I had the pleasure to interview the CEO of Georgia Capital, Irakli Gilauri. Georgia Capital is a Georgian holding that owns a lot of quality assets.

We have discussed the following topics:

Introducing Irakli Gilauri of Georgia Capital

[00:00:38] Tilman Versch: The audience of Good Investing Talks, it’s great to have you back for another podcast episode. This time we are covering more exotic stocks and today we are having Irakli of Georgia Capital here, he is coming from Tbilisi. It’s great to have you here. A warm welcome.

[00:01:02] Irakli Gilauri: Thanks, Tilman, for an invitation, my pleasure.

Post-Soviet-Georgia in the 1990s

[00:01:05] Tilman Versch: It’s great to have you here. Maybe let me get some more details on Georgia Capital out and why I’ve invited you. We already have talked a bit in the community, Good Investing Plus, people can apply via the link below if they want to learn more. I think Georgia Capital is a very interesting opportunity to participate in a quite liberal, like in economic sense, country and it’s also quite well managed and quite cheap at the moment. So people might be interested to learn more about it. We also had some more videos on a channel on Georgia Capital, which will be linked here, so people can find them. So, look above here. So people can find these videos already.

But this podcast, I also want to invest some time to better understand how Georgia Capital came about and what your background was. Irakli, let us jump a bit back to the 1990s, the early 1990s. We both were a bit younger then and the world was a bit different then. Georgia just came out of the post-Soviet time, and as I read your biography, I found out that you were studying in the late 1990s in Ireland and in London and learned investing and banking there. But how did you come interested in banking and investing and how was Georgia in the late 1990s or the early 1990s?

[00:02:45] Irakli Gilauri: So, very interesting times. I was very young back in ‘90s when Soviet Union collapsed and it was interesting to observe how the country lost nearly 75% of the GDP. You can imagine that there was no water, no electricity, no roads, roads were collapsing, no eating. Even it was difficult to communicate over the telephone. And I lived as a teenager, I lived in those times and in ’93, I started my university studies at the Georgia Technical University doing business.

Back then, everybody wanted to do business because we didn’t know what the hell the business was. Because everything was owned by the government, you know, nobody knew what the banking was because it was a state-owned bank and state-owned bank was giving loans to the state-owned companies. Retail client base was not existent other than depositing money, which was a small amount of money deposit. You could not even borrow the money from the bank. So, this whole world of doing the private business was really exciting for me and for everybody in Georgia because we didn’t know… I didn’t even know what the marketing was. The word ‘marketing’ or, you know, what kind of action you need to take to sell the product. Because it was, like, all supply driven.

So, when I started my studies in ‘93 in Georgia Technical University, we had the exchange program to study language during the summer. So I applied for the program and I went there for three months and I said that, “Okay, I’m not going back now, you know, I need to stay here and study business”, because, you know, back in Georgia, with all due respect, there was no knowledge of how the business is done, or how economies were working. Because we are in a command economy basically, it was not market economy. So it was really a big eye-opener for me. And so, I applied for the University, I went to the Dean and I had very little English and I persuaded the Dean that I really, really wanted to study here. And the Dean said, “Okay. We usually don’t accept students like this, but you want so much to study that we will accept you.” So, that’s how I ended up, just really wanting to do it.

So for me, it was a game changer basically, because in a way, I was really ahead of my peers in terms of understanding how macroeconomy works, how business works, how accounting works, because there’s different type of accounting as well. But anyway, you know, how the devaluation works, etc. So it was a big difference and after two years studying in the University, I had the choice to choose the banking or management or etc. And I chose the banking because I thought it was something which Georgia really needed to move forward. And I understood that the bank is a big player in the economy. With a good bank, economic can really grow and flourish; without that, it’s very difficult. So it was my choice back then in 1996. In ‘98, I graduated from the University, I had a four year really, really exciting studies there. I’m really grateful to my luck that I ended up there.

I chose the banking because I thought it was something which Georgia really needed to move forward. And I understood that the bank is a big player in the economy. With a good bank, economic can really grow and flourish; without that, it’s very difficult.

[00:06:32] Tilman Versch: But also your passion that you pushed. It’s not normal that people are so stubborn.

[00:06:37] Irakli Gilauri: I guess we Georgians are a little stubborn. Sometimes, it helps, not always though.

Starting to work in Georgia

[00:06:46] Tilman Versch: It does. Did you then decide to go back to Georgia right away or…

[00:06:53] Irakli Gilauri: So I decided to go back. I wanted to go back and I went and I started to work with National Bank of Georgia. And soon, there was an exciting opportunity with European Bank for Reconstruction and Development and I got a job there and I worked at EBRD more than four years. And then basically, I decided maybe I need to enhance my studies. I don’t know why I decided that. EBRD was a great platform for me to learn the banking. And then basically, I got the Chevening scholarship, UK government scholarship and I studied banking and international finance with City University; back then, it was called Cass Business School. So it was another great opportunity for me and I want to thank the UK taxpayers for that opportunity. And then I came back again, and I came back at the Bank of Georgia at the CFO office.

Working for the Bank of Georgia

[00:08:01] Tilman Versch: As you had no real private banking or even market economy, so you had to build this banking system from scratch. How much were you involved in this from the beginning or was there already something built when you entered Bank of Georgia?

[00:08:21] Irakli Gilauri: So, when I started with Bank of Georgia in 2004, there were 20,000 debit cards outstanding. Credit card was not existent and debit card cost you a fortune, you had to pay $300 to get debit card. And the bank had eight ATMs. Two handful of ATMs, that was something, yeah. So the strategy was very clear, we wanted to build a retail bank, try to bring people into banking because it was all cash economy. People were using cash, they didn’t even know how to borrow money, banks were not willing to lend to retail client base. So it’s almost all focus was about corporate banks.

When I started with Bank of Georgia, we had a market share of 15%. Market cap of Bank of Georgia was less than 20 million dollars. The balance sheet was 200 million Lari, total assets. I don’t remember the penetration, but it was single digit for sure; could be below five. So total assets to GDP was probably 3% or 4%. And we started consolidating, and we started to open up the branches, we were buying the ATM etc. and we were investing in retail banking heavily. And we went in 2006 in London and we tapped the market. And that was something because we raised $150 million and it was a lot of money back then. It was a huge IPO, it was a big deal. Because we raised the capital and then we issued the Eurobond, that was another big achievement. So we grew very rapidly into retail banking and penetration started to grow, and the assets doubled, tripled in a year. Even more, sometimes we quadrupled in asset size.

So it was a penetration game. It was at very low penetration, consolidation was happening, and this kind of things will never happen now in Georgia in banking, for sure. But there are some sectors you can do where penetrations are low and you have a very fragmented market and that’s where I think that our speciality is, that’s where we can feel the market and grow. And as you know, in this $20 million market cap, we were in the $2 billion market cap in 2018 when we demerged the bank into the investment arm and in the banking. So it was a great ride and I think that fragmented sectors, especially service industry, is a very beautiful thing.

It was a penetration game. But there are some sectors you can do where penetrations are low and you have a very fragmented market and that’s where I think that our speciality is, that’s where we can feel the market and grow.

[00:11:44] Tilman Versch: We’re already in the topic because it made a bridge to the foundation of Georgia Capital. I think you started first investing with Bank of Georgia, where you were CEO in 2011, or became CEO in 2011, you started investing into other businesses in 2014, round about that, I think the hospitals?

[00:12:05] Irakli Gilauri: So basically, I became the Bank of Georgia CEO actually in 2006 or 2007. And then in 2012, we did the premium listing, when we upgraded our listing from GDRC to premium listing, where we got into the FTSE 250 index. And so we grew our market share from more than double to 35%. So we had a 35% percent market share. We were making 20-25% return on equity, we had a very strong capital base, etc. And in early 2007, we ventured in Ukraine and we invested in Ukraine and we lost a lot of money there. So we came back to Georgia wounded in scars, bleeding. We said we need to do something else because we have a really strong position in Georgia, we are growing, we are compounding like there is no tomorrow. And what else shall we do?

