Renewable energies are booming. With Karsten Schlageter, a board member of the renewables developer ABO Wind, I discussed the developer’s business model. Here you can find the video of our conversation.

- Intro

- The Origin of ABO Wind

- Karsten Schlageter’s beginnings at ABO Wind

- Supporting Good Investing

- Renewable energy 20 years ago, 10 years ago & today

- The future of renewable energy

- Thoughts on the future market

- Hurdles of growing the market depending on the region

- Impacts of component and logistics prices

- Calculations and costs for a wind farm

- Investors

- Development of financing costs

- Value added by ABO Wind to renewable energy projects

- Phase: Site acquisition

- Differences: solar farms and wind parks

- Phase: Development

- Responsibilities in the early phases

- Costs of development

- Energy transition and the margins

- Phase: Financing

- Phase: Construction

- Scale advantages in the value chain

- Finding and keeping good people

- Decision making in the face of growth

- Phase: Services

- Subscribe

- Phases in developing wind & solar parks

- Hurdles in the different phases

- Payment

- The value of different phases

- Risks of owning the parks

- Community Exclusive

- Shares owned by employees

- International expansion of ABO

- Entering a new market

- Potential territories to enter

- Getting started in a market

- Making sure the ABO Wind culture lives in the different subsidiaries

- Managing subsidiaries

- Deployed vs. local units

- Top markets that Karsten is bullish about

- Difficult markets

- Effects of Corona on the company

- Motivation behind entering new technologies

- Managing the risks of new technologies

- Potential in hydrogen

- 2011 vs. 2021 in the renewable energy market

- Role of ownership

- Energy of the owners

- Karsten Schlageter’s shares in ABO Wind

- Evaluating ABO’s share value

- Repowering wind parks in Germany

- ABO Wind in 10 years

- Encouragement to invest

- Goodbye

- Disclaimer

Intro

[00:00:00] Tilman Versch: Hello audience. Hello Mr. Schlageter, it’s great to have you here. Today we’re talking about wind and the ABO Wind.

The Origin of ABO Wind

[00:00:10] Tilman Versch: For the beginning, I would like to ask you, what does ABO Wind stand for? What does the ABO stand for and when did you get in touch with the company?

[00:00:20] Karsten Schlageter: Hello Tilman. I’m happy to be with you today in this interview and it’s of course a question everyone poses that is really interested in ABO and in Germany, that’s kind of if you buy a newspaper on a regular basis so that’s definitely not what it stands for. It comes from our founders. It’s Ahn; Dr. Ahn who’s one of the founders and Bockholt – so ABO Wind.

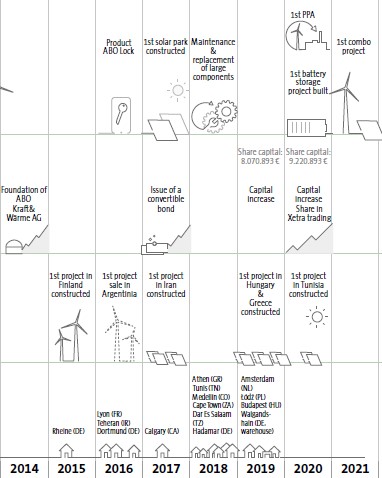

25 years ago, ABO Wind was foundered. Definitely, we were fully focused on wind, and today I hope we don’t only talk about the wind but also solar storage and other technologies because today we don’t only have the wind in our portfolio.

[00:01:08] Tilman Versch: Yes we will talk about different technologies of renewables.

Karsten Schlageter’s beginnings at ABO Wind

[00:01:12] Tilman Versch: When did you get in touch with the company? Since when are you part of the team and what was your role before you came on board?

[00:01:20] Karsten Schlageter: Actually it was also a funny story. I was responsible, before I joined ABO, for a large utility in Peru, so I was living in Peru and I needed to close down the subsidiary there. And then I said okay I’ll change my job to a new responsibility. I wanted to be and continue in an entrepreneurial mindset and I sent two applications and gladly the team here responded immediately. So we had the first interview from Lima, Peru with the team here then I flew over once and we met then the first time in 2013. And I started with the role of general manager – that’s the second level at ABO Wind, and I was responsible, at that time for some of our international markets. It was Ireland, Spain, part of the UK and then continually I grew my responsibilities.

[00:02:26] Tilman Versch: And since when are you part of the board?

[00:02:29] Karsten Schlageter: It’s now three years. So I had my first extension of the contract and it was a fantastic journey together with the founders, with my other colleagues, it is very joyful working here. It has a great purpose, we do something good for mankind and I think that’s motivating in itself and it’s exciting.

Supporting Good Investing

[00:02:57] Tilman Versch: Tilman here. I want to invite you to support my work. Below you can find the thank you page. Just click on it and there you’ll find ways to support me and allow me to produce further great videos like this for my channel. Thank you!

Renewable energy 20 years ago, 10 years ago & today

[00:03:13] Tilman Versch: I hope you can answer my next question a bit because it’s going back 10 years ago to the renewable industry. So what was the state of the industry 10 years ago and how would you describe it today in comparison?

[00:03:30] Karsten Schlageter: Yeah, it has changed completely and that’s what makes it so interesting and also challenging. I mean we could even go, let’s start 20 years ago, because I think it’s important to understand. So when you listen to the founders, it was really fighting against everyone. I mean fighting against, so to say, the virtual windmills, the administrations, the big utilities. We were really the outcasts, the outsiders. We believed in renewable but that was a niche market. We were very small, the percentage of electricity generated by renewables was very small but people understood already. There of course we had Club of Rome discussions and that is well known. We already knew at that time that climate change is an important factor so it was really that we started and built something big.

We were really the outcasts, the outsiders. We believed in renewable but that was a niche market. We were very small, the percentage of electricity generated by renewables was very small but people understood already.

It was visionary at that time. Of course, I was not there, so it’s really the job and the story of our founders. And then 10 years, 15 years later, you said 10 years ago, there is started to probably get more and more mainstream. So the first utility company started to switch to renewables. Before that, it was like wow, renewables? What’s that? This had no importance for them. The big thing was still coal and gas but then there was a shift. Some utilities started understanding; they started building their own renewable teams, their business development teams. And we grew of course – the company. We made it and we continue doing so each year more professionally.

And 10 years ago, I mean that’s also an interesting story. Maybe we still believed that solar didn’t really have a chance five, six, seven years ago. Then we really understood alp that wind, in some markets, is beaten with respect to price by solar and we started solar. So I mean maybe that gives you a bit of the dynamic. And today, I’m mean to continue the question; we are in the middle of the energy transition. It’s mainstream now. Now it even comes to the oil majors so we are in the center of this energy transition.

The future of renewable energy

[00:06:08] Tilman Versch: So with the next question, your answer might truly be wrong because I want to look out for the next 10 years and what is your take on the future of the industry for the next 10 years. But it’s about the future, so what do you think might happen in the next 10 years?

