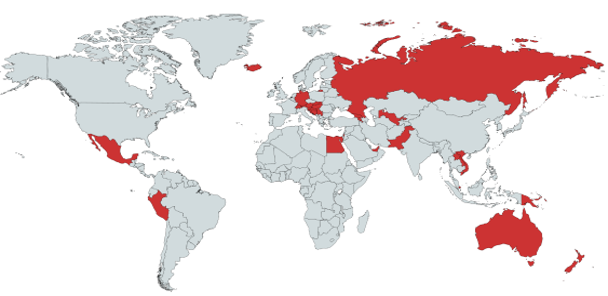

Axel Krohne is consciously looking for companies that are hardly observed by any other analysts. The countries in which he does research are therefore rather atypical. He recently visited Lebanon or Uzbekistan. You can find more of his travel destinations in this overview:

2017

2018

Therefore, it was a great pleasure for us to have an interview with Axel Krohne in Stuttgart in January 2019. This interview is divided into two sections. One further section was conducted in German and can be found on the German version of this page.

Axel Krohne on investing in emerging markets such as Russia and Nigeria

In this part of our interview, we talked to Axel about his strategies for investing in emerging markets. He explained us why he doesn’t invest in India or China, how he approaches Russian companies and why he focuses on the top companies in emerging markets. He also told us more about share buybacks and activism in emerging markets:

“I am the Master of Disaster”

Crisis exert a strong attraction on the value investor Axel Krohne. Because then he can find companies that are valued very cheaply. That’s why he consciously travels to countries that are experiencing or have experienced a crisis.

In this section of our interview, we also discussed the typical course of a year for the value investor. The fund manager also gave us insights into his quality criteria for companies and the importance of dividends in emerging market investments. Furthermore, we talked about currencies and the importance for his fund.

Disclaimer: We do not hold any shares in the companies named by Axel Krohne or in his fund. Please also note our disclaimer.