So we said, okay, because we don’t know how to operate outside Georgia, let’s focus in Georgia in different industries. And we started to pick some of the industries where we saw that we would benefit. And one was the healthcare and other was real estate because we had some number of real estate collaterals, land plots repossessed during the 2008 crisis. So we said, okay, we have this land plot, it’s not very easy to liquidate them or sell them. So let’s build the apartment blocks, wrap up into the mortgages and sell these wrapped up mortgages through the branches.

And it was ticket size for the… We were doing the long term mortgages, back then there was no ten year mortgages, so we started doing the 15, 20-year mortgages and it was like revolutionary. Basically, we were selling these apartment blocks, but to be honest, our retail business was benefitting even more, because we were getting really high-end client base. And Bank of Georgia was more known to be mass retail and we started to get more high-end with these mortgage products.

And then we started with health insurance and the government had some program that they would pay for the health insurance for some of the people, but the insurance company had to build the hospitals. Government actually, what they did, hospital infrastructure in Georgia was fully amortized. I mean, I don’t want to even say what kind of shape and form this hospitals were, I mean it was really bad to take the patient there. If you were not ill, you would get ill in that hospital for sure. So, the government came to the insurance companies and said that you build the new hospitals because there’s no point of renewing the existing ones. We will exit from the healthcare system fully and basically, will pay for the insurance premium for the health care for, I think, back then was one and a half million people.

So some of the insurance companies saw that it was like an insurance enhancement for health care, but we went and looked at the health care system as a whole. And we were shocked that it was bigger than banking, you know, the government exits, it’s totally fragmented. So we said, okay, we need to consolidate, we need to be investors in health care, it’s not like an insurance, just invest and build hospitals, we should separately manage the hospitals, separately manage the insurance, and basically, build and grow. So went and grew, I think at one stage, we had 30% market share in hospital beds and next one was like 2% or 3%.

And then we entered into the water utility, we entered to renewable energy, we then bought two pharmacy chains and consolidated them. That was probably one of the best acquisitions we have done. We consolidated five different insurance companies, and merged them. So we grew that business pretty rapidly and it became a very big portion of our business, not very big, but it was like a one-third was this investment portfolio, and two third was the bank.

So we said, okay, we have this land plot, it’s not very easy to liquidate them or sell them. So let’s build the apartment blocks, wrap up into the mortgages and sell these wrapped up mortgages through the branches. We consolidated five different insurance companies, merged them. So we grew that business pretty rapidly and it became a very big portion of our business, not very big, but it was like a one third was this investment portfolio, and two third was the bank.

[00:16:55] Tilman Versch: So, it’s still the time when you were CEO of Bank of Georgia?

[00:17:00] Irakli Gilauri: Yes, I’m the CEO of the Bank of Georgia. Back then, we restructured we put different CEO in the bank, I became CEO of the group. We had kind of different portfolio companies, we had separate CEO there. So it became like a bank conglomerate, maybe in Germany, when the Deutsche bank and the auto producer etc, was a big conglomerate, something like that probably. That’s where we were. So that cause a big growth anyway, we listed the healthcare business separately actually, so we had two listed companies, Bank of Georgia and the Georgia Healthcare.

Investment criteria for Georgia Capital

[00:17:48] Tilman Versch: Maybe let’s go back a bit before 2018, you started to spin off Georgia Capital with a lot of the assets. But before that, what kind of framework did you use to find new businesses? Was it more like that you got approached by people, or was there already a framework that you looked for, certain business criteria and declined others?

[00:17:00] Irakli Gilauri: Basically, I think number one thing for us always was the management. Do we have a management depth? Who will manage this or that business? And first was always the management. Then we obviously looked at the sector and how attractive it was, margins, investments, etc. But we really liked this consolidation stories of the fragmented, especially in service industries. So that’s kind of a criteria.

Also, I think that the pricing was very, very important. We call we want to buy cheaper. Everybody wants to buy cheap obviously, but you can make a lot of mistakes when you buy things cheaply and because we were self-learners, we couldn’t allow us to pay full price. So we were opportunistic. We were looking for opportunities and in Georgia, access to capital is and was very limited. So there is no private equity funds focusing on Georgia. Local capital market is not developed, so access to capital is very much limited. So we were probably the only game in town, if you wanted to exit your business, probably you should talk to us. So that was kind of an approach.

We were looking for opportunities and in Georgia, access to capital is and was very limited. So there is no private equity funds focusing on Georgia. Local capital market is not developed, so access to capital is very much limited.

Defining “cheap”

[00:19:45] Tilman Versch: What is cheap for you then, like, what multiples do you think of then?

[00:19:51] Irakli Gilauri: Yeah, usually what we will do is, say that you take the public company multiples and we would divide by 2. So, for instance, most healthcare businesses were trading at 12, 15, 20, 25 times. So, we will not take it 25 times obviously. We say, 10, 12, 14. So we would not allow ourselves to buy hospital at more than six times, so we would buy at five times, four times. That was kind of a target. We bought most of the hospitals below five, very last one we bought, I think, closer to six times EV/EBITDA. So that was kind of how we were defining the cheap; we want half price.

Understanding Georgia

[00:20:41] Tilman Versch: Before we jump into Georgia Capital’s foundation, maybe let’s think a bit about Georgia as a market. Georgia has 3.7 million inhabitants. I think, as Wikipedia said. The people live in very densely populated areas like Tbilisi and some major metropolis, so to say? How much of Georgia’s economy did you already know before you found Georgia Capital in 2018?

[00:21:16] Irakli Gilauri: Because we were the bank and we were doing the corporate banking, we knew a lot about the Georgian economy and the sector etc, we were pretty knowledgeable. As I say, we knew every cat and dog in this town. And every player in this business we understood very well, so that obviously was helpful knowledge in general, that you know the sectors, how they work. But actually, is a very different proposition to be a lender or to be an equity holder. We lended later on, but before we were very confident we knew a lot about it, but actually that’s not the case. You learn more when you become an equity investor. So yeah, we are comfortable with Georgia because we know this country very well.

Where is Georgia unique?

[00:22:16] Tilman Versch: Georgia has, compared to other markets in the region and also like other developing countries, very pro-business setup. How good or easy is it to do business in Georgia in your eyes?

[00:22:27] Irakli Gilauri: So basically what we have here, is that government understands very well in order to create wealth, we need to bring the investors’ investments in because we don’t have our gas, and we don’t have internal resources, we don’t have internal savings. Investors internally are very limited so we have to be good, friendly to the investors and this is the only way we’re going to grow our GDP. And that government understands very well. That is the primary driver for Georgia to be so business-friendly and investor-friendly. And I think we are very lucky not to have oil and gas, it would be a different country and probably not very well run and managed, to be honest.

It’s my speculation basically, but government knows that we need to have a good governance and they have excellent governance, they have excellent business environment. So we are very happy to be investors here in Georgia. So that’s kind of probably the biggest comfort as well. We as Georgians participate in the building of this country. So that’s a privilege, a lifetime opportunity when you are building the new sectors, you are building new management, you’re building the new companies and you’re doing all of this in your country. These companies are helping Georgia to go forward and you participate in this. You have some small participation in the progress this country is having. It’s a great pleasure to invest here.

The government understands very well in order to create wealth, we need to bring the investors’ investments in because we don’t have our gas, and we don’t have internal resources. Investors internally are very limited so we have to be good, friendly to the investors and this is the only way we’re going to grow our GDP.

[00:24:29] Tilman Versch: Do you see any risk that the pro-business setup changes with political shifts in the near future?

[00:24:37] Irakli Gilauri: I don’t believe because the fall of the Communist 90s, and I’m gonna say probably not very popular thing now, I think we should let all the nations to go fully bankrupt. Because they get their act together and sometimes, we want to help them. We are good people, we don’t want to help them, there is IMF, World Bank, there’s great organizations. But basically, you are not letting the nation to learn it’s lesson and that’s what happened to Georgia in the early 90s when we lost 75% of GDP. Back then, nobody knew what Georgia was. So, we were not even part of the World Bank or IMF probably, in the beginning.