[00:06:25] Karsten Schlageter: Yeah, I mean you said giving forecasts, we are almost certainly wrong but I think what we can see clearly today is that renewables will continue their path and the build-out of renewables will speed up, the ramp-up will speed up. I mean there is any number you want in the market but I would say it’s legitimate to say the speed of investment, the amount of investment will at least double in the next 10 years compared to the last 10 years and it will get a different angle as well. We will now really see it, and that has started, that’s irreversible. We see a sector coupling. I think that’s the new release story that drives additional growth of the sector.

So while we have in the past, purely a focus on electrification, in a sense of renewables replacing coal and gas, now we start with electric vehicles to electrify the transport sector and we see since last year, a huge discussion about also decarbonizing the industry via electricity. And one way, and I think this will really pick up in the next five, 10, 15 years is the hydrogen business and green hydrogen you again need renewables so demand is huge.

Thoughts on the future market

[00:07:54] Tilman Versch: What is your internal forecast for the next years, if you have one?

[00:08:00] Karsten Schlageter: Do you mean at ABO Wind or for the market?

[00:08:05] Tilman Versch: For the market, the wind market or the energy market.

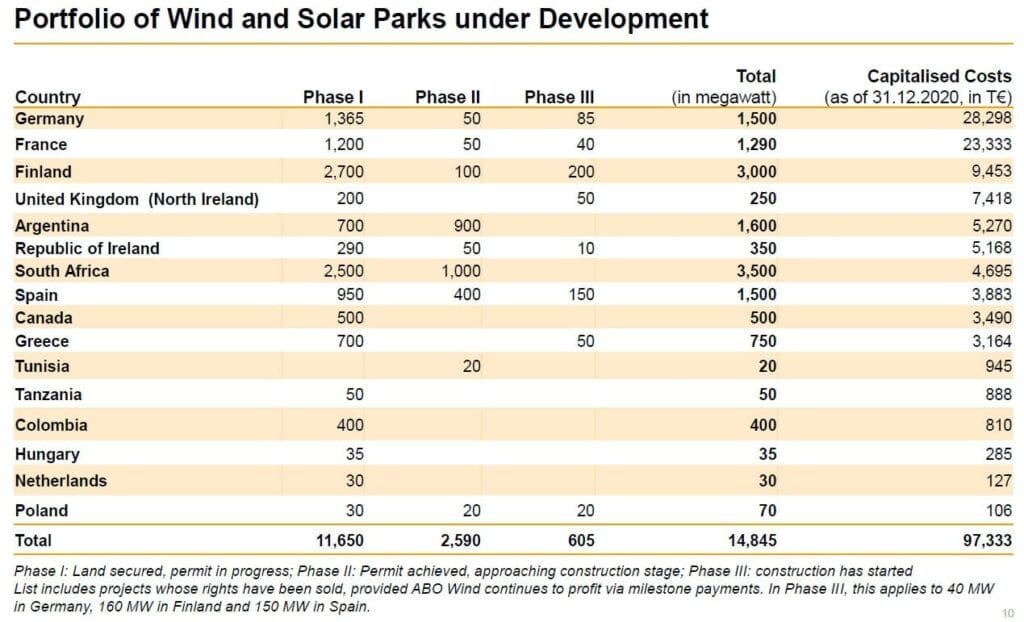

[00:08:10] Karsten Schlageter: We see enormous growth rates in many markets. We did not yet discuss our markets. We are in 16 markets so the pace of electrification and decarbonization will be different in any market. But in the European Union as we talk, just yesterday, the European Union raised their targets, made details about their strategy. And I believe in that scenario that the EU sets for us so we will have 55% less carbon dioxide compared to 1990 and that means, in most markets, that we really need to double the capacity. So what we came to, the current situation in 25 years, we will double this at least in the next 10 years.

Hurdles of growing the market depending on the region

[00:09:10] Tilman Versch: Where do you see the biggest hurdles and problems for future growth of renewables?

[00:09:18] Karsten Schlageter: Again, it depends a lot on the individual markets you look at. So in Germany, we are a densely populated country so the surface available for wind energy, solar energy, is definitely the key. I mean we have a lot of resistance close by households so this is the main challenge. In other markets, maybe it’s the economic environment. For example, let’s go to the other end, maybe we have large surfaces in Africa or in Argentina but then you have very high capital costs and political instability and not at all resistance. Here in some areas, we do not face any resistance, it’s quite the opposite. So people fully welcome it if you install windmills because then they get at least some job taxes. It depends where we look at. I mean if you want, we can of course focus on some of the markets.

[00:10:25] Tilman Versch: We will during the interview.

Impacts of component and logistics prices

[00:10:30] Tilman Versch: Is steel price for instance on topic for you?

[00:10:35] Karsten Schlageter: Absolutely. It’s steel, it’s all the components we need for batteries, we need for the production of modules like wafer and silicon. So all these prices are really important and what you read a lot in the press, and all industries are affected. But it affects us as well as logistics costs. Whereas for example in module prices, you usually 1.2 cents per kilowatt on logistics. Now currently, we add five so it has really skyrocketed. It’s amazing.

Calculations and costs for a wind farm

[00:11:15] Tilman Versch: What are other parts of this calculation if you do them? Like logistics, steel, what are other parts that are important to consider?

[00:11:25] Karsten Schlageter: If we evaluate a wind farm, we have very clear cost structures. So of course it’s the components but that’s only one thing. It’s the turbine itself or the solar module and then you have the grid connection cost which depends on the voltage level you can connect, so this is a very important determinant. And we do have the cost of the land. If you need to pay extremely high like in the Netherlands or other high-value markets for land, then it drives up your costs considerably.

And last but not least that many forget is financing costs. So of course the industry now profits a lot from very low interest environment and from a lot of money that pours into it – green bonds and any kind of green financing.

Investors

[00:12:20] Tilman Versch: Maybe let’s take a look at the 10 years perspective in the investor that changed or the five-year perspective. What investors are currently in the renewable business that wasn’t there five or 10 years ago?

[00:12:40] Karsten Schlageter: Do you mean entrants that came in the last years?

[00:12:44] Tilman Versch: Like investors that want to invest in wind parks, solar parks. Are there many new coming investors?

[00:12:50] Karsten Schlageter: Absolutely, yes. When we go 20 years back, we had mostly private investors that really believed in something good for the planet, that were idealists and we cherish a lot of these shareholders because many of them are with us. And these are really valuable and believe in some greater purpose so that’s great to still have them on board. And then I mean in recent years, really the finance industry noted that on the one end, industries need to undergo transformation really to understand that energy transition is needed to fight climate change. So they look into all these ESG topics.

On the other end, many pour directly into investments in renewables or in companies like us that invest and are purely doing business in the renewable sector. So we had a lot of entrants from family offices, from large asset managers. But also, of course, a lot of interest in an acquisition of projects or investing in ABO Wind by pension funds and even oil companies are interested in these sectors today. It has changed completely. So if you have a nice project that is bankable, has a tariff, then there is a large queue behind such assets that want to buy.

Development of financing costs

[00:14:25] Tilman Versch: Maybe this also has implications for the financing costs? Do you have a rough sketch of how they got down the last 10 or five years?