So what happened that Georgia went bust and people realized that there’s two things why we live so badly. One is the corruption, there was a big corruption during Soviet Union and that was the main thing. And second one is socialism and communism. So the side effect we have now, left wing parties have a very, very low popularity, left-wing parties get less than 5% all together. So basically, you need to be a pro-business, pro-market in order to win the elections in Georgia. So, I do not think that any time soon we are fearing this. That is what another reason why we eradicated corruption etc. We tackled this problem was exactly because of this lesson learned in early ‘90s. That was kind of a big help to the country that we were sorting out the governance and we are actually pro-market. Now our governments are pro-market. Some people want equality and socialists and I would love to invite them to Georgia in ‘90s or late ‘80s to experience it.

Is corruption a thing?

[00:27:07] Tilman Versch: Coming back to the point of corruption, is there still corruption in Georgia? Or is it like tiny?

[00:27:16] Irakli Gilauri: We are doing the business and we are everywhere; we don’t come across that. So there would be something somewhere, it’s not something which comes from the top, it’s vice versa. So that’s kind of another big pleasure to be in this country. When you do the business, you do it for business. That’s also a big plus for Georgia.

Spinning off Georgia Capital from the Bank of Georgia

[00:27:45] Tilman Versch: So, let’s jump back to the business level as I already promised. In 2018, you decided to spinoff parts of the Bank of Georgia conglomerate into Georgia Capital. Why did you decide to do that?

[00:27:59] Irakli Gilauri: I think there was a number of different reasons but basically, we were a systemic bank. We were investing also at the same time, I think it’s little bit unfair to stakeholders of Bank of Georgia to possess such risk. Investment is a risky business basically, and you have a bank and investment together, so it’s one link. Another one is that it was becoming too complicated and too big. And we were also very big for the country. In 2018, our market cap to GDP was 12, 13% and all our business were in Georgia. As a comparison, Samsung was the same market cap to GDP ratio, but they were all over the world. Now you can imagine how big we were for this country.

So we had to split these two and have a pure banking, which would be the pure bank play, and investment separately. Actually, when we split these two, I realized that investment is even more difficult proposition, because when you are part of the big bank, you can have a margin of error because it’s a big conglomerate. And we became smaller without the bank. And we realized our discipline should grow double or triple.

[00:29:54] Tilman Versch: Why did you keep the shares of Bank of Georgia in Georgia Capital?

[00:30:00] Irakli Gilauri: Because the market cap would have been too small and we thought our investors would suffer with the liquidity of the stock etcetera. So that’s why we cannot increase the size of our investment company. So that was kind of the main idea behind it. And that’s probably helpful, back then, we saw that it would be beneficial size wise and liquidity wise to have Bank of Georgia in the portfolio. Plus it’s a great investment.

[00:30:37] Tilman Versch: So you could think of selling these shares one day when the other businesses are big enough or…

[00:30:43] Irakli Gilauri: I think the Bank of Georgia is grossly undervalued, maybe even more undervalued than Georgia Capital, to be honest. So now we don’t think about that at all. But actually, nothing is strategic in our portfolios. Our strategy is not to have strategic investments in general. But we are not a typical private equity house which can rotate this portfolio. We are just a difficult animal, I guess. We aren’t rotating portfolio that fast and won’t be able to do it because we are only Georgia focused, on one hand. On the other hand, we are not like a conglomerate, which operates all the businesses from one headquarters.

So, Georgia Capital is 25 people. We are just capital allocators and that’s what we do. And we let businesses to run themselves because each business is to have a value as separately with management etc. So in case we decide to exit the business, there is a separate platform, imaginary platform that some third party can come in and buy it. So basically, we are not private equity, because we don’t rotate; we are not conglomerate, but we are somehow conglomerate because we are holding maybe longer than somebody. So I don’t know what to call it, to be honest. So we call ourselves investment company. Probably that’s what we are, I don’t know.

We aren’t rotating portfolio that fast and won’t be able to do it because we are only Georgia focused, on one hand. On the other hand, we are not like a conglomerate, which operates all the businesses from one headquarters.

The fair value of Bank of Georgia

[00:32:30] Tilman Versch: Let’s find more about your nature in this interview out. But coming back to Bank of Georgia, you said it’s grossly undervalued. What do you think the fair value of Bank of Georgia is and why?

[00:32:45] Irakli Gilauri: I think right now the Bank of Georgia is trading at three times price earnings and it’s making 30% plus ROE. Is it gonna make 30% plus ROE forever? No, but can it make 20% plus forever? Probably it can, yeah. It’s been making so in past 20 years or so. Doubling the price of Bank of Georgia, some analysts do have a target of 46 pounds, when now it’s trading at 21. I think one analyst says that. But in general, I think it’s grossly undervalued. And if you look at Bank of Georgia’s valuation and then our discount, you see how grossly the Georgia Capital is undervalued. So that’s where we are, that’s fact of life unfortunately. That’s why I think double of the Bank of Georgia probably, the fair price would be.

Reasons for leaving Bank of Georgia

[00:34:05] Tilman Versch: Coming back to Bank of Georgia in 2008, you had a very warm seat there as a CEO. Why did you decide on a personal level to leave this seat or retire and say, “Okay, I’ll enjoy life from now on and I don’t want to build a new business line again.” What drove you to go to Georgia Capital?

[00:34:28] Irakli Gilauri: I think I’m the person who gets bored easily. I need to have, I think, exciting stuff to build a new investment company. We are in the business of building different institutions in different sectors, and you learn a lot of new things. So I enjoy learning new things. In Bank of Georgia, there’s a lot to do. There’s huge digitalization, the new CEO is doing a great job doing that. But I think that for me, being in a lot of different industries is a very exciting thing to do.

So I said I would like somebody else to run it and I’ll do something else. And I enjoy it, I don’t know why somebody in my place would say that I want to stay with Bank of Georgia and okay, we spin off and we’ll find some new CEO for this investment company from internally or externally. I don’t know what kind of person would do that. For me, it was very obvious that I wanted Georgia Capital to venture new things.

Targets for Georgia Capital

[00:35:50] Tilman Versch: You already explained a bit, but maybe let’s pick this out. What is the key target of Georgia Capital?

[00:36:00] Irakli Gilauri: So basically, the idea is to compound returns 25% plus a year to grow NAV per share. So far, in four years of our history, we’re not there yet in terms of growing our NAV but we are not too far away. I think we are at 5% territory now but it’s not good enough obviously, we need to grow and I think we will grow to make sure that we are making 25% NAV growth per year on average; above 20 we should make, but 25 would be nice to do. So that’s kind of the very simple target for us and that’s pretty much it. I mean it’s not complicated.

The service industry

[00:37:00] Tilman Versch: So with this 25% return target of NAV growth, it’s a challenging target. And you have to own good businesses for this. So what kind of business do you like to own, or even build at Georgia Capital to achieve this target? What nature of businesses do you like?

[00:37:21] Irakli Gilauri: I think service industries was the sector I think is exciting which can grow and generate such kind of growth and returns. One of my favourite one, for instance, now is… I have favourites apparently. My favourite is education business, K to 12 in the schools we are investing. A phenomenal sector, like, it’s amazing. I never thought social sector exists. Just to give you a very simple overview how education sector works.

So you have a revenue locked up for more than 12 years. Your capex is limited because you don’t build some sophisticated buildings or equipment, like in hospitals, for instance, if you compare. In hospitals, you need lot of sophisticated machineries, MRI, etc. The teachers are easy to train, unlike doctors for instance. And the EBITDA margins are greater than in capex heavy healthcare. So you saw the healthcare sector was good, but I have better one. I think the education one is an amazing sector. What has demonstrated education is even greater. So the worst crisis, the Covid was the worst crisis for education, because kids cannot go to school, they cannot attend, they cannot use the infrastructure. So in that kind of cases, some sectors just go bust.

What happened in education? We grew EBITDA in private schools. How we save the cost, you know, we could even inflate some prices because of distance learning etc. But in the worst crisis for education, we actually grew the business group. Now we have more than two times acceptance this year. Now we’re just closing the acceptance of new students two times more than the Covid times and pre-Covid times also. And it’s a huge growth in Georgia because people believe in education in Georgia a lot and we are offering affordable education. We are in all three segments, but are growing the affordable part aggressively. And that’s where we are going to consolidate even farther, the private education. This kind of sectors can generate 20-25% growth, even triple digit maybe for some time.

People believe in education in Georgia a lot and we are offering affordable education. We are in all three segments, but are growing the affordable part aggressively. And that’s where we are going to consolidate even farther, the private education.

Adapting the structure

[00:40:30] Tilman Versch: You already mentioned that you’ve learned a lot by changing your position from debt to equity holder. Can you maybe elaborate this a bit and share some of the learnings you had?

[00:40:42] Irakli Gilauri: Sure. If we look at these two very different animals, so in the bank, you are a debt provider. You are collateralised and you are diversified, so you have a much warmer seat. When you are investing, like the portfolio of Georgia Capital, we are very concentrated and you are equity holder and you are on the kind of a subordinate to the debt. And basically, your margin of error is very limited. So you really need to be extremely disciplined when you’re making your capital allocation decisions. It’s very easy to make a mistake in investing in equity because it’s not that easy to run the businesses profitably, and grow them, and find good management, etc. So I think that’s kind of two totally different paradigms and way of thinking as well.

Managing people

[00:42:09] Tilman Versch: How important have people become in this equity focused approach? So how much focus do you take on your team at Georgia Capital and also the management teams in the companies?

[00:42:22] Irakli Gilauri: This all about people. The bank was also a people business and we need to have good people. But here, it’s extremely important; growing and developing talent, helping them because you cannot run so many businesses, it’s impossible, don’t even try. Even if you can run, they are not going to be liquid for you because people are buying management. We had this recent very good partner coming into our water utility business, but the focus was with the excellent management team, that’s what attracts the strategic investors. So we need to have a top-class management team to bring a top investor because we need to bring strategic investors who would pay international prices.

So what we are doing our business is to buy locally with local multiples, consolidate, grow, bring management and develop as an institution or develop as an international institution, which would attract international strategic buyers who would be willing to pay international multiples. That’s why we should be able to generate high returns because we are not buying at international multiples and selling at international multiples. We are buying at local multiples and building the international team which would be competitive. Even if they come to Germany, they should be able to run like the companies run in Germany. The checks and balances, governance standards, risk management should be up to speed so that they can compete even in EU. So that’s our proposition, that’s what we do and that’s why we think that we have managed to bring very good investors in Georgia as well, international investors.

We need to have a top-class management team to bring a top investor because we need to bring strategic investors who would pay international prices.

[00:44:45] Tilman Versch: How do you find these people and how do you incentivise them right that they stay with you for a longer time?

[00:44:52] Irakli Gilauri: For us, the foundation of Georgia Capital is good governance. We think we are great believers at good governance, gives access to the international capital markets, and gives us access to management. Management is attracted towards good governance. And I think that good management, they want professional well-balanced boards, which they can learn and grow and develop and kind of attract each other. Good governance attracts good management and well-governed companies are looking for great talent. And I think that’s the foundation of Georgia Capital, good governance which gives us access to capital and access to management. That’s what Georgia Capital is all about.

We need to bring and develop and grow and incentivise. And we incentivise them with shares. So we have now the proxy shares for each portfolio company. And we say that whatever you manage, you’re going to have a part of it. And our cash bonuses and cash salaries are not very generous. It’s like, buy a cappuccino and some sandwich. But they can become wealthy by having proxy shares, or in case of Georgia Capital or people who work in Georgia Capital have Georgia Capital shares they take. So that participation is critical and that’s what the great talented people are attracted to. And we are looking all the time.

I think that’s the foundation of Georgia Capital, good governance which gives us access to capital and access to management. That’s what Georgia Capital is all about.

[00:46:52] Tilman Versch: To work it out a bit, good governance is not like having fresh fruits every morning for your employees.

[00:47:00] Irakli Gilauri: Definitely not, we don’t have fresh fruits. If we behave well, we get a cup of coffee once a day.

[00:47:13] Tilman Versch: But what is then good governance for you in the company? How does it boil down to examples?

[00:47:21] Irakli Gilauri: Yeah, so basically, there are no personal interests. Interests are for the company and to grow and develop the company. For me, my interest is to help the CEO to be successful. And we can bring help for him. The senior people in our board, for instance, who can help them when they present the project etc. We are there to help, not to push somebody. Politics occupies very little in a good governance. Probably, there are some politics always, it’s very loud word to say that we don’t have internal politics, but we are all driven for value creation. That’s our politics. So if you want to be part of it, you’re very welcome. And if we start doing some internal politics, some people have egos, etc. I mean we all do, we need to manage them. That’s when you get crushed and you won’t bring good people who want to work for this environment where we all have one goal of creating the value.

Learning from mistakes

[00:48:53] Tilman Versch: Like with every good approach, it’s normal that you do mistakes setting it up and you learn from them. So since 2018, what kind of mistakes have you done and what have you learned from it? And how did you fix these mistakes?

[00:49:10] Irakli Gilauri: I think one big mistake, it’s not big in size but in terms of management time, it took some… We invested in sub-scale businesses which were exciting, but it wouldn’t really move the needle into the NAV of Georgia Capital and we lost a lot of management time. We have not invested too much in the businesses, it’s not like ticket-size capital-wise, but we lost management time which is also a capital, right? So I think that was the mistake which we realized. That’s why we have the other category in our portfolio where we put the subscale business. And we say that we will be exiting it slowly. It’s for sale basically. That was probably strategically the biggest mistake which we made when we started Georgia Capital.

Now we are focusing on scalable businesses. We say that we want to have a 300 to 500 million Lari of equity ticket size achievable before we would invest. If we don’t see that this business can achieve equity value of 300 to 500 million Lari within the next three to five years, we just don’t touch it. So it was kind of a big one. I think that in the end, we realized that it was not a very good idea and we stopped doing it. And we don’t invest in the subscale business and we put up for sale the subscale business. We exited some of the business already. We exited, for instance, commercial real estate business, pretty attractive actually, which was small business in our portfolio.

So we also… I think it wasn’t a mistake other than the… I guess, strategy-wise also, another one was that we want to focus on the sectors which are not capex heavy. So the Georgia Capital having the big discount and we invest in capital heavy industries just makes no sense. You just go and buy Georgia Capital, right? And I think that even if our discount goes to zero, we shouldn’t invest in the capital heavy industries because I think that we will get back to the discount, because you need to have cash available all the time to have the opportunity of buybacks. That worries us.

And the third one, I guess I have a lot of mistakes to learn from. I think another one is probably the leverage at the hardcore level is not the best idea when you are an investment company. So I guess you need to have limited leverage because whatever cash you generate, I think it’s a lot of leverage at hardcore level which we have decreased significantly after selling 80% of our water utility business.

So we have realized the mistakes and we have addressed and we are addressing them. Another one which we are addressing is the Chairman CEO. I think that we need to split this role in two because as I said investment is risky business, we need a greater balance in the governance. So I think that would be another improvement. Actually, it was a good idea in the start-up phase, but right now, after four-five years of existence and I think that we are on the right track, I think there is no need for one person to occupy these two roles. It’s different, we are comparing that there are lot of chairman CEOs in investment companies who invest in public stock. And we said that it’s different, public stock, you have a liquid stock you own and you can sell at any time.

Here, you own private businesses which are not that liquid because you are in Georgia to start with. They will probably go talk about our exit, but to my surprise, for good companies, there is a lot of hunger for well-run, well-positioned companies. So I thought that Georgia would not be that liquid, but for the company class what we have, I think that there is quite a demand. So basically, another thing which we are addressing is splitting this role in two and hopefully, next year, we will announce how we will be doing.

We shouldn’t invest in the capital heavy industries because I think that we will get back to the discount, because you need to have cash available all the time to have the opportunity of buybacks. Another one which we are addressing is the Chairman CEO. I think that we need to split this role in two because as I said investment is risky business, we need a greater balance in the governance.

[00:54:38] Tilman Versch: How does it work that you realize this mistake? Is someone coming from the team and saying, “Hey, this might be a mistake. It doesn’t work that well”, or is it like you sit there or you have some mentor who helps you with thinking about things?