[00:14:38] Karsten Schlageter: There was a huge decrease in cost. It’s totally correlated with the interest rates of central banks. You simply can look it up. I mean when today we have almost negative central bank rates for 10 years so you add 2 or 3% depending on where in an industrial market you are. And it has decreased in line with the general interest environment. It’s really a huge impact, but also people then ask; hey, what happens if it goes the other way around? And then we simply need to say we’re very well protected because then usually tariffs of electricity go up as well. So prices rise again and we are in a natural hedge.

[00:15:43] Tilman Versch: That’s good to know.

Value added by ABO Wind to renewable energy projects

[00:15:44] Tilman Versch: Let’s take a look at the value that ABO Wind adds to the renewables production ecosystem, I would call it or the production of renewables, and I brought a slide from your slide deck for this and would like to ask you to guide us a bit through the different segments you have as ABO Wind, and maybe also highlight what are the most important fields for your business, and which are the strongest. Let’s start with the most important fields and maybe describe the fields of business you’re doing.

[00:16:20] Karsten Schlageter: Here you are with the functions and the value chain we add and that’s interesting. So we do that technology-wise for wind, solar, storage, and more and more, also for hydrogen projects. And explaining exactly what we do, you also asked about new investors, new markets, and entrance. One could also say, and let’s also focus on what protects us, what creates market barriers.

[00:16:51] Tilman Versch: These are my questions that are coming up.

[00:16:55] Karsten Schlageter: I’m sorry!

[00:16:56] Tilman Versch: No problem.

[00:16:57] Karsten Schlageter: But I think this is usually what is interesting for a general audience and an investor-like audience. So site acquisition, the first one. That’s already one of these high entry barriers.

Phase: Site acquisition

[00:17:05] Karsten Schlageter: Today there is a huge competition for land rights, so usually you rent the land for 25 years 30 years; today even some projects for 35 years or longer. To get there, you really need people there centrally on the grounds that I am able to speak to landowners that have the same language, that is not arrogant, that have the same flavor and that’s what our teams do all over the world. So our planning people, with today with geoinformation systems you identify sites, you go to landowners and then you put them under contract and then we start the next phase – the development.

[00:17:55] Tilman Versch: Maybe let’s stick with the site acquisition. Is it different in different destinations? For instance in Germany, you mostly rent the spaces and in Argentina, where you’re also present, you go about buying land as well, or is it generally renting?

[00:18:15] Karsten Schlageter: Usually we prefer renting, and the whole sector does because it gets very capital intensive if you start buying all these huge lands you need, and also landowners usually pass from generation to generation their land, to their children and so on. And they do not want to sell, they want to own it, they want to have it, enhance it; they want to often also have their own wind farm on their land. So I would say in 95% of cases, we just rent. And then there are some countries where you are more or less obliged to buy, or where uncertainty is too big to rent, and only then do we consider buying. One case in Hungary. There are some regulations so we prefer, for example, to buy land.

Differences: solar farms and wind parks

[00:19:02] Tilman Versch: Is there a difference in wind and solar, because think solar farms are more dense?

[00:19:09] Karsten Schlageter: Yes, there is, of course. Solar farms, they use much larger surface. People sometimes especially, actually in Germany prefer solar farms because for some reason it’s very subjective, they do not interfere with the general landscapes, according to the taste of some people, but they eat up a lot of land. So for one-megawatt solar, you need approximately two hectares. For the same megawatt of wind, you pretty much need no ground space it just has the foundation. And that, compared to a megawatt of solar is really nothing.

Phase: Development

[00:20:02] Tilman Versch: So let’s go-ahead to development.

[00:20:05] Karsten Schlageter: In development, once you have the land, then you need to do the permitting order; so get the environmental approval, the approval of municipalities, the buy-in of stakeholders. A lot of hard work, again, a lot of things we have learned over the last 25 years, you need a lot of suppliers for that. So again, it has high hurdles to entry. You really need to know how to plan and design and engineer projects in the sense that they fit to the environment, that the impact is limited, that it’s acceptable to authorities; a lot of brain and engineering goes into that. So there we have our planners but also engineers. Then if you allow and if you have more questions, then we can come back.

Responsibilities in the early phases

[00:20:55] Tilman Versch: I will come back to the site acquisition development part because I think the development part is mainly run by your local or central offices, and with the site acquisition part, is there a network you have on the ground like you have location scouts or something like that? Or are you doing it all by yourself?

[00:21:18] Karsten Schlageter: It’s a mix. But these two phases are usually, fully done by our decentral teams. So the site acquisitions are done in all the countries or in Germany we have several offices. So people go to the countryside and we have a holistic approach. And then the same people, in most cases, also then develop because we want that they manage all stakeholders, that our colleagues have the full picture on the holistic project. So they do it decentrally but supported by the central functions of course. The engineering teams are central, they are in the headquarters.

Costs of development

[00:22:04] Tilman Versch: Is there, on the cost side before we come to financing, is there any trend you could make? Costs are going up for putting solar farms and wind farms on or is it going down, what is the trend?

[00:22:19] Karsten Schlageter: Unfortunately these development phases, they get more and more expensive and more and more risky. First, I mean we already touched the land, so of course, today landowners know more and more about their privileged situation, so the prices of renting go up, especially as many competitors want the same lot, and also the complexity of environmental permits is increasing.

We have this contradictory momentum. On the one end, everyone wants to combat climate change and I think this is really what mankind needs to focus on. On the other end, often the same people they want to protect the species, and I think we want to do that as well but it is often really extreme. So then you need to do more and more studies, lengthier studies and higher compensation. In the end, that also means that you often have projects that fail in these phases.

So it’s also depending on countries. In Germany, at least every second project fails in these phases and France as well, but in France maybe not that many. In other markets a bit less. In some markets, it could even be more. So it’s really a risky investment a very, very high risk, and it also has high returns. That always goes together or most of the time together. That’s why we focus so much on this field. That’s where our strength is. That’s where high risk is and fortunately, we also take high rewards from these segments.

Energy transition and the margins

[00:24:04] Tilman Versch: Do you have a hurdle rate for projects where you say, I want to have an IRR of 50% before I do this?

[00:24:12] Karsten Schlageter: We do not discuss so much in hurdle rates. First of all, we are driven by the purpose of doing, and pushing the energy transition. So sometimes we even do projects that have a very low margin but we do it and we develop it because it’s also the volume. I mean it has also some business reason, the more volume you have the better your buying power in the market is. But the main purpose is the energy transition.

And then of course, usually, we would like, but that’s often just wishful thinking and sometimes it’s bigger, but we would like to have, on average, a 10% margin on the CapEx, on the project CapEx. So of course in this, if you invest one year in the site acquisition you need I think at least double that. So if not, you will not sustain. If every second project fails every second euro is lost, so you need double at least, I mean, you can take from that, that usually a Euro, that early on is invested we expect it to multiply.

Phase: Financing

[00:25:32] Tilman Versch: Then let’s go to the financing phase.