[00:54:54] Irakli Gilauri: All three. People come and say, you know, that’s why you need to have a culture that people speak up. If you don’t have this culture that, you know, boss is right and everybody is wrong, it’s like you are doomed for failure. So our culture is that you talk about it, what you are not happy with, etc. Board is a what you call the good governance, When we say that what is a good governance example, it is identifying the mistakes, ability to identify the mistakes, right? That’s good governance.

And we have a very high calibre board and the board is very much involved. And they look at us sometimes, you know, we can go crazy and there is a board to tell us, “You are too aggressive”, so this balance is very important. And you yourself also. For me, it is very difficult to work with people who do not recognise mistakes because we all make it and we need just to learn from it. If you don’t learn from it, you know, then it’s a bad judgment. Then it’s not a mistake, it’s a bad judgment.

Russia’s war & impact on Georgia (Capital)

[00:56:16] Tilman Versch: Jumping from mistakes to crisis, I think we already mentioned Covid a bit, but we discussed this in the community with you because you came on to chat with us and people who are interested in this can jump into the application form below via the link to the community. So let’s think a bit about the crisis you currently have like, all the crisis we are both in from the impacts of the Russian attack on Ukraine and all the changes. What does this mean for Georgia and Georgia Capital, like, since the beginning of the year, what has changed through the attack of Russia on Ukraine?

[00:56:55] Irakli Gilauri: So Georgia being attacked before, we know what it is like in 2008. But we were lucky that the whole conflict has been resolved very quickly and we had a very brief war basically. So we, as a nation, knew what Russia is capable of. I think that people forget Georgia as it is too far away from Europe, so it’s not happening with us, it’s happening somewhere else. I think Ukraine was very close to Europe, this war was very close to Europe and that woke up the European countries. And it’s good that they woke up.

But for us, it was obviously a big shock in terms of war, next door neighbours, it’s not very pleasant, it’s not good news. But slowly, we realised and we thought it would be a big economic shock on Georgia and we had the different macro models, and we thought we would have zero growth in 2022, something -2 or -3, but we humans don’t know. We can guess something but it’s difficult to know what would happen. That’s why it’s a good thing to live one day at a time, not to worry too much about the future. Anyway, we realised that a lot of the region has changed, the economy of the region changed. So if you had like Central Asian countries transporting oil and gas and different goods through Russia to Europe, they’re now using alternative routes through Georgia.

We also had a lot of Russians, who we did not expect; they just left Russia and moved to Georgia, especially people working in IT industry. And then now, we are having IT services exporting from Russia to Europe and other countries and the services we never exported. So our labour market changed dramatically, labour structure changed dramatically. The potential GDP growth most likely changed dramatically so a big shift happened there. Then exports, for instance, we brew Heineken beer in Georgia and Heineken stopped producing in Russia. They have ten brewers there and they stopped exporting from Russia. So they needed a destination. Now, we are exporting in seven countries where Heineken Russia was exporting.

So we have a lot of side effects which caused the Georgian Lari to appreciate from 3.3 dollar to 2.85. And against the Euro and against Pound, even greater appreciation because we had a big inflow of foreign currency. Georgia’s business-friendly environment also helps here. So we have investment also coming in. If you look at the foreign investment in Q1 versus the GDP, it’s the highest ever recorded. So you have big investments coming into the country. You have labour market shifting, structure changing, you have the logistics changing, the exports going up. And Georgia did a great thing also to have a free trade agreement with China and EU. There are actually two countries who have a free trade agreement with simultaneously China and EU, it’s Switzerland and Georgia. So basically that also helps because our exports also stepped up.

Tourist recovery was amazing and I think that the government managed to change the tourist structure as well. We managed to attract tourists, after the Covid, from high-earning countries and high spenders. So right now, in terms of numbers, we have 65% of number of tourists recovering. So 65% of 2019 tourists are coming to Georgia in numbers. But in terms of the money spent, it’s more than 100% than what we had back in 2019. So last year, we had 10% GDP growth; this year, we have 10% plus GDP growth. So huge growth, I mean, base was high. So if you look at the recovery in 2019 in Europe, we are number two after Ireland.

So Ireland is ahead of us in terms of the growth of GDP compared 2019 and then it’s Georgia. Because we outperformed 2019 by far. Basically, the nominal GDP in dollar terms now stands at around 25 billion dollars. It’s a small amount, but before Covid, we were around 17, 18. So this huge growth and Lari appreciation together created more attractive investor destination for foreigners.

You have labour market shifting, structure changing, you have the logistics changing, the exports going up. And Georgia did a great thing also to have a free trade agreement with China and EU. So basically that also helps because our exports also stepped up.

Is there a threat from Russia?

[01:03:11] Tilman Versch: Besides all the good news, I have to play Dr Doom. So, how do you see that Russia one day attacks Georgia again in this decade?

[01:03:25] Irakli Gilauri: You see, we’ve already been attacked and Russia got what they wanted, these two land plots we used to have. So I think attacking Georgia again, unless there is a Olympic sport of attacking Georgia, I don’t think it would happen. It’s my view, but I think other nations are more under danger than Georgia. We are ahead in that game.

[01:04:07] Tilman Versch: So you don’t see a high likelihood of an attack again?

[01:04:12] Irakli Gilauri: Yeah, I don’t think. If you attack Georgia, what will you gain? You already have what you wanted. So I think that there are more things to do than attacking Georgia.

[01:04:30] Tilman Versch: You already mentioned that many Russians came to Georgia now. Do you have a rough number how many Russians are there? To remember for the audience, it’s 3.7 million people that live in Georgia. So even a smaller migration could make a huge difference.

[01:04:48] Irakli Gilauri: Yeah, especially in the industry which is not present in Georgia. Basically, the numbers are somewhere between 80,000 to 200,000 IT specialists, let’s put that way. And even if you have 50,000, they add 50,000 dollars a year. That’s 2.5 billion, that’s 10% of GDP. It’s a very big number. So if you have 100, that’s 20% of GDP.

Russian migrants

[01:05:23] Tilman Versch: We already know that you’re a good businessman and a good investor. You’ve made something with the bank that might be good for some investors as a criteria. So I claim to say this. What opportunities do you see coming from the migrants to Georgia and how they are already impacting the business of Georgia Capital?

[01:05:50] Irakli Gilauri: Yeah, I think that is a very interesting opportunity, they are two-fold, immediate. Exporting IT services is more supply driven than demand driven. So if you have good IT teams which, on outsource, people can order their softwares to be built; so we now have that. And we are experimenting with one of our small businesses to export the IT services, like coding for instance, to sell the code to foreign companies by using the IT resources. So, that’s one we are looking at.

Another one is, we are in education business and in healthcare business and everywhere we need edtech. And there are people I have been meeting, who’ve been in this industry and we can build a partnership with very talented Russians who can help us create new digital products. So that’s another opportunity. But itself, this conflict created a lot of side opportunities. For instance, we are in the healthcare business and education business, and there was a lot of Asian countries using Ukraine, Russia, and little bit Georgia for medical education and university education. And now we are looking that Georgian medical universities are getting flooded.

And very natural for us, we are in both industries, to enter the medical university, and export that services. We have the doctors who will teach and we have the hospitals where we train and we have everything. And the market is huge. So we are looking at this opportunity very closely, both from education point of view and from the healthcare point of view. So there are gazillion opportunities. We just need to be very disciplined which one to pick. Why I like the university one? Because we are already present in both and it’s much easier for us, I believe. And capex-wise, it’s much lighter because we already have the hospitals. We don’t need to build this new training centre etc. for the students. I think we can attract the high calibre students in that industry who want to study medicine.

We are experimenting with one of our small businesses to export the IT services, like coding for instance, to sell the code to foreign companies by using the IT resources.

Community Exclusive: Boiling investments down

Hey, Tilman here! I’m sure you’re curious about the answer to this question. But this answer is exclusive to the members of my community, Good Investing Plus.

Good Investing Plus is a place where we help each other day by day to get better as investors. If you are an ambitious, long-term-oriented investor that likes to share, please apply for Good Investing Plus. I’m waiting for your application.

Without further ado, let’s go back to the conversation.

Energy production in Georgia

[01:10:30] Tilman Versch: To end the crisis part of the interview, where’s the energy coming from in Georgia? Like the electricity and the gas. And is there a risk for you from high prices?