[00:25:35] Karsten Schlageter: There our central teams as you asked, come in. These are really finance experts that have the relations, as we said, with family offices, with insurance investors, pension funds, municipality investors, so a lot of different segments. And also they do the financing with banks, so usually we work with commercial banks, because that makes it easier, multilateral banks is a long passing process that we only do in some emerging markets. And they add a lot of value. If you don’t have the means to finance a project, then you need to sell at a much higher discount. That’s why our strategy definitely is to sell turnkey, and I think we’ll come to that later and some minutes but the strategy is really – develop, finance, build, and sell when the, when the asset is de-risked, so to say. When it’s operational, then the risk drops immensely. And then, we pass it on to an investor that has a long-term view and just looks at it as a bond, in a sense.

[00:26:52] Tilman Versch: I have no question on the financing side; I think it’s quite clear to me.

Phase: Construction

[00:26:58] Tilman Versch: Then let’s move on to the construction and sales.

[00:27:00] Karsten Schlageter: Yeah with construction, we have strong engineering teams, and construction electrical engineers that can build the civil side as well as the electric parts, so it’s about grid connections today. As I said before, these teams organize all the construction, but not a lot so to say. We do the foundation’s we access roads, the grid connections, defenses, the installation of solar plants, whatever’s needed, we organize it. Of course we have a lot of subcontractors that we use and that we bring together, we are not a construction company as per se.

Scale advantages in the value chain

[00:27:45] Tilman Versch: Where do you have scale advantages in this part of the value added chain, because you’ve grown and you’re in different countries, are there any scale advantages?

[00:27:58] Karsten Schlageter: We definitely have scale advantages in all of these value chains. So, for example, if today you want to really identify sites in a very competitive environment, you need to have complex GIS systems so you spill that out to all the markets and regions you have. If you do development, development is maybe very individual, so I’m not sure if we can talk here about scale it’s more the experience. The repetitive learning of our colleagues that stay for many years, we are thankful to them really and we have very low churn rate on people. People stay with us, and we like to have them on board. We are family.

But I would not say that scale, financing is definitely a kind of scale because the market is not so huge, so you often repeat with banks once you have done all the structures in the market. Let’s for example, use France as a showcase. So in France, we do per year two, three or four financing transactions and then we maybe do these transactions with already two or three banks. Over the years, there’s a lot of scale; you know the bank, they know us as a trusted customer. So it’s a lot of these relations you have and then the transactions are a bit, I mean, it’s not nice to say that to our colleagues who are in detail who need to find a lot of work , but there is of course some copy and paste, no you do not start from scratch.

For example, our first transaction in Greece last year – that took a lot of months just negotiating the contracts, educating maybe some of the stakeholders involved, but now we’re doing the second transaction, and hopefully it goes much smoother and faster with these economies of scale you have. And in construction procurement, I would say of course there’s a very important topic to have economies of scale. If you buy modules suppliers in China, for example, they would not talk to you if you do not have a certain minimum size. Indeed, that is really important to do projects and to have a strong pipeline to be taken seriously, and the same for wind turbines.

Finding and keeping good people

[00:30:33] Tilman Versch: How do you make sure that the best people like to work for you, and stay at ABO Wind?

[00:30:43] Karsten Schlageter: First of all, it’s really a challenge today. It’s more a challenge, fortunately, for us to find new colleagues. We are a growing company and we have grown to 750 colleagues now, all adding a lot and bringing their energy. So what do we do to keep people? First of all, of course we want to have a nice atmosphere. We want to keep the family spirit, and fast decision-making, so that people see they have an impact, what they do really has results. They do not report to abstract boards, they talk to the owners, to the board members directly, we have open door policies. And this is important to keep this culture. We have the purpose of course of the company I’ve refer to several times. So we really work for something that motivates us all every day. That also makes people stay.

And then of course, we adjust to more, let’s say, modern topics. We introduced home office before Corona, so that’s an important topic that people ask so we allow more and more, smaller programs. We have for example e-bikes; everyone who wants an e-bike can get one. Before Corona, we had a lot of socializing sports teams, I mean, all these things add up and I think the most important is really this ABO culture that we try to pursue and it has continuously existed for the last 25 years. And maybe one last thing, I think what is important at ABO is we allow and see people holistically. Everyone is allowed to be who he is and no matter what his or her orientation is, or what one likes. So we do not come to the office in suits and a façade. It’s really okay; we are the people that, we really are. That’s important.

Decision making in the face of growth

[00:32:59] Tilman Versch: In this work setup, how do you keep up? What you already mentioned as one strength was being able to make fast decisions. How are you able to make fast decisions even if you’re growing like this?

[00:33:15] Karsten Schlageter: It’s a big, big challenge really and we address it every now and then and think about what we can do. Because you have when you grow, people do not know every department so there’s uncertainty and that’s perceived everywhere. Just recently we introduced something, we’ve had project groups for many years, and now we have a country groups. These are groups where we have every function in such a group. So the project group obviously focuses on one project, and they are really asked, and we try to give them all the freedom to take the decisions. This of course enables, after certain discussions, very fast decision making.

So with these projects, if they need to let’s say make a decision on an additional investment, no one needs a top level management so to say. And if still someone needs to, they simply drop in the office. It’s very direct. We have these groups, and it’s the same for the countries. So we delegate a lot of decision making now to the country. There’s then a finance person, a development person, a country head, and even an engineer. So these should really concentrate on a country market, gain know-how and make fast and of course qualified decisions. Is not only about the fast decision making, people need to be enabled then also to make the right decisions.

Phase: Services

[00:35:05] Tilman Versch: Maybe let’s finalize this graphic with the services. Maybe let’s start with the revenue basis. Are the services your main recurring revenue part or are there other recurring revenue parts in your revenue structure?

[00:35:20] Karsten Schlageter: In a very narrow sense, that’s the recurring revenue, but it’s below 10%. And I should have said that, coming back to your question, this is very sensitive to scale. I mean we grow; we will also grow by an organic acquisition, so we will also buy service parts and 1m parts from other companies. It is a very competitive market so margins are thin, but yes, of course they will contribute to the overall success. The recurring aspect in our business is that we reinvest and grow in our pipeline development and I think you will come back to that later. For those who do not know the sector, maybe it’s a bit more like the pharmaceutical industry. We live on our pipeline and the quality, where it’s located, and what the value is, that’s the interesting thing.

Subscribe

[00:36:30] Tilman Versch: You want to renew my energy? Then, please subscribe to this channel; leave a comment or alike. This boosts me and drives me 100% carbon-free. And if you’re listening to the podcast you can also write a review. That’s great. Thank you.

Phases in developing wind & solar parks

[00:36:40] Tilman Versch: Then let’s go to the pipeline. Your pipeline is segmented in Phase I, Phase II and Phase III, if I’m adding this correctly. What is the difference in these phases?

[00:36:57] Karsten Schlageter: Phase III is the easiest. So there we already build all constructions imminent. So projects are usually already financed, these are the ones that you will see grid connected in most of the time, less than a year. In Phase II these are permitted projects and Phase I is land secured, permit in progress. So that’s what we discussed before. Phase I is really where we have certainty that projects can do it and where we have the land secured.