[01:10:45] Irakli Gilauri: So basically, we are a big renewable producer. We have a lot of hydro and we have a next door neighbour, Azerbaijan, with whom we have long-term contracts and we have a very friendly relationship with Azerbaijan. The gas is coming from Azerbaijan, and renewable energy mainly is local, and with some gas turbines which are fired with other gas. So we have not had the Russian gas, I don’t know for how many years, so we have diversified 15 or 20 years ago, diversified away.

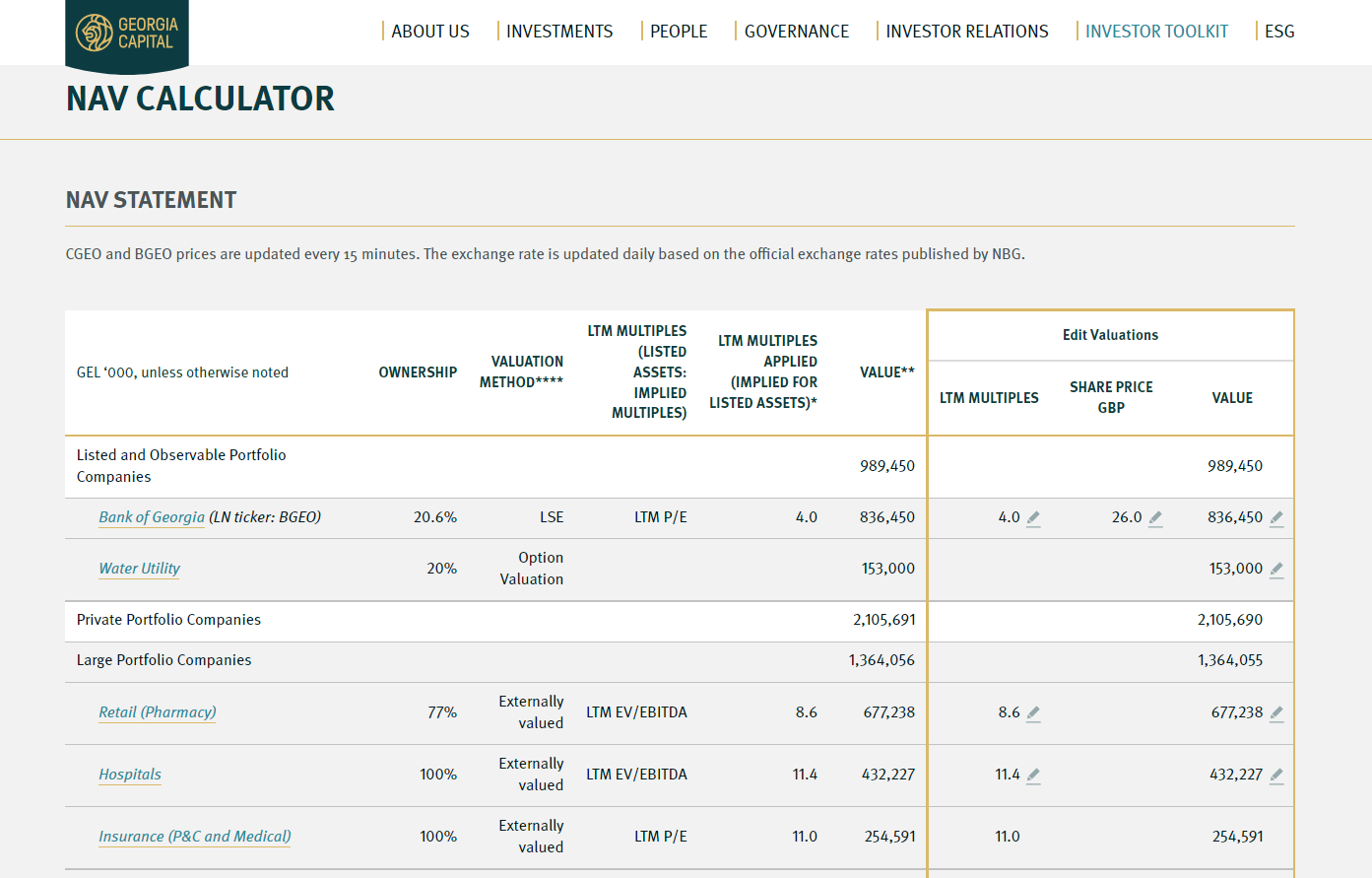

The NAV calculator

[01:11:30] Tilman Versch: That’s what we will also do, but yeah, it’s a painful thing. Let’s jump a bit to your NAV and the NAV calculator on the website. Here in the video, you will see this, that there is a nice tool you have on your website which you can also find by the link below and we can somehow work around the NAV of Georgia capital and get an idea how you define the values you have. But when I talked to other investors, there was always the question how trustworthy this NAV is. Let me frame this question is, how do you work on making these numbers which are NAV, which are calculation numbers like, real money numbers at Georgia Capital?

[01:12:23] Irakli Gilauri: So basically we do the DCFs, we are not inventing the wheel there. We do the DCFs, we compare to the international multiples and that’s how we come up. I think the best way to do it is to actually realize the value and see whether people are willing to pay that NAV. So the last transaction which we did to realize the water utility value was 30% premium to our NAV. So if we are trading at 60% discount to our NAV, we sold to three times more valuation that investors are valuing our water utility business. But then, investors say, “We don’t believe it anyway. You are still at 60% discount NAV.” So we are enjoying the NAV discount.

[01:13:24] Tilman Versch: How do you come to the peer multiples? Like, what is your process of picking the right peers, for instance, in the hospital space?

[01:13:35] Irakli Gilauri: So mainly it is DCF driven, it is cash flow driven, the multiples are more kind of a check. And we have Dawson Phelps, the third-party evaluator who comes and does the value and then ENY who signs off. So we have a lot of third parties who are doing that. The thing that the DCFs showed, I think we are conservative. That’s why we sold at 30% premium.

Let’s put that way, you know, there’s a control premium which we are not valuing. For the strategic investor to come and have control of the company, they pay for that, obviously and that’s not valued in our NAV valuation, the control premiums. I think, whatever we sold, it was always at NAV or above NAV. The commercial real estate businesses which were sold, it was not big but still it was above NAV. I think it was 40% above NAV.

Finding external investors

[01:14:51] Tilman Versch: So one important driver to raise the value you have there is this strategic investor. So where do you find them and how do you approach them?

[01:15:05] Irakli Gilauri: We don’t find them, they find us. So basically, there is a lot of hunger for good quality, high growth, well-run, well-institutionalized companies. And I think that we’ve been approached, all of our companies we have in our portfolio, we had credible buyers approaching us, talking to us. And sometimes we don’t talk, sometimes we talk. But we saw that we had good interest on this water utility business from different buyers, different bidders and in the end, we decided to go along with the current one, Aqualia, who bought this asset. And we are very happy with this transaction, with the partnership. We are happy that the investment value has been growing also.

So I think that investors are very happy because when we sold our 20% stake, what we have retained in the company was valued at $45 million and now, in two quarters, it’s went up to $55 million, because the company’s growth of EBITDA and cashflows are actually more than we expected due to the energy prices going up. It has renewable energy attached to it and plus, we had appreciation of Lari. So we don’t find, they approach us and then we talk and we engage or don’t engage.

Example of the water asset

[01:17:16] Tilman Versch: Can you walk us, if you’re allowed to do this, a bit through the sale of the water asset? Like, what assets did you have there? When the buyer approached you and how the buying process worked for that?

[01:17:29] Irakli Gilauri: Yeah, maybe I cannot say every detail, but I can try to talk what I can.

So basically, we announced in November 2020 that we want to realize the value of one of our large investments. In this way, we thought that if we put the value at NAV or above NAV, that would help to eliminate the discount. So as soon as we said that, we had multiple approach for our portfolio company and for other investor portfolios as well. So we had a lot of incoming inquiries. Actually, we didn’t realize but it was good approach to start if you want to sell something. We didn’t say what exactly we are selling. We said that in that large portfolio, one of them we will sell. So it was a very good exercise because we saw a lot of interest for different assets. So we didn’t realize, but it was a very, very good approach.