Hurdles in the different phases

[00:37:40] Tilman Versch: Where are the biggest risks in these phases, and how much default risks do they roundabout have? You’ve already mentioned it.

[00:37:54] Karsten Schlageter: You’ve asked these questions nicely before to understand the business model so now it’s easy for me, hopefully, to explain. In Phase I, you have come over this land hurdle. Often we do lose land writes in competing schemes. For example, in Germany the forest, the state-owned forests they tender their land. So you participate with, for example, 20 competitors and it’s really a race. But once we have the land, then the major risk is of course the permitting, and this most of the time has to do with environmental topics like protected species in these in these areas, we do of course pre-selections. If we are in Phase I, we have pre-checked the sides but still you can find, for example a protected bird, an eagle, a red kite or even some smaller animals, like bats.

A lot of things can make projects fail. In project two, when you are close or about to have a permit then most of the time they no longer fail, then something really strange needs to happen. Maybe for example, you’re in a politically very unstable environment. We had one project in Argentina when the crisis fully hit, so we had a project permitted with a tariff. And now it’s about to maybe fail, but it’s a very small one so it’s not so significant for the group. But extraordinary things I would say can happen. And in Phase III, fortunately, and we keep our fingers crossed and of course we do a very professional job but so far we’ve had no failure at that stage.

Payment

[00:40:03] Tilman Versch: So, if we go through these three phases, where’s the point where you will receive cash, if you sell it after Phase III or how you going about it?

[00:40:06] Karsten Schlageter: Yes, it’s usually standard business model. Now we need to differentiate again into the markets we are in. It’s quite the standard business model as in Germany or France is really in Phase III. So, sometimes we get some upfront payment or we get, because of the disbursement of bank financing some money, to finance the construction. But the real ownership change, the flip of assets to the new owner is at cost, we call that the commissioning of a plant.

The value of different phases

[00:40:43] Tilman Versch: If I, as an investor would ask you how would you value the different phases and give them a certain worth, how would you do this?

[00:40:53] Karsten Schlageter: I will turn it around if you allow. I would say how do investors approach us? And this is transparent to the market, I could not tell you whatever, I think, or what we think, but what the market says. For example, there are there were several acquisitions that I’m constantly confronted in the analyst conferences on investor talks. Nordics sold their project pipeline to RWE. So this was the benchmark in the market and it was really highly valued. Don’t ask me now exactly what the megawatt price was, I wouldn’t know.

[00:41:36] Tilman Versch: Google is your friend is you want to find out.

[00:41:40] Karsten Schlageter: Exactly! Everyone listening today can Google it, it’s very transparent. And it’s interesting because it had an impact on our share price, and all the analysts were saying, wow you are undervalued, you are undervalued and we can only say yes of course, I mean we have a strong pipeline. It is mainstream now, it is in all markets. It’s often a timing issue when projects materialize, how fast you can bring them from Phase I to II and then to III. But yes, indeed now of course if you look at our share price development but also our competitors, it had an impact. The whole mainstream focus and discussion of the finance industry now on renewables, on energy transition has an external impact. Of course we internally have also done a lot to sustain that.

Risks of owning the parks

[00:42:40] Tilman Versch: Why is there no Phase four, like owning the wind parks yourself?

[00:42:45] Karsten Schlageter: That’s a very, very good question and we are asked that all the time. And we also frankly sometimes discuss internally, if we should change that. But I think we do it the right way because, if I may use this financial terminology, we are a pure-play so to say. We focus really on the risk side. As I said, the risk is when you develop and you fight for land when you need all the intelligence, the tools to really bring this project to permitting and you need to understand that this is not only, let’s say, oh we do it in a year no, in France, this sometimes takes eight years. In Germany now it’s maybe five years.

So it takes a long while and it is a high risk, and then when then you have grid-connected, then the return is pretty low. Then it’s more the character of a bond, because you have repetitive very stable, very easy to plan returns, and revenue over 25, 30 years. And this is capital intensive, of course and we think, instead of having this much capital in the long run in an investment. We reinvested in this first phase which has overall higher returns. That’s the story.

Community Exclusive

[00:44:20] Tilman Versch: We have already seen the project development, value-adding chain, what are your competitors in this space?

Hey, Tilman here. I am sure you are curious about the answer to this question, but this answer is exclusive to the members of my community, Good Investing Plus. Good Investing Plus is a place where we help each other to get better as investors day by day. If you are an ambitious long-term-oriented investor that likes to share, please apply for Good Investing Plus.

Shares owned by employees

[00:45:04] Tilman Versch: It sounds a bit like you have a certain ownership culture in the company. Is this also reflected in the shares that people that work at your company, own the shares, or is it like many German companies where people don’t own shares, even if they are highly engaged?

[00:45:24] Karsten Schlageter: I would, unfortunately, say it’s the latter. People are fully engaged and identify highly with the company, are committed and as I am, but many never took the chance to buyshares. This is maybe I think a bit like everywhere in Germany. It’s not so much shareholding culture but of course, we have many colleagues that own shares, I myself as well of course but many colleagues very early on bought shares and of course, now are also happy. Fortunately for us, and for them, it has paid it out a lot. If you’ve bought shares three years ago, it has tripled, and if you have bought them 10 years ago, then the return is even higher.

[00:46:20] Tilman Versch: Do you have certain programs for this?

[00:46:23] Karsten Schlageter: No. The truth is we are often asked by colleagues; hey shouldn’t we have a share program for employees? But we need to also be realistic. We are still a midsize company and we cannot. I explained before, we do a lot for our colleagues, we try really to make it a great environment to work in, but there are limits also and these share programs are very costly. So we encourage people to directly buy shares from their bonuses or from the regular salary.

International expansion of ABO

[00:47:00] Tilman Versch: Then let’s go to your key topic, the international profile of ABO Wind. Maybe let’s take a look at this map, and can you try to tell a bit about the history, how it developed, and what were the first countries you expanded to from Germany, and also why?

[00:47:24] Karsten Schlageter: This is also very, very interesting and it starts in, let’s say, a funny way and then gets more and more systematic. So when we started, it was all entrepreneurial and small and the industry was really immature. So you could also say, at a certain moment some years, many decades ago, I mean, the map was really a white space for renewables. There was maybe Germany, a bit in Spain, a bit in other markets and then the world was without renewables. So you could pretty much go everywhere and start the business. And how did it work at that time? So first, for example, Spain and Argentina were among our first markets. And how did we do it? Frankly, we knew someone who worked here, went back to the whole market, and it was purely let’s say these ad hoc moments and entrepreneurial seeing of an opportunity, in retrospect, if we could also say not systematic, in a sense.

Then there was the next phase where we started to have teams that defined criteria that filled out huge Excel sheets to identify new markets. For example, one of our most successful market entries was to Finland and this was really an analytical thing. So we came with a lot of countries of the world and then drilled it down and Finland was the outcome and then we went there. It was the first fully systematic market entry. And five years ago, then we started to double the speed of expansion. We doubled the countries and there we also used quite a systematic approach but also used different criteria.

Entering a new market

[00:49:30] Tilman Versch: So can you tell us a bit more about the systematic approach? What is important for you before you enter a new market?

[00:49:33] Karsten Schlageter: It has so many angles. Even if you do a lot of analytics, in the end, you need to take the risk. But yes, I will tell you a bit about what we do. So we will look at the renewable sector, what is the prospect of growth. We look at the political level; we look at if parties that are in government, and parties in opposition that support energy transition. We look at the bankability of a country, of the rating. So if it is investment grade, then it’s much easier for us to get commercial bank financing which I explained before, is a core part of our business model. You would be surprised which countries are bankrupt and which are not.

For example, we see Colombia. Colombia has been for most of the time investment grade country so you can get bank finance there. Tanzania, to pick one country, obviously is not. Then we look at cultural fit. Is the language a huge barrier? Is there a time zone difference that is too big? It’s really a long, long catalog we look at. But in the end, even if all are ticked, you need to say hey, can we do it, do we have access, and can we find projects? Early on, we often do beta tests in the market, we talk to institutions, we even talked to competitors. So it’s really a process today.

Potential territories to enter

[00:51:14] Tilman Versch: What markets close to where you said, okay, there were many boxes ticked, but, you finally didn’t decide to go there? Are there any examples?

[00:51:25] Karsten Schlageter: Let me think about it. I mean, let’s see it from the other way around. Where are we not yet and we think it might be good markets? So for example, in Europe, we have the umbrella of the European Union, which I think is a very positive element. And there we still lack Italy for example. We lack Sweden. We lack Norway. We lack some Eastern European countries, so these are always on our list. You might decide to enter with one or the other. But even if many boxes have been ticked, they’ve never taken the initiative

It’s obvious, but it’s also good to repeat what you cannot do, one after the other, or even in parallel. So you need to have a phase of expansion and then a phase of consolidating the countries. It’s one thing going there and opening an office, hiring five people, and then starting but then it takes you five years to make a profit in such a market. We have a bit in waves, expansion consolidation, and then we consider a market again so it takes careful risk-taking, I would say.

Getting started in a market

[00:52:53] Tilman Versch: How long does it take after starting your office in the market until something happens? Is it five years or is it quicker?

[00:53:02] Karsten Schlageter: It depends a lot but five years is really a good assumption. If we go into a market and acquire semi-developed projects, and we did so in Finland, fortunately, we did so in Hungary; then of course you have a faster route to the market because half of the way is maybe completed. But if you just start with green field as we do it in Canada or South Africa, then it takes you, that that long. Maybe it’s four, five or six years. It’s really again, an investment you need capital for, and again it’s another answer why we said hey we want to expand internationally. We do not want to focus on Germany and keep our assets. If we would, in theory, have infinite capital then of course we could do everything at the same time, but we prioritize our core businesses as I have explained.

[00:54:02] Tilman Versch: Is it usually five people who go into a new destination and build the office there, or is it just one curious guy from Wiesbaden going there or a curious woman from Wiesbaden going there?

[00:54:15] Karsten Schlageter: Fortunately, we have these guys or women that want to go there and explore and feel that they are in the market and do it and overcome all the challenges. But again, it’s the symmetric way that we do today. We try to do it in teams and we try to do it with local hiring and let’s say a minimum size is five. Usually we scale up quite quickly, so 10 is a good size. Because again, I explained before, the functions you need, you need different functions. You need of course, all these planning people; you need colleagues that understand the grid connections, people that can talk to customers there, so it’s a different set also. One person cannot do it all.

Making sure the ABO Wind culture lives in the different subsidiaries

[00:55:12] Tilman Versch: How do you make sure that in these new units, the ABO Wind culture still perpetuates, or that your standards are held, however you want to frame it?

[00:55:25] Karsten Schlageter: If you asked me before COVID, it would be much easier to answer. Because, of course, a midsize company lives on interacting with people, that people come to Wiesbaden. We go to the markets; we do a lot of introductory courses and training and also in markets, we go together with new colleagues to possible clients, institutions, banks, etc. So I would say it’s an ongoing process. And you touch an interesting point, because especially now after the Corona crisis, where I have not even met some key people that we hired, for example, in Canada. I’m not allowed to fly there, because of the regulations, so we cannot go there. And I have not seen some of our key personnel we hired last year.

But that triggered also a more systematic way. Now, we want to create more formal onboarding sessions and trainings and get together. So it needs, again, an investment to keep people in this culture, in this ownership culture, in this entrepreneurial spirit. But it’s also the day-to-day. If people act and commit errors, we need to accept it. We need to encourage people to make decisions, we need to also accept that it’s maybe not always in a way that I personally or one of my colleagues would have done it. But there are different ways to do things in especially in different countries.

Managing subsidiaries

[00:57:02] Tilman Versch: So the units are 100% daughters of ABO Wind, but as I saw from the annual report, they are entities themselves, so you could close them without having a bad effect on ABO Wind or how you’ve built the structure there?

[00:57:22] Karsten Schlageter: I would say to the first part you mentioned, yes they are 100% ABO Wind, and simply closing it, would have huge side effects. Usually, we are really for the long run. I mean, look at Argentina; we are there for almost two decades now. Not totally, but almost. And we go through the ups and downs, we believe in the long-term potential of a market and we invest. Sometimes we invest less if there’s a crisis. If the market gets more attractive, we invest more. So we are really for the long run. We have closed, and it was even before I joined only one office, and that was in Bulgaria. And it was total because of the super adverse effect on the environment. If countries introduce taxes that kill your business model then okay, finally, you might have no choice but to leave.

Deployed vs. local units

[00:58:28] Tilman Versch: So for instance in Canada are there any people in the general markets that are marked orange on the map, is there always a person that comes from Wiesbaden, or are there teams that are locally built?

[00:58:38] Karsten Schlageter: Most of the time they’re locally built. We always have at least one or more in Germany responsible. And the functions also dedicate a certain person to a market, but it’s most of the time locally. Sometimes we deploy one colleague for a temporary period. Sometimes because there’s an interest, someone goes there for the long term, but in a systematic way, we build stronger teams. That’s good because we need this local flavor. You need to talk to municipalities, authorities, landowners and as a foreigner, you get lost.

Top markets that Karsten is bullish about

[00:59:23] Tilman Versch: Which three markets are you most bullish about because they offer the most interesting opportunities, and why is that so?

[00:59:48] Karsten Schlageter: Good question. In the end, every market that we are in has, let’s say, an interesting story to tell and is attractive. Of course, our core markets are Germany and France. And these are very profitable markets and where we have had strong teams for many decades now. And these are the markets where we know the environment best. And it’s the largest office so I would be strange not to name them among the top three. For me, it’s also and this is maybe also personal, Spain. I’m very bullish about it.

When I started in Spain when I joined ABO, you asked me where did I start and I told you, I started in Spain, and it was a dead market. No single investor. I had a list of at least 100 investors all over the world, I called one and then the next one and they did not even want to engage in the discussion. And today we have huge targets. We have so many competitors; every investor now wants to buy from us in Spain. And it’s a market that is self-sustaining in the sense that you no longer need subsidies. So it’s a free market also for renewables. It’s there where renewables already push out everything else. And it’s a good showcase of what we will see in the next 10 years all over the world.