And we had a lot of incoming inquiries and we started to talk. There were some credible parties, not very credible parties, etc. So we started to spend some time and educate them about the business. We had some management meetings. Management was also incentivised properly on the sale, that is important. And as we walked through and we were getting no binding bids and we were moving on to binding bids, so it was interesting process actually. So we never sold before in private transaction. We had a lot of public deals, we did smaller private transactions, but with strategy we haven’t done it before and it was very interesting learning. Actually, it’s much simpler than people think.

We didn’t realize but it was good approach to start if you want to sell something. We didn’t say what exactly we are selling. So it was a very good exercise because we saw a lot of interest for different assets.

[01:19:49] Tilman Versch: When the deal is finished and the money is on your account, is the relationship with the asset over? Because I think in this case, it was Japanese buyer if I’m not totally wrong, that bought the asset and the management of it is also something that has to be done on the ground. And do we have still an involvement there as this kind of service company maybe for the buyers of assets?

[01:20:15] Irakli Gilauri: No, the water utility, Spanish company bought it, Aqualia. So on water utility, we are 20% shareholders there. We have put option for 25 but we are the partners, we sit on the board, we work together. We actually have a very intensive meeting and it’s actually a very fruitful partnership. I think that Aqualia wanted to have a local partner to guide them and we are very happy partners. So far, we have a very good partnership. And I think that’s kind of a proper recipe for our strategy guys to come in and we help them in the beginning with our minority shareholding. Some may not want but that’s also a service we offer in a way. So it’s part of this deal, I guess. And we have a shareholder’s agreement and both parties obviously obey this agreement. That’s kind of a pleasure to have such a knowledgeable partner because we are learning more. And as I mentioned, I love to learn.

Capital allocation

[01:21:46] Tilman Versch: I also would love to learn a bit about how you use the cash proceeds you get from the sale. Generally, there’s three options like reinvest into the business, payback dept, or do buybacks. So how did you decide in this case? And you already mentioned that the debt levels you have weren’t that happy for you. Tell me a bit more here.

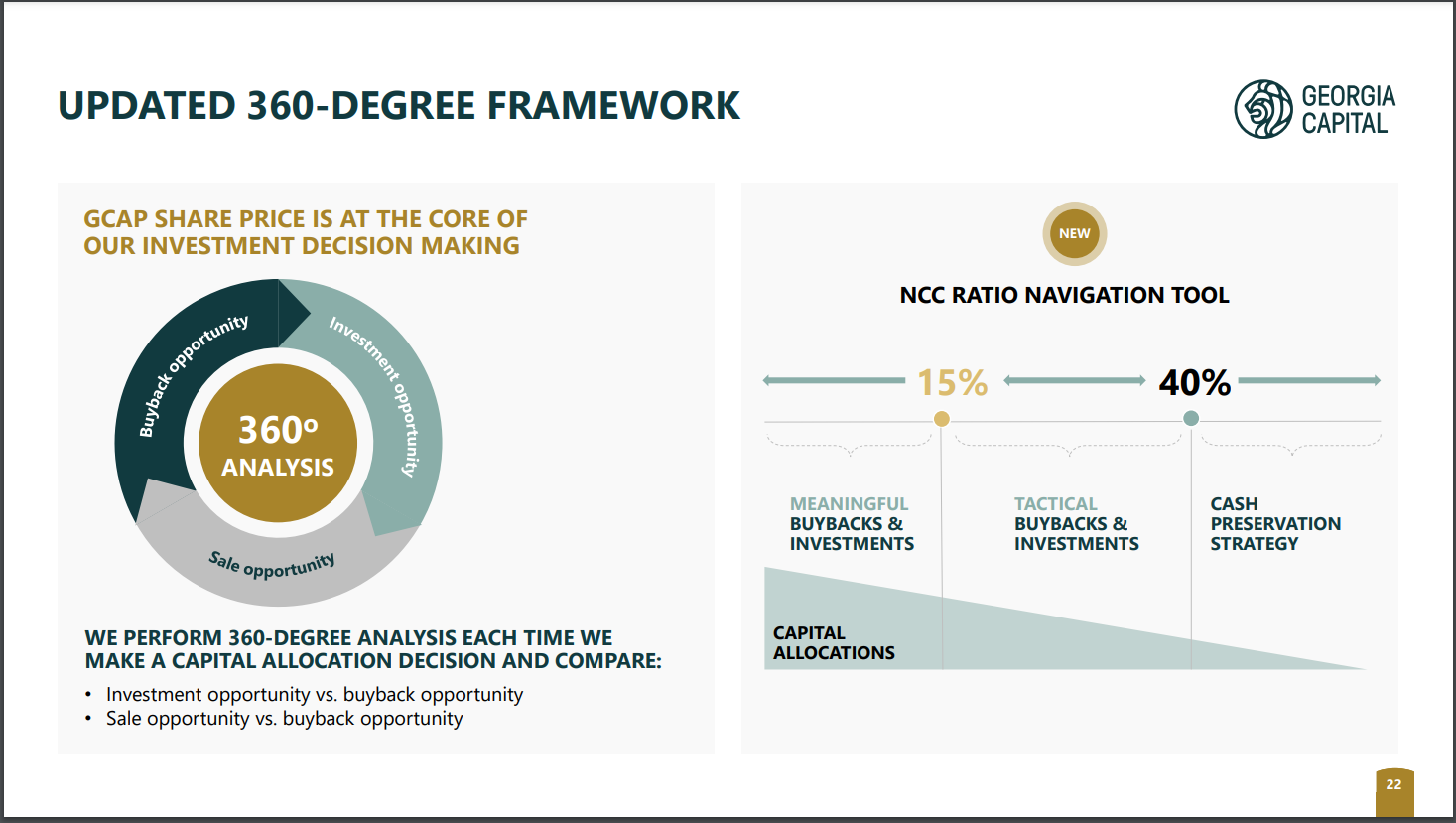

[01:21:11] Irakli Gilauri: Most difficult question probably for me is how you allocate the capital between these three, investing, buying back; buyback is also investing, that’s how we look at it, we are investing in Georgia Capital basically; and leveraging. That’s where we have put up in May, we had an investor day in London. We have put up this framework how we allocate the capital between these three.

So basically, we have this NCC ratio, it’s net capital commitment which is a ratio of net debt plus investment commitments what we have. These are the old balance sheet investment commitments and then we divided ratio to the portfolio value. And we say that the combination of these two, the net debt and the committed investments should not be more than… If it’s close to 15%, then the we are more bullish in buybacks. So if this one is above 15 and now it’s around 23, we are okay to do little bit buybacks and leveraging is more on the agenda. So if this ratio is towards the 45, we don’t do buybacks, we just deleverage aggressively. So this is kind of a knob volume button, where we are in terms of how aggressive we are on buybacks and how aggressive we are in terms of deleveraging.

So right now, we are in a middle territory where we are doing little bit of buybacks. In past 12 months, we did buybacks worth $25 million of stock we bought back, and we are buying back some more. So we are kind of in a mode of… volume is not high up on the buybacks, it’s a little bit down. And on the investment side also, we are trying to limit the investment. Our investment portfolio is what we have identified education, renewable energy and the outpatient clinics. Outpatient clinics is actually generating enough cash to do reinvestment itself and we are not investing there. And education and renewable energy is where Georgia Capital investor is putting up money.

I want to just underline here that all the investment that our portfolio company does, we at Georgia Capital need to sign off on that. An investment committee decides on that, so management has full delegation into the operations, but when it comes to capital allocation, that’s where we step in.

And we say that the combination of these two, the net debt and the committed investments should not be more than… If it’s close to 15%, then the we are more bullish in buybacks. So if this one is above 15 and now it’s around 23, we are okay to do little bit buybacks and leveraging is more on the agenda.

Thoughts on dividends

[01:25:34] Tilman Versch: How do you think about dividends at Georgia Capital?

[01:25:39] Irakli Gilauri: I think that for us, as long as we can generate a big increase the NAV per share by buying back the shares, I think that’s what we’ll do. But as long as this discount closes down, then we will be thinking more in terms of dividends. Let’s say the sustainable dividend capital return policy for us can be done as soon as we take care of the leverage. In 2024, we will be repaying the bond and that’s where we want to decrease leverage significantly. And since we will do that, the cash flow generated by operating company is not reach to our investors because there’s a debt in between. As soon as we take care of this debt, I think the dividend policy can be introduced.

But I would call it more kind of a capital return policy, which would say that we have option to buy back or give you cash. So every six months probably, that’s where we need to decide we are buying back or give you cash. But investors will have a visibility on the amount of buybacks or dividends they will receive. Right now, they don’t. Right now, we are very opportunistic. We just come out and say, “We have $5 million, $10 million buyback program”, and we switch on and off. We cannot commit because of this debt we have, we cannot commit to a continuous and progressive capital return policy. But we hope we will soon after deleverage.

[01:27:30] Tilman Versch: Thinking about debt deleverage, what is the sustainable level you want to keep in the future? Or is there any metric you think that should be the future key metric or the future key range?

[01:27:45] Irakli Gilauri: For us, if you look at the debt and the capital commitment is the same in a way. So we want these two not to be more than 15 percent of our portfolio value. Right now, our portfolio value is around $1 billion dollars. So we think that $150 million of net debt and capital commitment at any given time is a conservative well-balanced number, for instance. We shouldn’t commit more than $150 million to invest at a given time, or we shouldn’t have a net debt of, combination of debt and committed capital, you should not have more than 15%. Right now, it’s $150 million.

That’s the way we think that we are comfortable and that’s the kind of area historically where we think that this is a comfortable level of debt and the capital commitments together. So we’ve been conservative here because capital commitments you may change and say, “I don’t want to commit that capital”, but also this is good for our discipline. So we need to manage ourselves as well. So it’s good for our discipline that we don’t commit too much in terms of investment. So in proportion to our portfolio, we are not aggressive in terms of investments and commitments.

For us, we want the debt and the capital commitment to not to be more than 15 percent of our portfolio value. It’s good for our discipline that we don’t commit too much in terms of investment.

Renewable energy

[01:29:20] Tilman Versch: Before we close the interview, maybe let’s jump at the renewables which we haven’t discussed really in details. How do renewables fit to your more asset light approach in the company? Because it’s like…

[01:29:32] Irakli Gilauri: It doesn’t. We had that one, the asset light we announced in May, it’s not something which fits right now. We were committed to build some projects. It’s very difficult to recommit if you are in process of building. But we need to solve this puzzle as well because it’s not part of our core strategy.

[01:29:57] Tilman Versch: Do you need a lot of equity to build renewables in Georgia, or is there also like, in Germany, many companies can just take capital from the bank and build renewables because the cash flows are so plannable?

[01:30:18] Irakli Gilauri: You would need to put up some equity here in Georgia. You cannot do only with the bank but we can also do this business, which is a very good business, tdo a third party money and be like a manager or have a partnership where you don’t commit that much etc and bring more debt and you do it more asset or equity light way. So we are working on that to solve the puzzle. This is something which is on top of our agenda how we’re going to go about renewables. Right now, in our NCC ratio, when I say it’s 23 or 24%, it includes the commitment to invest into renewables. So if we manage to solve this puzzle in a way that we are managing or we are in partnership or what have you, we may not… This commitment will fall out which would improve the ratio, which would allow us to do more buybacks in a way.

[01:31:29] Tilman Versch: So, what is your strategy in renewables or if it’s still evolving, you can also say, it’s still evolving at this point of time?

[01:30:38] Irakli Gilauri: No, no, I think that number one goal would be to stay in the business but generate more like a fee, income out of it. Being a manager as Georgia Capital rather than investor. Maybe stay as an investor whatever we have invested now but then we manage other people’s money as well. And that’s where we make the retainers and fees and return sharing basically. So that’s another approach we think we can take. We don’t have a final solution yet so I don’t want to just say too much. We have not arrived but we are working, it’s on top of the agenda that we make this renewable energy asset light.

Where will Irakli be in 5 years?

[01:32:43] Tilman Versch: So we started in the early 1990s and now let’s jump a bit to the future. Let’s maybe think about the year 2027, like in five years. How likely is it that you will still be CEO of Georgia Capital then?

[01:33:00] Irakli Gilauri: For sure, I will not be CEO of Georgia Capital, I will be Chairman, I hope anyway. I enjoy what we do and basically I think that this company, the Georgia Capital as an asset, as a capital allocator, I think I can contribute as much being a Chairman as I am a CEO now. Because the way we run these companies is you need to be really hands-off from the operating companies. And I think that being a Chairman, we can have this capital allocation strategy which is appropriate and then I can do it not full-time to be honest. I think that investors also will be happier that they can get cheaper version of me.

Who might follow?

[01:34:00] Tilman Versch: How will you go about finding the new CEO then? Will it be the person that came across to you honestly and said, “This is a mistake”, or what is the search formula you will do in this case?

[01:34:13] Irakli Gilauri: I don’t want to jump ahead, but I think that people who tell you that and who are courageous enough and care enough to tell you what mistakes you make, I think that’s a very big value. That individual or group of individuals will obviously be valued who are open.

[01:34:40] Tilman Versch: Is it likely that the person will come out of Georgia Capital’s team or if you don’t wanna say anything here, it’s also okay.

[01:34:50] Irakli Gilauri: No, no, no. I think the more likelihood to come out from the Georgia Capital team than not, or from the group.

The outlook

[01:35:00] Tilman Versch: And then think about the line of businesses in 2027. What might be new businesses under the umbrella of Georgia Capital that are in the scale of bigger businesses?

[01:35:16] Irakli Gilauri: In ‘27, for sure, our education business could be the largest one in our portfolio or close. It will be large for sure. I think that another industry which I like a lot in our other businesses and we are really testing the management there, is auto services which is fragmented. There is one large player and then it’s totally fragmented. I think that to make their number two player is a big industry, big sector. It also resonates our ability to consolidate fragmented sectors, grow in the service industry, etc. So it’s kind of our bread and butter. So that’s another one, which I think that could become an upcoming investment stage company, and that’s where we might be investing in the future.

I think that clinics and pharmacies will go outside Georgia. We as Georgia Capital do not invest outside but our asset light businesses are encouraged to go outside of Georgia. And I think that we will have pharmacy chains and we are also building franchises. For instance, we have franchise of Body Shop. And we will be growing outside Georgia in Azerbaijan, Armenia and maybe other countries as well with these pharmacy chains and franchise shops. I think that polyclicnics, which are also asset light basically, we can grow this one into the region.

We may start growing our education business in the region. So there are a lot of opportunities for asset light businesses to go outside. So in five years’ time. I think education business, polyclinics business will be big. In pharmacy we are already outside, but pharma will be strong regional player for sure. It will be very attractive for big strategics because with one goal, they can cover the whole region. I think that polyclinics and schools will be opened for sure in the region. Our lab, which we just got the JCI accreditation in the region, this is the only JCI accredited lab, will be also a regional player. And probably would exit one of our large investors, I don’t know which one…

I think that another industry which I like a lot in our other businesses and we are really testing the management there, is auto services which is fragmented. It also resonates our ability to consolidate fragmented sectors, grow in the service industry, etc.

[01:38:39] Tilman Versch: It’s not a good strategy.

[01:38:45] Irakli Gilauri: So probably we will exit one of this, then we will have, as I said, auto services maybe. I don’t want to jump ahead but going into the investment stage company. So next five years, we are pretty busy, I think, in terms of growth. We can generate a lot of growth with very little capital commitment, to be honest. And we will have a capital return policy in place.

Closing thoughts

[01:39:18] Tilman Versch: I’ve asked all my questions. Is there anything you want to add for the end of the interview, we haven’t discussed that comes to your mind?

[01:39:29] Irakli Gilauri: No, no. It is actually my first podcast ever. I enjoyed very much and I want to thank you for such a great interview, such a good engagement and such great questions. I think it’s an excellent time I had with you. Thank you.

[01:39:49] Tilman Versch: Thank you. Thank you very much, I also enjoyed it. And thank you for the audience for staying till here were saying to hear and bye-bye till the next interview.

Disclaimer

Finally, here is the disclaimer. Please check it out as this content is no advice and no recommendation!