[01:01:20] Tilman Versch: So these two core markets and Spain are your three bullish markets? Or is there any other market you would say, if you wake me up in the morning at three, I would say this is a great market?

[01:01:32] Karsten Schlageter: Really, I can continue now. You asked me three, I gave you three, but I can continue. For example, I’m in Canada. We’re still new there. We just hired a new, very good management team. We continue hiring. We have the largest project in all of Canada, under development with 500 megawatts in Alberta, Calgary, we are in Nova Scotia where we develop a nice portfolio, a very small niche market, but huge wind speeds. So it’s exciting to do projects there.

And suddenly, there are things popping up which I would not have anticipated two years ago. Suddenly, a lot of people start talking about exporting hydrogen or you might have read Fortescue is one of these big players. So suddenly, you start possibly seeing huge export-oriented hydro green, hydrogen projects. So in Argentina, we now suddenly talk about gigawatt projects, in South Africa may be as well. In Canada, we do. We have one discussion ongoing for a huge project for hydrogen export, we discussed that in Finland. So if you want to see the excitement in these markets, there’s a lot we can continue to discuss.

Difficult markets

[01:03:05] Tilman Versch: Maybe we also look at time. Let’s go to the markets where you have a feeling there are more headwinds than tailwinds. So the wind blows in your face instead of in of your back and supports you. What markets are these?

[01:03:20] Karsten Schlageter: We have them always and that’s also why we base our thinking on our portfolio. So that’s why we have a diversified set of countries in different maturity stages and different cycles, life cycles. Whereas headwind, for example in Tunisia, the government needs to really organize itself in a sense, they have not even, at least until recently, named an energy minister. So the energy minister needs to sign all the regulations. So in such a market, you have difficulties, of course. But again, in the long run, we see positive.

In Tanzania, we have seen a change in the presidency so let’s see how that evolves. We had headwinds in the past. So a new president might give it a new, positive impetus. And of course, we also need to say and admit, I mean, in Colombia, especially in South Africa, we are hit quite a bit by Corona. If everyone who reads the news sees Colombia is still very much struck, South Africa as well. So it’s, it’s not easy for our colleagues to travel. But again, we then have great people, they find their ways, they find alternative routes. We have done the first environmental stakeholder, the audience listening to stakeholders in a virtual way, in Colombia. And this also creates a lot of innovation, if you have good people that want to overcome obstacles.

Effects of Corona on the company

[01:05:13] Tilman Versch: Did corona make your company stronger?

[01:05:17] Karsten Schlageter: On the one hand, I’m absolutely sure it pushed innovations like digitalization. Today, it’s everywhere in the world, we are connected, we are teams, this was not so perfect in the past. And this saves a lot of flights, travel, in this sense, stronger. But also I personally feel, there might be different understandings, I personally feel that there’s a thread and this is when you are so long apart, it works because you know each other, you trust each other; you know the procedures, the processes. But now we are in a phase, as I said, we hired additional people that have not been integrated before Corona. Now we are at a point in time where we definitely need to take a lot of care and not have some people go astray or that we do not lose people.

Motivation behind entering new technologies

[01:06:23] Tilman Versch: So let’s move on to the other markets you’re trying to enter, you’ve already entered. In 2014, you founded ABO Kraft & Wärme, which is heat and heat energy, and biogas, I think. In 2007, you did set up your first solar park. In 2020, you built your first battery storage project. In 2021, you built the first solar and wind project together. So why did you go for these new businesses? And what are your key learnings from them?

[01:07:00] Karsten Schlageter: First of all, I think I mentioned it, but it’s also good to repeat. Our founders were motivated by the energy transition. So it’s not let’s say, they say hey, there’s wind, we can make a profit. No, they really want an alternative energy system. They want to combat global warming in a social, friendly way. So it’s not one technology that will be sufficient for that so because of their interests and I hear I refer really now to the owners, the original founders, they were very interested in bioenergy. That’s not my field but we have, especially in Germany, we developed early on some biogas projects. It’s a business we never expanded it to international markets because it’s complex. It’s a more logistics-driven business. So it is not like wind or solar farm. You pretty much build wind and solar farms, and then you run it but there’s not so much to do.

But logistics in biogas, every day you need to manage the streams of material. It’s different business models and some of these and most of these things are now in the Kraft & Wärme as you mentioned. So this is also internationally relevant. We started solar five, six, seven years ago. I already said when we suddenly felt that the solar market gets competitive. Before it was a subsidy market, only living on subsidies, and suddenly like in Mexico, that was one of the trigger moments. It beat the wind in tenders. And then we started, hey, we need to rethink. We started large-scale solar projects and we hired very experienced colleagues and now every second project is a solar project we start. And the reason that you mentioned rightly is storage. Again, we repeat a bit in the same way, we hired a very experienced female manager and she built the business. And it starts also quite promising. We’re now building a 50-megawatt project in Ireland. That’s quite huge in storage terms.

[01:09:38] Tilman Versch: What are the business opportunities you’re expecting from these businesses?

[01:09:45] Karsten Schlageter: Solar is like wind. It’s a very profitable, long-term business. Solar is the most competitive one where you can do large-scale projects in most countries. We are operators; we have countries where we just do solar-like in Colombia, for example. What can I say I mean the same business model as I explained applies, we have good margins, again we expect also the 10% on average on CapEx, at least in the long run.

And storage is of course, where we have different business models. Storage will become part of some solar projects we call that then hybridization. But also storage would be a standalone and then you have different services like frequency, control of grids, you shift the supply and demand some hours from, let’s say peak production of solar to the evenings, I mean lots of business models. And also we have another business model off-grid or lets in weak grids we supply with batteries, the communities, or large industries also. So it’s a key component, batteries, to get closer to seeing 100% renewables in the grid.

Managing the risks of new technologies

[01:11:16] Tilman Versch: Is there any big extra risk from going into these new technologies or is it doable with the existing knowledge you have? So how are you making sure to manage the risks, well in these new technologies?

[01:11:33] Karsten Schlageter: Definitely. You need different know-how. That’s why we have created the group on batteries; it’s not that someone does it that has no clue. As I said we hire an experienced manager. We also hire additional colleagues. There’s one aspect, maybe that’s especially different, this needs a management system, and you also need to understand when to load a battery when to give electricity to the grid, again so this needs an intelligence system which usually in solar and wind, you do not have. I mean solar you produce when there is sun, wind you produce when there’s wind, but in the storage business you need of course intelligence, and this is more software-based. There are additional competencies needed and it’s more market-driven. So you need to anticipate in the next 10 years how volatile a market will be because you want to get the energy when prices are low and you want to feed it back into the grid when prices are high so you need to do this as often as possible to make a battery profitable.

Potential in hydrogen

[01:12:48] Tilman Versch: Investors often love options in businesses that might become a bigger business themself. I have the feeling that in the energy market a lot of things are speeding up now and changing and cost aggression is kicking in at a certain point. So, where do you see this, or where is ABO Wind, already lurking around and spaces where they could build new businesses we haven’t even talked about yet?

[01:13:15] Karsten Schlageter: I would say, the big, new thing is hydrogen. You have read about it I’m sure. So hydrogen will be needed to decarbonize some of our industries. It might be needed in long-distance transport; it might be needed in some specific areas, maybe some in heating, some backup generation assets. So this is a big, new thing for us. First of all, it’s a huge driver, because every green hydrogen element you will find needs some renewable assets behind to generate it. But secondly, we also in partnerships or alone, want to expand into this area to the central integrated hydrogen businesses. We see a lot of opportunity in combining all the technologies we have, so we have hybridization. In Spain, that is taking off now, so we combined wind, solar, and storage and maybe in the future hydrogen. So a lot of things really will come together and that will, once again, replace the conventional assets we still see in the market, and that will be there for a while.

2011 vs. 2021 in the renewable energy market

[01:14:38] Tilman Versch: It’s a hard question to answer, but I find it’s interesting. So if you compare being in 2011 and being in 2021, where would you say, I’m more hyped by the chances you have in renewables, which year would you pick this year or 2011?

[01:14:58] Karsten Schlageter: Me personally, I would pick today, because I like now that it becomes mainstream and omnipresent, and now we really do the transition. If you see it more from an entrepreneurial avant-garde visionary perspective, 10 years ago would maybe still be more fascinating but even today we have that now. What you asked at the beginning, looking 10, 15 years ahead. How will it look like, how will it work? I mean there are so many open questions we need to answer and that’s really what all our colleagues work on, and that’s a fascinating thing. We need to do it; ABO Wind wants to be part of it. We need to be successful with the energy transition. If not, first of all, of course, we lose against climate change with catastrophic impacts on all of us, but also it might mean if we do it in the wrong way, to lose jobs or to have too many people that we lose on the way to full decarbonization.

Role of ownership

[01:16:08] Tilman Versch: For the end let’s talk a bit about entrepreneurs behind ABO Wind, the family Bockholt and the family Ahn. They’re currently holding 52% of ABO Wind. Is there a certain point where they go through capital increases below this 51, 52% threshold?

[01:16:31] Karsten Schlageter: First of all, I of course do not want to speak in name of others. So it’s up to them to communicate these things or to give their personal view, but what I can say, what we discussed at the board, we want to stay with this agility and entrepreneurship and fast decision making and it helps to have the owners on board. They have a lot of knowledge. They give a lot of energy to the company and they are, to my understanding, fully committed to keeping 50% plus one share to keep control. So we still have, and you call it an option I call it also an option, it’s not that we want to do it or that we think about it, but we have the option of course to have an additional capital increase, to come to this limit.

Energy of the owners

[01:17:28] Tilman Versch: In Value Investing terms, Warren Buffett and Charlie Munger play a pretty important role. And from Warren Buffett, there’s this quote that he likes to tap dance to work. Have you seen one of the founders, tap dancing to work or how would you describe their energy today?

[01:17:45] Karsten Schlageter: Yeah, I see them with full energy. Again, I could tell some things which I do now not, but I think that’s no secret. Matthias Bockholt for example, is a sports person so he comes, sometimes by bike. And it’s not a tap dancer, so to say. One secret about me, I love Argentine Tango, so you might see me sometimes dancing tango, you know, good spirit for ABO as well.

Karsten Schlageter’s shares in ABO Wind

[01:18:17] Tilman Versch: Maybe another secret, I don’t know, I haven’t found it in the annual report; how many shares do you own of ABO? And is it a significant portion of your wealth?

[01:18:36] Karsten Schlageter: Unfortunately not yet but I’m building up. Yes, I hold some, I should not disclose, but some €10,000 so there’s room to grow. I actually tried to invest more, but then the share price was always in front of me, so to say but I continue to build it up especially since I’m a Board Member. So, it’s a small shareholding. I also hold other different things we have like mezzanine financing so I’m fully committed. That’s not the question.

Evaluating ABO’s share value

[01:19:27] Tilman Versch: So, do you personally think that the share is overvalued at the moment?

[01:19:33] Karsten Schlageter: No, I would say not. It has actually risen three times in value in the last year so that’s really a success. As I said, it’s driven by our build out of the portfolio, so we have continually grown the project portfolio and we will continue doing so. And it’s also driven, of course, by this new, general very, very positive environment. It’s also driven that we are now perceived as a much lower risk company because as I said in the past, we have been in a niche, now we are the core of the energy transition, nothing will move without renewable projects.

Repowering wind parks in Germany

[01:20:31] Tilman Versch: We already have the picture of the wind pack in the back and one topic that comes up before my final question – is repowering an important topic for you, like replacing of old engines with newer, bigger ones?

[01:20:38] Karsten Schlageter: Yes, it is definitely, especially in markets that are more mature like Germany.

[01:20:50] Tilman Versch: Do you have a rough estimate of how much is in the pipeline that’s repowering?

[01:20:56] Karsten Schlageter: In Germany, it gains very high significance but I cannot tell you how much it is, maybe 10, up to 20% of the pipeline.

[01:21:12] Tilman Versch: Maybe I will get the information from Mr. Kofka and could put it in the show notes.

ABO Wind in 10 years

[01:21:22] Tilman Versch: The final question, before you have the chance to add anything we haven’t discussed, where do you see ABO Wind in 10 years?

[01:21:26] Karsten Schlageter: I see us in more countries. I see us doing much larger projects and today that’s why we increase our capital, that’s why we issue subordinated loans. I think we will be a key element of the energy transition. So we will have grown in the service area we discussed before, so by organic and inorganic acquisitions, as I explained, and are at a lot of organic growth, so stronger positions in batteries, a significant position in hydrogen in batteries and more in more axillaries services. You said it; all will be integrated so there will also be more intelligence coming to all of that, so intelligent use of these energies software. I think we will also, of course, grow in size, maybe we will double, I don’t know, but that’s not a target for us. We want to be part of the energy transition and have a significant position so growth in itself is not an aim. But it comes with the market, or when the market grows, of course, ABO Wind will grow.

Encouragement to invest

[01:22:50] Tilman Versch: Then, do you have anything to add for the end of the interview we haven’t discussed?

[01:22:55] Karsten Schlageter: I think we really have touched a lot of topics. I’m happy you invited me. You call yourself Good Investing and I can only encourage the financial community to continue investing in renewables, not in conventional assets. We as ABO want to be part of the journey; we’ll continue to drive the energy transition. I think we’ve touched it all. I think that’s the spirit, the purpose. Thanks for allowing me to be with you today.

Goodbye

[01:23:25] Tilman Versch: Thank you very much for coming and thank you. And thank you also to the audience. Have a great day, y’all. Bye-bye.

Disclaimer

[01:23:36] Tilman Versch: As in every video, also here is the disclaimer. You can find the link to the disclaimer below in the show notes.

The disclaimer says; always do your own work. What we’re doing here is no recommendation and no advice, so please always do your own work. Thank you very much.